Unigold Inc (TSXV: UGD) was a high volume trader last week, seeing 1.8 million shares trade on Wednesday alone, an anomaly for the junior gold explorer. The junior is focused on gold properties in the Caribbean – an unusual location to many undoubtedly. However, the firms flagship property is located nearby to the world class mine known as Pueblo Viejo, currently run by gold mining behemoths Barrick Gold Corp (TSX: ABX) and Newmont Corp (TSX: NGT).

In terms of share structure, the firm appears to be well held via a number of institutional investors. With 78 million shares currently outstanding, the company is currently 12.8% owned by that of Eric Sprott, and 10.6% owned by Osisko Gold Royalties. Further large shareholders include Monarch Gold at 8.3%, Evanchan, owned by Rob McEwen, at 8.1%, and officers and directors at 7.2%.

Collectively, this amounts to an outstanding 47%, or roughly 37 million shares, held by what traders like to refer to as “strong hands.” Outside of these shares, the company also has 17 million warrants out with an exercise price of $0.14, and 5.8 million options with an average exercise of $0.25 per share.

The Neita Concession

Unigold’s flagship property is referred to as the Neita Concession, located on the western edge of the Dominican Republic, along the border with Haiti. The property, at 22,615 in size, is stated to have good infrastructure, power, workforce, roads and telecommunications available. The company currently owns concession on the property for a period of three years plus two optional extensions. In this regard, Unigold has held the property for a total of 17 years, including through four concession renewals, having spent over $42 million developing the area while also drilling over 123,000 metres collectively.

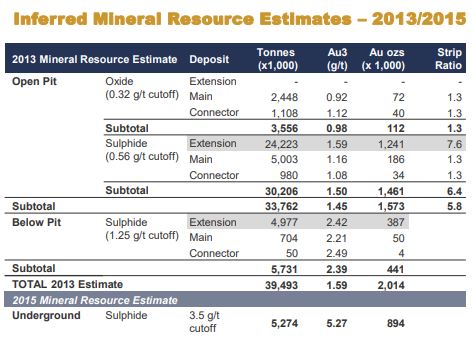

In terms of project development, Unigold is currently in the process of completing sufficient geotechnical work for finalizing its pit and tailings design for its oxide resource. It’s oxide resource, based on a historic 2013 technical report for open pit, is said to have 112,000 ounces averaging 1.0 grams per tonne gold. The resource was based on $1,500 per ounce gold at the time, with the resource extending to 30 metres from surface and a cutoff of 0.32 grams per tonne cutoff.

Following the finalization of sufficient geotechnical work on the oxide resource, Unigold will be looking to complete an economic study on the resource to determine how profitable the operation may be. This study is expected to be completed in the third quarter currently.

The sulphide deposit however is where the major interest lies, with the company currently in the process of completing detailed metallurgical studies to finalize a process design. The same 2013 mineral resource estimated a total of 1,461,000 ounces of gold at an average grade of 1.50 g/t gold with a 0.56 g/t gold cutoff for its sulphide deposit on an open pit basis. Below pit, there was estimated to be a further 441,000 ounces of gold sulphides with a 1.25 g/t cutoff.

A 2015 mineral resource estimate further estimated that 894,000 grams of gold sulphides exist underground at an average grade of 5.27 grams per tonne gold. Following the metallurgical studies, the company will look to complete both sufficient geotechnical work as well as expand the mineralization along strike in the fourth quarter of 2020. For this, Unigold is currently targeting a 2 million ounce resource of gold equivalent at a 3 g/t cut-off.

Lastly, the company is well capitalized – last week the company closed a financing for gross proceeds of roughly $6.0 million, at a price of $0.18 per unit. A total of 33.3 million units were sold, with each unit having one common share and one half warrant, with an exercise price of $0.30 for a period of one year. This financing bodes well for Unigold, whom currently has an operating cost of less than $125 per metre drilled, with the company boasting a productivity rate of roughly 1500 to 1800 metres per drill per month.

Unigold Inc last traded at $0.42 on the TSX Venture.

Information for this analysis was found via Sedar and Unigold Inc. The author has no securities or affiliations related to the discussed organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

I’m going into the market! This is a fantastic gold exploration company with proven assets and massive upside potential with future, fully financed drill program summer 2020