Spruce Ridge Resources (TSXV: SHL) is one of today’s biggest movers, with the equity currently trading up 62.5% on the day on volume of over 4.68 million as of the time of writing, bringing the equity to $0.13 after soaring as high as $0.15. The large move follows a day where the equity saw volume of 1.1 million, over four times the typical volume seen by the equity.

The move in the equity appears to largely be a result of follow-on activity from that of Canadian Nickel Company (TSXV: CNC), an equity that Spruce Ridge currently holds 8.1 million shares in as a result of the sale of a property to the firm in February of this year.

Canada Nickel has had a significant run over the last two days itself, a result of environmental and social issue idealist positioning in relation to the mining of minerals from the earth. The company announced before markets opened yesterday that it had established a subsidiary named NetZero Metals Inc. The subsidiary is focused on developing zero-carbon production of nickel, cobalt, and iron.

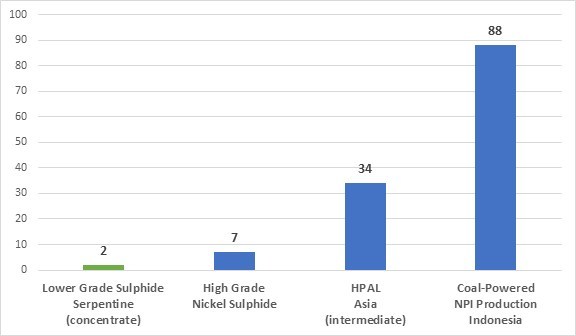

How the company intends to generate “NetZero” Nickel, Cobalt, and Iron (all of which it has applied for trademarks for), appears to be somewhat based on its location, and naturally sounds rather gimmicky. Power for the operation is being supplied via a nearby zero-carbon hydroelectricity operation, while the project itself, the Crawford Nickel-Cobalt Sulphide project, is comprised largely of serpentine rock. Rock, that evidently when exposed to air, absorbs CO2. This is done via a naturally occurring process of spontaneous mineral carbonation.

The short of it, is that the company appears to be marketing heavily what is effectively a naturally occurring process, in combination with its proximity to a nearby hydroelectricity station. From here, the company will move to utilize electric vehicles to reduce emissions when compared to that of diesel vehicles, including large equipment used in the mining process. Milling and processing, which uses large amounts of electricity, is supposedly covered via the firms zero-carbon power source. Finally, the company will look to capture offgases, typically comprised of CO2 and SO2, and reroute them to be captured by the waste rock and tailings where possible.

While sounding gimmicky to the typical investor, we evidently live in atypical times. The story was picked up by a number of news agencies such as BNN Bloomberg, but also by media firms focused on clean energy and anything Tesla. And evidently, Tesla CEO Elon Musk at one point called on the nickel supply chain to move to focus on sustainability – with Canada Nickel now having answered that call. The result, is a (rather short) response from Musk himself on the topic, following a post by Teslarati.

Sounds great

— Elon Musk (@elonmusk) July 27, 2020

The end result is that Canada Nickel Company has surged from Friday’s $1.35 close, to that of $2.84 at the time of writing, after hitting a high of $3.00.

And with this surge, Spruce Ridge Resource’s stake in Canada Nickel has climbed from a valuation of $10.9 million as of Friday, to that of $23.0 million as of the time of writing – a significant figure, given that the company as a whole currently has a valuation of $17.46 million at the current share price.

FULL DISCLOSURE: Spruce Ridge Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Spruce Ridge Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.