FULL DISCLOSURE: PTX Metals is a sponsor of theDeepDive.ca.

PTX Metals (TSXV: PTX) is one of the big market movers this week, with the equity rising from a low of $0.15 per share on Monday to a high of $0.245 this morning, marking a combined move of up to 63% on the week. In nominal terms, trade volume has exceeded $1.7 million as the equity pushes higher.

While the volume has arrived to the stock despite no news, plenty remains ongoing internally at PTX. The company in December launched a 5,000 metre drill campaign at their flagship W2 Cu-Ni-PGE project in Ontario’s Ring of Fire. The project, which the company refers to as the gateway to the region, will see drill crews work to follow up on drill holes that last year intersected 0.55% copper equivalent over 220.1 metres and 0.74% copper equivalent over 93.8 metres at the CA1 zone.

Set to occur over two separate phases, the first phase of exploration will work to test and delineate known targets with the aim of expanding the current resource estimate. This phase will also see the testing of geophysical targets, and work to build the understanding of higher grade zones on site. The larger program meanwhile aims to merge the CA1 and CA2 zones through further step out drilling.

READ: PTX Metals Commences 5,000 Metre Drill Program At W2 Property

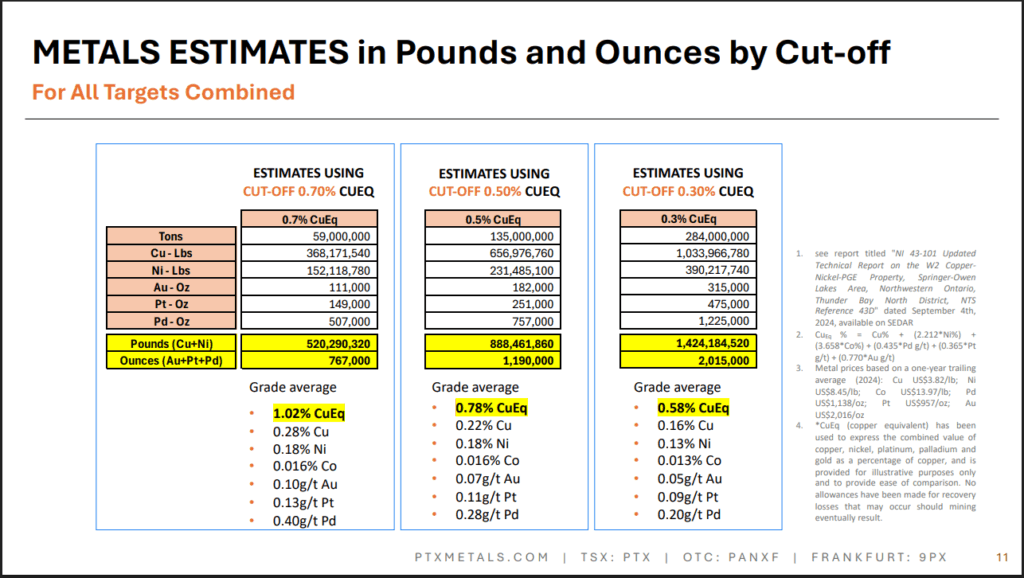

The larger strategy here is for PTX to prove out an exploration target that suggests 135 million tonnes exists here at a grade of 0.78% copper equivalent. The W2 property, which is surrounded by Barrick Mining on the western end, is said to have the potential for Ring of Fire similarities in host rock and mineralization, with PTX proposing the property could potentially contain a southwestern extension of the wider region.

But exploration isn’t the only thing that seems to be driving the story – PTX Metals also has a potential spin-out waiting in the wings via their Green Canada subsidiary. Initially formed in 2023 to acquire a series of exploration stage uranium projects in Canada, the subsidiary has progressed in recent years, culmination in the November announcement of a proposed going public transaction.

That go-public transaction has also seen the subsidiary – which PTX will hold a 48.7% interest in post an ongoing financing – agree to acquire the Marshall Uranium Project from Basin Energy. A subsequent arrangement has appointed CanAlaska Uranium (TSXV: CVV) as the operator of Marshall, who will carry out an initial work program on the property.

What’s more, is that Green Canada has also entered into a nine month exclusivity period to negotiate the terms of an earn-in option that would see the company acquire up to a 51% stake in the North Millennium Joint Venture Project, which is currently owned by CanAlaska and Basin Energy.

A recent financing announced in connection with the go-public transaction has seen the sale of shares of Green Canada occur at $0.13 per share, valuing PTX’s stake at an estimated $2.4 million on a pre-go public basis.

The closing of the go-public arrangement is expected to culminate in the appointment of Richard Mazur as Executive Chairman, while Greg Ferron, Jean-David Moore, and Olivier Crottaz will serve as directors, with Rhys Davies to serve as a geological advisor to the new firm. Closing of the arrangement remains subject to shareholder approval.

PTX Metals last traded at $0.22 on the TSX Venture.

FULL DISCLOSURE: PTX Metals is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover PTX Metals on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.