Northwest Copper (TSXV: NWST) broke out of its sideways trend this morning after reporting positive assay results for its Kwanika copper-gold project, found in Quesnel Terrane of British Columbia. As of the time of writing, the equity is up 19% to $0.25 on 1.82 million shares traded, after hitting a high of $0.27 earlier in the day.

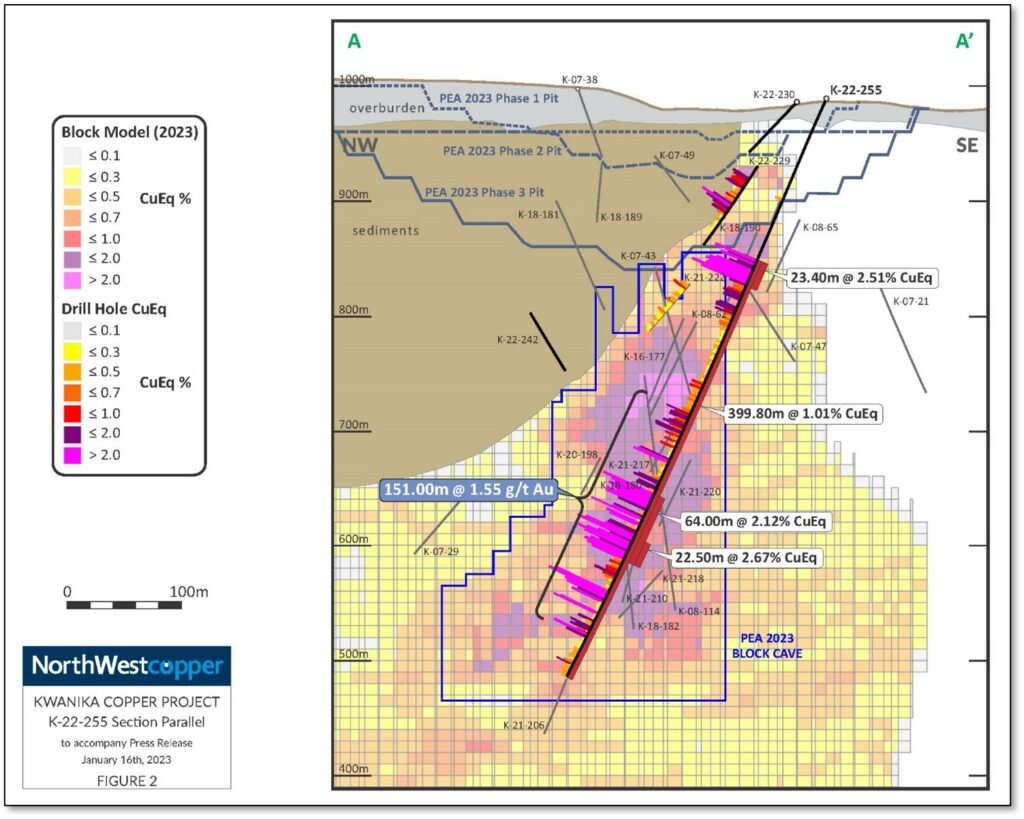

The jump follows the release of assay results from hole K-22-255, which was conducted as part of the firms 2022 drill program that was designed to test 8,600 metres in aggregate at the project. The program was stated to have three goals, including adding additional high grade at the Central and South deposits, increasing the size of the deposits, and searching for new satellite deposits.

Highlights from the results include:

- K-22-255: 399.80 metres of 0.62% copper, 0.74 g/t gold, 2.0 g/t silver (1.01% copper equivalent) from 152.20 metres

- including 23.40 metres of 2.12% copper, 0.70 g/t gold, 6.2 g/t silver (2.51% copper equivalent) from 152.20 metres

- including 151.00 metres of 0.70% copper, 1.55 g/t gold, 2.2 g/t silver (1.50% copper equivalent) from 363.00 metres

The holes is said to have returned “one of the longest and highest-grade copper-gold intervals ever completed at Kwanika,” having notably intersected a thick interval of high gold grades. Further, the hole terminated in copper and gold mineralization, suggesting that the system may continue even deeper.

However, it was noted that after a depth of 516.0 metres alteration “starts to wain,” with lower grade mineralization occurring until the termination of the hole at a depth of 552.0 metres. Multiple zones were believed to have been intersected throughout the hole, including 64.00 metres of copper equivalent, and 22.50 metres of 2.67% copper equivalent, as seen below.

“Hole K-22-255 highlights the strength of the mineralizing system at Kwanika Central, with a very long interval averaging 1% copper equivalent, and multiple higher-grade copper-gold zones within it. The hole shows a typical Kwanika pattern of copper dominant material higher in the hole then becoming much richer in gold at depth,” commented CEO Peter Bell.

Recent PEA Suggests 11.9 Year Mine Life

The results follow the recent release of a preliminary economic assessment study for the Kwanika-Stardust project, published by the company on January 5. The PEA proposes an 11.9 year mine life, that would see average production of 90.6 million pounds of copper equivalent per year, with peak production slated to occur in year 6, when the mine would achieve 152.1 million pounds copper equivalent. Life of mine totals suggest 694 million pounds of copper, 803,000 ounces of gold and 3,204,000 ounces of silver would be produced.

Initial capital required to place the project into production are presently estimated at $567.9 million, with two years of construction expected. Once running, average cash operating costs of US$1.58/pound and all-in sustaining costs of US$2.01/pound of copper equivalent are expected. Net present value of the project, with a 7% discount, is estimated at C$440.1 million, with a pre-tax IRR of 17.1% and a payback period of 6.37 years in the base case at US$3.63 copper, US$1,650 gold, and US$21.50 silver.

The PEA is said to have included mineralization from the Kwanika Central, Kwanika South, and Stardust deposits. Kwanika Central contains both open pit and underground mining models, while Kwanika South is based only on an open pit design, and Stardust is only based on an underground model.

The latest drill results released this morning were not included in the recently completed PEA study. Furthermore, one hole remains outstanding at the Kwanika Central zone from last years drill program, along with six holes conducted at the Kwanika South Zone, which could further impact the recent study.

“Gold represents approximately 35% of annual revenue in the recent PEA at Kwanika-Stardust and K-22-255 demonstrates the strength of the gold system within the strong, continuous copper mineralization,” said Bell on the results.

Northwest Copper last traded at $0.25 on the TSX Venture.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.