Marimaca Copper (TSX: MARI) has taken an uncommon approach to stabilizing the price of their inputs for their flagship Marimaca Copper project in Chile, announcing this morning that they have entered into an option agreement to acquire a sulfuric acid plant.

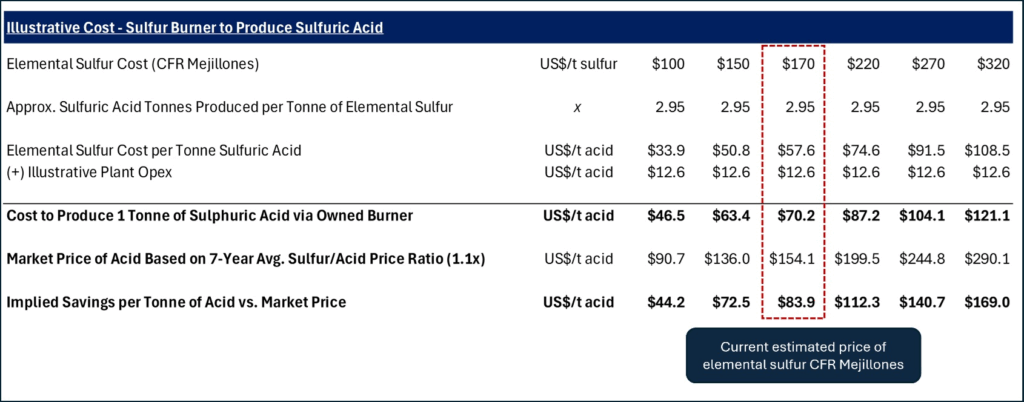

The plant, which has a capacity of 150,000 tonnes per annum, represents 30-40% of the total estimated needs of the Marimaca Oxide Deposit once fully operational. While it may not cover the entire need for the project, the acquisition of the plant would reduce the volatility of a key input cost, while also reducing the cost of sulfuric acid to the company by an estimated 30%.

Under the terms of the option agreement, Marimaca has agreed to pay US$2.5 million for the plant, which is expected to be moved to Mejillones. An exclusivity period of 3 months has also been arranged to enable the company to further review technical and engineering aspects, as well as operating cost estimates for the installation and operation of the plant. Similar equipment, if purchased new, is estimated to cost between US$35 and US$40 million, with total installation costs between US$50 and US$60 million.

If the option is exercised, the plant is expected to be mobilized to Marimaca’s site before June 30, 2026.

“The MOD is forecast to be a mid-level acid consumer in the context of Chilean heap leach operations, and we continue to recognize acid cost as one of our most important drivers of profitability. We have numerous operational levers we can utilize to reduce acid consumption, if necessary, however, lowering the volatility associated with one of our key consumables was a logical step for the Company,” commented Hayden Locke, CEO of Marimaca Copper.

A definitive feasibility study for the Marimaca Oxide Deposit which is undergoing final review before publication will not capture potential upside from the acid strategy.

Marimaca Copper last traded at $11.10 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.