The demand for gold and gold miners is heating up. Friday night after the bell, Marathon Gold (TSX: MOZ) announced that it would be conducting a bought deal financing via a syndicate of underwriters for gross proceeds of $30 million.

The bought deal will see a smattering of involvement from investment banks, with the financing being co-led by Canaccord Genuity, Sprott Capital Partners and RBC Capital Markets, signifying that i-banks as a whole are returning their attention to the gold sector. The financing will see 20,000,000 units of Marathon Gold sold for $1.50 each, providing gross proceeds of $30 million.

Each unit will consist of one common share and one half warrant with an exercise price of $1.90 for a period of 12 months from the date of closing. An over-allotment option of 3,000,000 units has also been granted to the underwriters, which would bring in an additional $4.5 million for the miner.

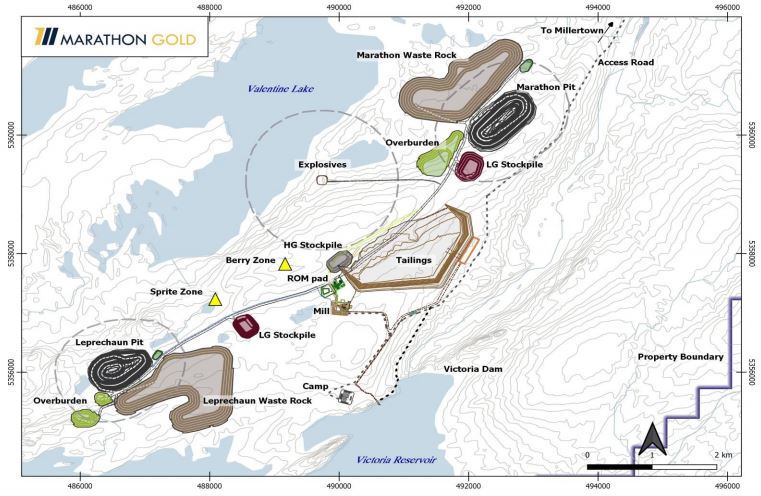

Proceeds from the financing are to be used to advance Marathon’s 100% owned Valentine Gold Project located in Newfoundland, including the permitting, development and exploration of the property. Remaining funds will be used for working capital and general corporate purposes. Closing of the offering is anticipated to occur May 26.

Marathon Gold last traded at $1.67 per share.

Information for this briefing was found via Sedar and Marathon Gold. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.