The popular belief that cannabis will work its way further into mainstream culture and further into mainstream medicine borders on religious. That suits venture-stage equity promotions just fine, especially when the tenants of the scripture are so widely known, the divine miracles so wide spread and accessible. We’re going on year three of the Canadian small cap markets being captivated by the cannabis sector, and a year of dismal performance hasn’t thinned out interest much. Traders are still jumping on cannabis issues as soon as they get a pulse.

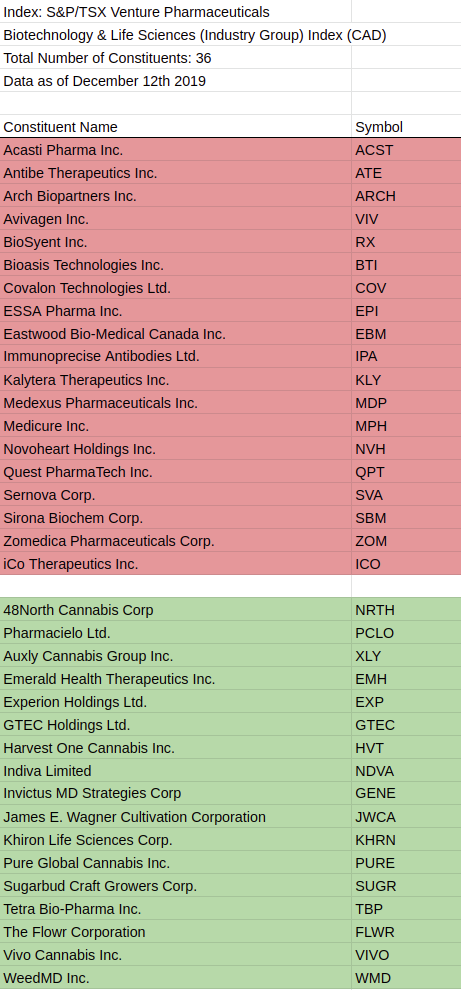

So completely has the church of cannabis captivated the collective imagination of the venture equities markets that seventeen of thirty six of the TSX Venture’s Bio-Pharma/Life Sciences index are cannabis companies.

While many have notional or actual connections to therapeutic cannabis, these are cultivation start-ups. With a very few exceptions, there isn’t much drug development going on in these companies, and to the extent that they’re selling medicine, it isn’t being done commercially.

Method One: Nomenclature

Call it a drug company and hope for the best

There are three basic ways for cannabis co’s to engage with healthcare. The most popular one is to pay lip-service to it. Append the word “Health” or “Therapeutics” to the name, put a doctor on the board of directors, and hope that the cultivation team churns out something that is medical grade. The poor performance of these equities is unsurprising, and their inclusion in this index is quite clearly holding it back.

