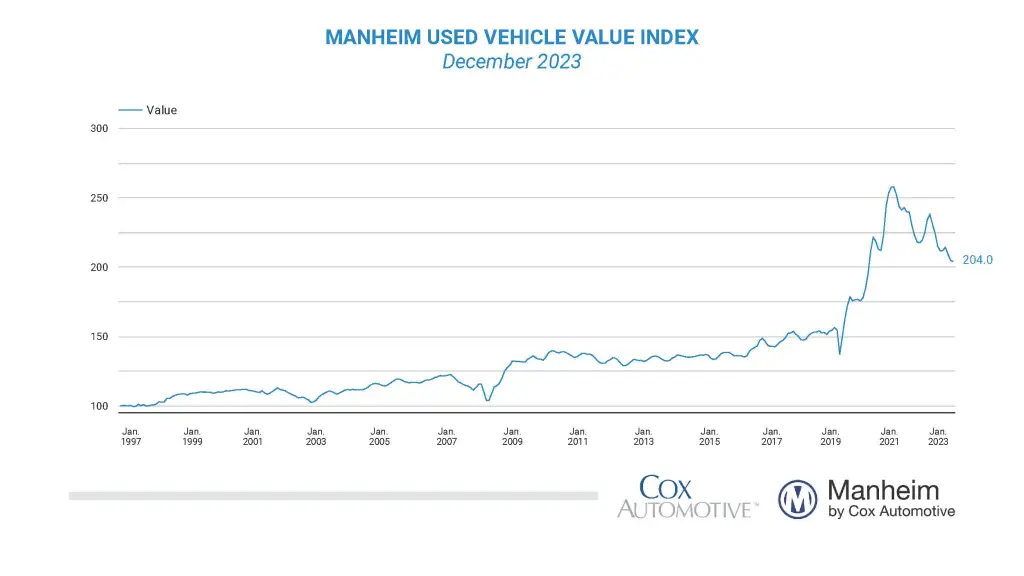

The Manheim Used Vehicle Value Index (MUVVI) closed 2023 with a 0.5% decline in December compared to November, marking a larger-than-expected 7% drop from the previous year. This downward trend, steeper than anticipated, has seen used-vehicle values plunge nearly 21% since their peak in December 2021.

Cox Automotive Chief Economist, Jonathan Smoke, highlighted the year’s end, noting a milder decline compared to 2022 but still surpassing typical annual decreases. Looking ahead to 2024, Smoke emphasized that “the keyword for the wholesale market is ‘normalcy.’”

He anticipates constrained growth with less than a 1% volume increase, and a normalization trend in price patterns, marking 2024 as a year of relatively standard depreciation in the wholesale market, the first in five years.

Here are the takeaways from the last month of 2023:

- December witnessed above-average weekly declines in Manheim Market Report (MMR) values, especially in the final two weeks. The Three-Year-Old Index recorded a 1.4% aggregate fall over four weeks, surpassing the 0.5% average decline seen between 2014 and 2019. Daily MMR Retention averaged 99.0%, indicating market prices slightly below MMR values. The sales conversion rate increased to 53.8%, reflecting improving demand.

- Market segments like luxury, pickups, and SUVs experienced seasonally adjusted prices remaining lower year over year, with compact cars being the worst performers. Despite December losses, the market segments’ declines were still better than the industry’s 7.0% drop.

- Contrary to the overall market, used-vehicle retail sales in December rose by 3% compared to November and 1% year over year, based on vAuto’s observed changes. The average retail listing price decreased by 0.4% in the last four weeks, with a year-over-year decline of 4.3%.

- Total new-light-vehicle sales increased by 13.0% year over year in December, with a 17.5% month-over-month volume increase. The sales pace reached 15.8 million, up from the previous year and November. Fleet sales saw a 22% YoY increase, with rental fleet sales soaring by 72%. Fleet market share remained steady at 16.1%.

- December witnessed a 4.5% YoY drop in the average price for rental risk units sold at auctions, with a 3.3% decrease from November. The average mileage for rental risk units plummeted by 20.2% compared to the previous year and 5.3% from November.

“For the economy and the auto market, we’re in for just 1% to 2% growth, but growth beats a recession,” Smoke said on Monday during a call. “As we enter into 2024, new supply is back to spring 2020 levels, which favors consumers and leads to lower prices.”

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.