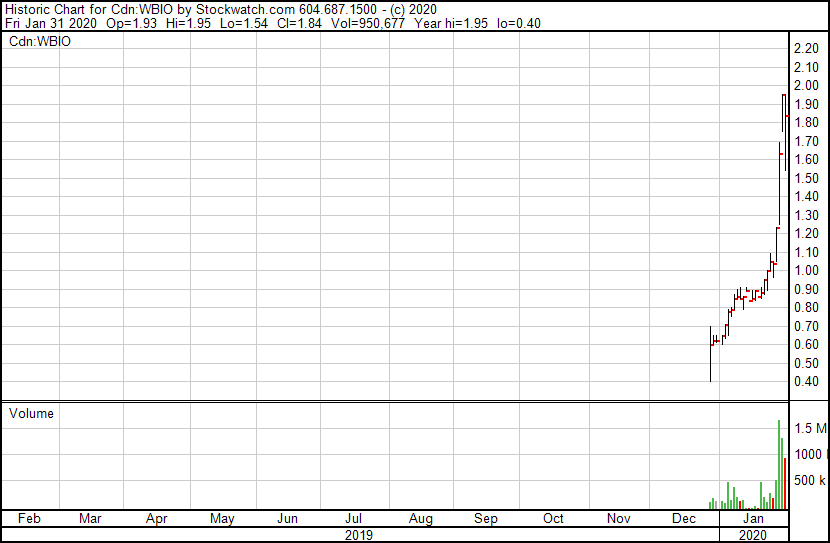

Recently re-organized cancer drug development company WPD Pharmaceuticals Inc. (CSE: WBIO) has been one of the top performers on the CSE this past week, up 75% on 3.2 million shares, to close Friday at $1.84.

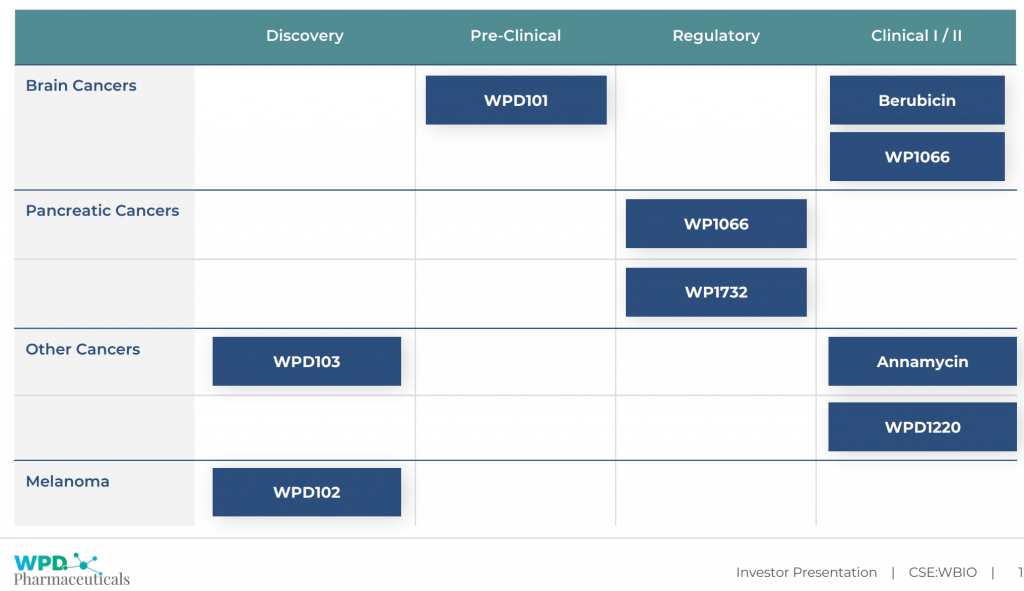

The pharmaceutical research company, formerly known as Westcot Ventures Limited, re-listed on the CSE after leaving the TSX Venture exchange on the final days of 2019, shortly after making an all-stock acquisition of WPD Pharma, itself fresh off of the acquisition of various different patents for in-development cancer drugs. The drugs are all showing pre-clinical trial promise for use in the treatment of various different types of brain and nerve cancers, melanoma and pancreatic cancer. Novel brain cancer drug therapy WPD101 appears to be the flagship of this portfolio (they list it first in the deck). It’s expected to begin phase one clinical trials this year.

The idea behind most of these appears to be the process of using certain modified proteins to smuggle a drug payload past the blood brain barrier and to the tumor-specific receptors. There are 8 total development stage drugs that the company hopes to get through the pre-clinical phases. The company boasts partnerships with name-brand universities like Wake Forest, the Mayo Clinic, and the Polish government, as well as various layers of grant funding that can advance the development objectives without diluting the cap structure.

WPD’s cap table features three large blocks of stock that were effectively used to buy the in-development cancer drugs from the patent owners. That stock and the stock used to buy out the other WPD shareholders represents more than half of the outstanding shares. It’s presently owned by entities who are surely excited to see their work move through the development process and potentially become life-saving cancer drugs. In this environment, there’s a good case for that excitement.

