Despite being an OECD country, it appears that Canada is facing a growing food insecurity problem, that one CEO warns is about to get a lot worse.

According to Maple Leaf Foods (TSX: MFI) chief executive Michael McCain, 5.8 million Canadians do not have adequate access to food— a figure that has been steadily climbing over the past 15 years, subsiding only once during the beginning of the Covid-19 pandemic when additional government subsidies were rolled out. However, it’s not the lack of food supply that is behind the problem, but rather lack of income to afford food. “It’s all of those systemic issues that are at the core of food insecurity,” said McCain, pointing to various problems such as income inequality, poverty, mental illness, lack of access to skills, and racism.

“The fundamental drivers of food insecurity [are] not food. Canada has an ample supply of food,” he continued, adding that food companies have been too focused on alleviating the crisis by focusing on boosting supply, when instead the problem is lack of access to food. University of Toronto professor Valerie Tarasuk echoed similar sentiment, warning that current record-high food inflation is further exasperating the problem, eventually forcing income-strapped households to compromise quality of food even more.

“Prior to the pandemic, we know that two-thirds of food insecure people were in the work force, which means we’ve got a whole lot of businesses where people are working, and not able to make ends meet,” Tarasuk explained. Indeed, the compounding effect of global crises over the past several years, including Covid-19, subsequent supply chain disruptions, adverse weather effects, and the conflict in eastern Europe have sent the price of food to historically high levels, leaving not only those in developing regions struggling to survive, but also millions of Canadians.

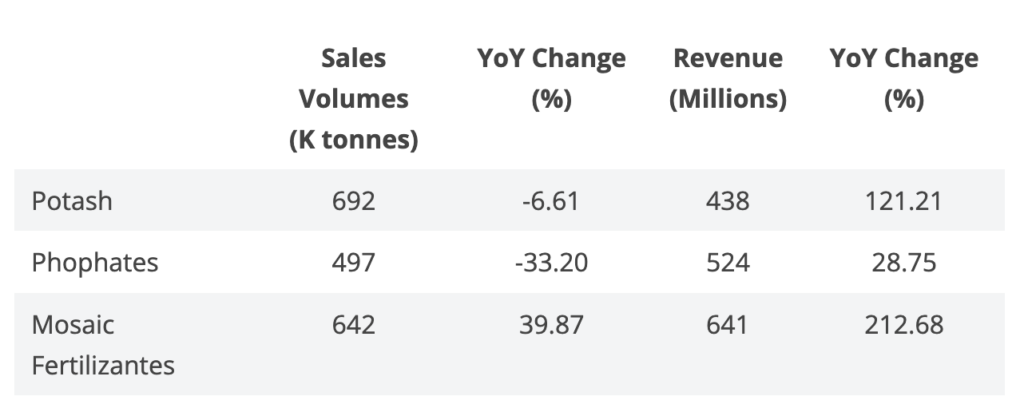

Making the problem much worse, though, is the current astronomically high cost of agricultural inputs, which will adversely affect the price of future crop yields. The Mosaic Company (NYSE: MOS), for instance, reported a decline in sales across two out of its three Potash, Phosphates, and Mosaic Fertilizantes segments, yet revenues increased substantially amid surging selling prices.

Information for this briefing was found via the Globe and Mail and the Mosaic Company. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.