Colombia was the world’s main source of platinum until 1820 and the largest producer between 1917 and 1923. Up until 1920, nearly all PGE production came from placer deposits in Russia and Colombia.

In fact, it was a fascination with Colombia’s platinum mining past that inspired management at Max Resource Corp. (TSX-V: MXR) to become the next big thing in PGE exploration.

Towards that goal, Vancouver-based Max has acquired a Canadian PGE property and is planning to spin off a new company, PGE Americas Corp, thus taking the first step in building a portfolio of PGE assets, cemented by a trio of metals with strong market fundamentals – platinum, palladium and rhodium.

PGE Americas flagship project is the PGE Choco Project. Located 120 km from Medellin, PGE Choco is within an historical platinum mining district. Between 1906 and 1990, Colombian mining company Choco Pacific extracted 1.5 million ounces of gold and 1 million ounces of platinum, all within 8 meters of surface. Max’s 2019 field work highlighted concentrate values of 114 grams per tonne (g/t) platinum and 341 g/t gold. Historical drilling logs also show evidence of palladium and rhodium.

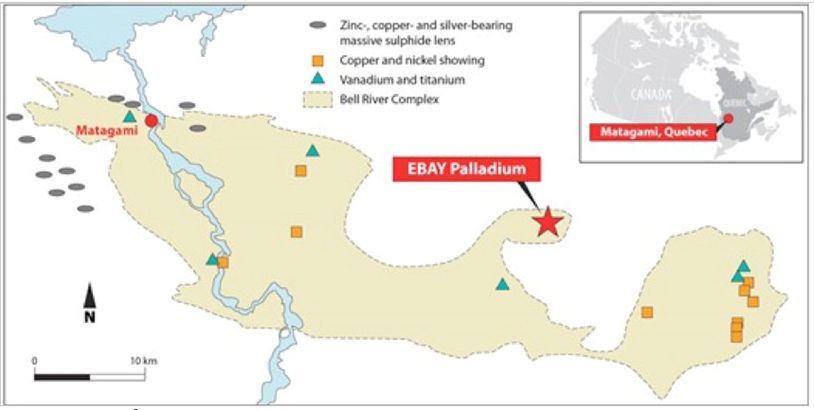

In addition, Max Resource just announced the acquisition, through its subsidiary PGE Americas Corp, of the Ebay Palladium, Platinum and Rhodium Project, located 30 km southeast of Matagami, in the Abitibi region of Quebec, Canada.

This article was originally published at AheadoftheHerd.com. The original work can be found here.

Ebay Palladium, Rhodium and Platinum Project

Formerly optioned in the mid-2000s to Hinterland Metals Corp, Ebay lies on top of the Bell River Complex, a layered mafic intrusion extending 65 km long by 15 km wide by 15 km thick.

Despite discovery of significant PGE values in 1991-92, including 4.87 g/t palladium and platinum grab samples, the Bell River Complex saw little exploration, not until a Quebec government survey identified a large layered mafic intrusion, and a huge pyroxenite-gabbro breccia body comparable to the Lac-des-iLes PGE ore body in Ontario being mined by North American Palladium.

Hinterland consolidated the central portion of the entire Bell River Complex, including the newly identified breccia body. The 131 sq km project, comprising three PGE target areas, was considered the largest unexplored layered mafic intrusion of the Abitibi Greenstone Belt.

In 2005, more select grab sampling returned 3.04 g/t palladium, 1.39 g/t platinum and 0.18 g/t rhodium. (we note rock values here of a very decent $312 per tonne)

A drill program was slated for the fall of 2006, designed to test a geochemical anomaly found 400m south of Ebay, and an anomaly that a high-definition aeromagnetic survey traced for around 5 km.

That November, Hinterland Metals discovered a new platinum-palladium zone, returning an average 1.9 g/t Pt + Pd over 3.0m. Assays from eight holes received the following March showed a broad zone of PGE mineralization, between 6.7 and 31.1 meters wide and 300m long, with grades up to 2.52 g/t PGE.

Several semi-massive sulfide intervals assaying up to 1.12% copper and 0.36% nickel over 1.8m were also reported.