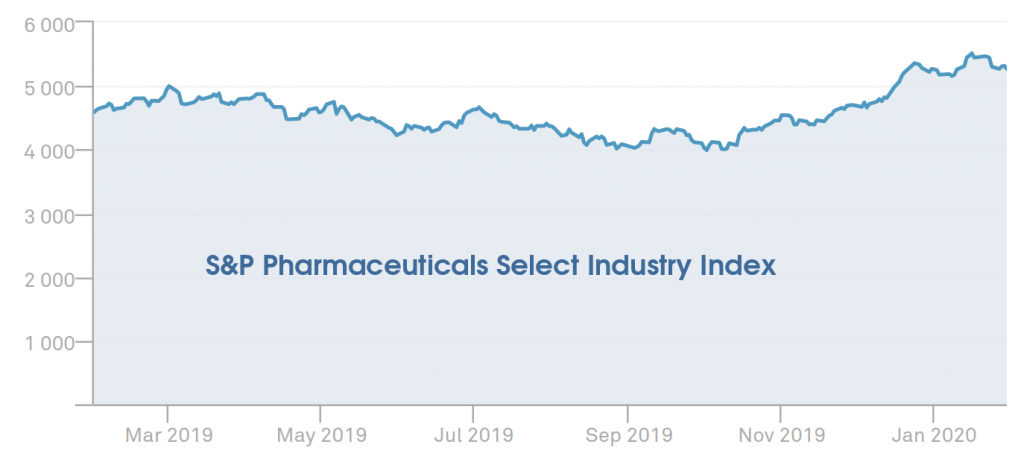

The larger pharma indexes have been on a tear for the past three months as the FDA executes an apparent mandate to pick up the pace on drug approvals (or rejections). The CSE doesn’t group their pharma stocks in any kind of index, so it’s difficult to say how it does as an incubator for pharma.

The S&P select pharma index is composed of larger, more mature companies and the NASDAQ Smart Pharma index tracks some companies with drugs in the clinical trial stage among their in-market drugs, which might account for its more aggressive climb over the past three months. Obviously, one can expect an equally sharp swing down when the trade is off, the deeper into the risk curve one looks.

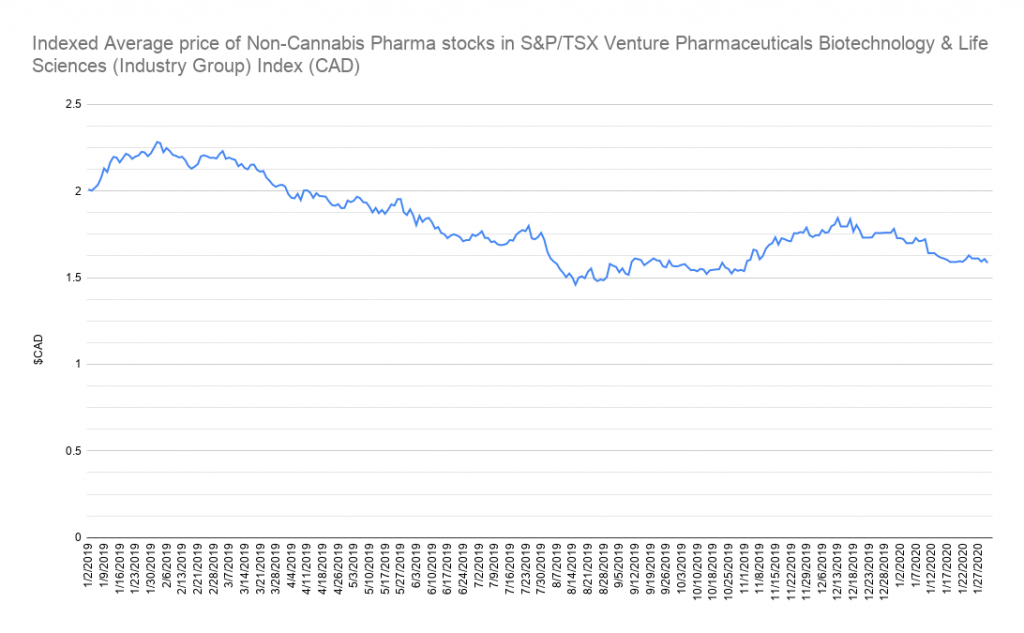

There’s no true index for pre-clinical or even clinical stage pharma development companies, so it’s tough to track the sector as a whole. We wrote in December that the TSX Venture’s Biopharma / Life Sciences Index contains too many cannabis cultivation startups to be a reliable proxy for drug developers. The unweighted average of the non-cannabis components that we made at the time doesn’t show the same liftoff as the NASDAQ Smart Pharma, but it’s just as well, because many of these companies are thinly traded with little volume.

WPD Pharma hasn’t filed any financial statements since it became a fundamentally new business through the acquisition of the core development portfolio and listed on the CSE. It isn’t clear what the cost of the ongoing development of these cancer drugs is, and we won’t really know until this new listing files a few consecutive cashflow statements. The company is vocal about their grant funding, which will certainly help investors get more for their money, but it isn’t yet clear just how much.

WPD has hired Vancouver’s Strike Communications to handle investor relations, and Caelum Finance Ltd. as capital markets consultants, telegraphing to the market that they’re serious about sustaining an active, interested market. If the development team is able to advance these drugs into the trial stage and ongoing FDA liberalization continues to stoke investor appetite for the early stage pharma sector, WPD could conceivably be in position to take advantage of that appetite.

The operative variable here, apart from the as-yet-unknown burn rate, is how attached those founders are to their positions, and how they go about unwinding them when the time comes.

Information for this briefing was found via Sedar and WPB Pharmaceuticals Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.