It appears that the popular trading app Robinhood is finally in the hot seat, after being accused by Massachusetts regulators of aggressively marketing to inexperienced users and failing to implement controls to protect them.

Certainly long overdue and frankly quite puzzling why it took this long, especially following the disgraceful buying frenzy of bankrupt Hertz stock back in June, the Massachusetts Securities Division has filed a complaint against Robinhood on Wednesday, accusing the infamous trading app of exposing its users to “unnecessary trading risks” and not implementing the fiduciary standard that was introduced by the state earlier in the year.

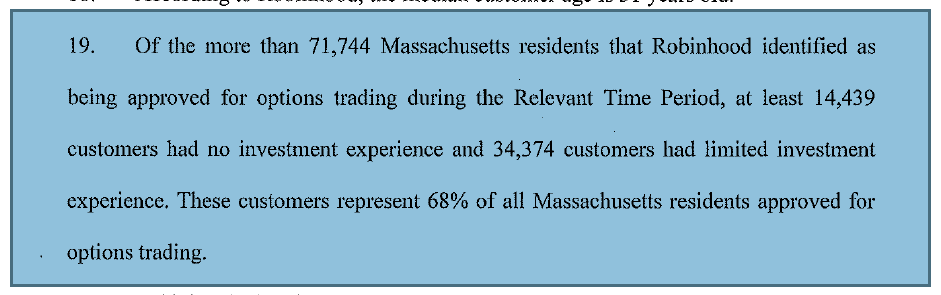

As noted in a Wall Street Journal exclusive report, Robinhood, which not only earns revenues for trades carried out by its customers but also sells its order flow in the event of revenue losses from commissions, has been granting customers with no investment experience the capacity to carry out an unlimited number of trades without properly screening them for options trading. In fact, the 20-page report reveals some alarming data, including the fact that the trading app approved over 68% of Massachusetts residents that had made applications for options trading, even though they had little to no prior investment experience.

The complaint goes on to also highlight some of the questionable individuals who have been using the app to conduct trading on a daily basis, including one user who had “no investment experience” but still made roughly “92 trades per day” since the beginning of February. Another user, who also had no investing experience prior to Robinhood, started trading on the app back in April, and was averaging 75 trades per day since.

The regulator also accused Robinhood of encouraging users to interact with the platform constantly, via what it refers to as a “gamification” of the application that requires “continuous and repeated engagement.” The complaint points to Robinhood’s new cash management feature, which accompanies a customer wait list to sign up for early access. In order for users to advance their position on the wait list, they were prompted to “tap” a fake credit card in the Robinhood app up to 1,000 times per day.

In addition to the most recent allegations, Robinhood has been the subject of other growing pains. Prior to the Massachusetts complaint, the trading app recently settled a claim from the FINRA for $1.25 million, after being accused of not taking the necessary steps to ensure its users were getting the best pricing. Amidst all that, Robinhood also experienced numerous outages, including an outage spanning several days back in March, which also happened to be a historically significant day for the markets.

Information for this briefing was found via the Wall Street Journal. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.