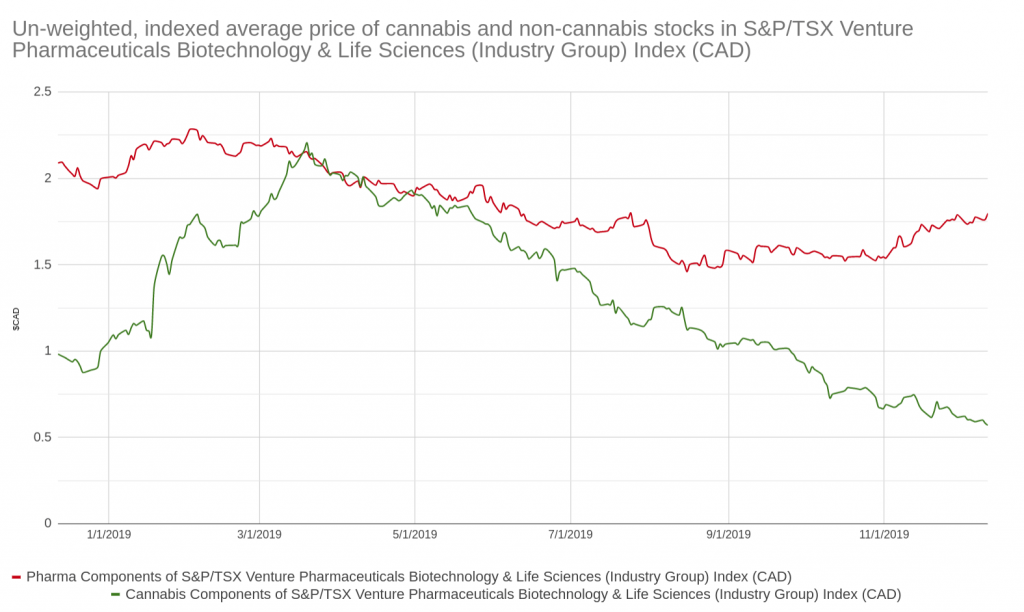

The index is weighted, but the TSX doesn’t say how they weight the individual stocks, so we pulled the cannabis companies out and calculated the simple averages of the cannabis and non-cannabis groups, with no weighting. The study showed the traditional pharma companies pulling away as a group, as the cannabis components – most unprepared to be either cannabis cultivators or medicine providers – took a dive.

Method 2: Build out the sales and distribution infrastructure

Very few cannabis companies follow the second basic path to the cannabis medicine business being driven at by RAMM Pharma (CSE:RAMM), which we wrote about last week (CSE-listed, not part of this index). That model consists of creating the relevant medicaments and propagating them through distribution channels. Companies like PharmaCielo (TSX.V:PCLO) and Khiron Life Sciences Corp. (TSX.V:KHRN) claim the manufacture of such products, but have yet to demonstrate that they can get them to market in any kind of commercial volume. Until they show sales, those companies are truly practicing something a lot closer to the lip-service model.

The build-it-they-will-come approach has a lot more going for it than the low volume cultivators pretending to be lab companies. The difference is an active fostering of consumer adoption, and the trick to that is eliminating cost at the point of care. WeedMD (TSX.V:WMD) – Starseed backer LiUNA has worked cannabis coverage in to union healthcare plans as an opiate alternative. That initiative to make whole-plant cannabis available to patients through traditional healthcare channels seemed extreme in 2017, but appears to be catching on. Major League Baseball’s recent heel-turn on cannabis as medicine is an indication that institutional attitudes are coming around. The further a company can get its cannabis or cannabis drug products into traditional healthcare supply lines, the better off it is. The most reliable way to get there is by following the same protocols as non-cannabis drugs.

Method 3: General Patent

Be a leader

As the saying goes, alternative medicine that has been proven to work is just called “medicine,” and the means by which medicine is approved for sale and ends up being covered by health plans hasn’t changed much.

Tetra Bio-Pharma (TSX.V:TBP) is easily the strongest performing cannabis pharma stock on the TSX.V in the past few weeks, and one of the best performing pharma stocks of any kind. It’s the poster company for the third, more traditional method of cannabis drug development. TBP’s various planned clinical trials are all designed to show that particular cannabinoids or cannabinoid concoctions, administered through specific delivery methods, are effective at treating one thing or another. Their plan to trial QUIXLEEF, a vaporized cannabis product designed to treat pain in cancer patients, was on hold by the FDA indefinitely until, suddenly, on November 25th, it wasn’t. The stock started to move immediately following the good news which, it would appear, was part of a larger shift at the FDA.

Bloomberg News reported December 6 that the US federal agency is “Green-lighting drugs at breakneck speed,” approving more treatments and approving them at a quicker pace in an attempt to get treatments to patients quicker. TBP has responded by advancing in-progress trials and requesting new trials, including one for a drug meant to treat heptocellular carcinoma (a type of liver cancer).

An accelerated pace at the FDA favors companies who approach cannabis medicine like traditional drug researchers, because it’s one that favors traditional drug researchers. If or when the market will come around and start floating those types of deals is anyone’s guess. It might take a few successes or a capital injection from larger pharmaco’s. Clearly, at least in terms of Canadian markets, there’s a marked lack of deal flow.

Information for this briefing was found via Sedar. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

FULL DISCLOSURE: WeedMD is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover WeedMD on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.