However, despite the promising drill results, progress was halted in 2008 during the global economic crisis due to a sharp decline in platinum prices, and Hinterland had to put the project on hold.

The considerable come-back of these metals has put the Palladium, Platinum and Rhodium Project back on the front burner, so to speak.

The current palladium price of US$1,550 per/oz is seven-times the 2003 price of US$201 and the current US$5,500 per/oz rhodium price is eleven-times the 2003 price of US$476, making the EBAY project an excellent exploration project for our wholly-owned subsidiary PGE Americas Metals Corp.,” Max CEO Brett Matich commented.

Max is currently re-assaying drill core for PGE values including rhodium, iridium, osmium and ruthenium, in anticipation of a fall 2020 drill program.

Boom, out go the lights

Platinum prices are likely heading higher, potentially catching the wind already in the sails of its sister platinum group metals (PGMs), palladium and rhodium, which have been soaring of late due to a combination of tight supply and robust demand for catalytic converters, needed to meet stricter air pollution standards.

The hair trigger is an explosion at a refinery belonging to Amplats, the world’s second largest platinum producer.

According to media reports, a Feb. 10 explosion damaged phase A of the South African company’s Anglo Converter Plant, part of a chain of processing facilities at its Waterval smelter in Rustenburg, 141 km from Johannesburg.

A phase B backup plant can’t be used because water was found in the furnace, posing the risk of another explosion. That plant has also been shut down, for 80 days. Repairs at the phase A plant won’t be completed for 12 to 15 months.

With both plants at the smelter out of commission for a minimum three months, Amplats was forced to declare force majeure – allowing the suspension of contractual obligations due to unforeseen circumstances such as this. The hit to EBITDA is expected to be over $1 billion, based on current platinum prices.

The immediate effect, along with hammering the shares of Johannesburg-based Amplats and its parent company, Anglo American, was to raise spot platinum prices by almost 3%, on expectations of crimped supply.

Amplats told shareholders it has cut its 2020 production guidance for PGMs by almost a million (900,000) ounces, from between 4.2Moz and 4.7Moz, to between 3.3Moz and 3.8Moz.

That’s a big deal. Not only does the Anglo Converter Plant refine ore from Amplats’ mines, it also processes material from other platinum miners including Sibanye-Stillwater, African Rainbow Minerals and Royal Bafokeng Platinum.

For platinum alone, the smelter closure is expected to strip 500,000 oz, the equivalent of 8.7% of global supply, from the 5.7M oz of platinum produced in 2019 and tallied by the US Geological Survey.

Supply chain vulnerability

The sudden loss of this refinery, and its planned back-up, shines a bright spotlight on the problem of supply insecurity, that stalks the PGE market.

It couldn’t have come at a worse time, considering the negative impact the coronavirus has had on supply chains across all industries.

According to the USGS, the supply of PGEs from South Africa, the top producer, is anything but guaranteed. For the past two years, production has been falling, owing to jobs cuts and mine shaft closures – a trend that is likely to continue.

Autocatalyst demand accounts for three-quarters of palladium demand.

Currently, and for the foreseeable future, palladium is facing constricted supply. The palladium market has been in deficit for eight straight years. The reason has mostly to do with structural problems in South Africa. About 90% of palladium is mined as a by-product of nickel and copper in Russia, and platinum in South Africa. These two countries dominate the market.

South Africa’s platinum mining companies are under constant pressure to contain costs, because their mines are very deep, hot and labor-intensive. They also face frequent strikes. In 2014 workers at the country’s three major producers – Lonmin (now Sibanye-Stillwater), Amplats and Implats – downed tools for five months demanding that wages be doubled. Additionally, there are significant infrastructure constraints; the country has limited processing capacity, with power and water being constant concerns.

Recently, Implats took a big step to diversify its risk from South African mines, by allocating capital to North America and acquiring Canada’s North American Palladium (NAP) for CAD$753 million. NAP is one of two primary palladium producers globally. The other, South Africa’s Sibanye, bought Stillwater Mining and its palladium mine in Montana, to form Sibanye-Stillwater.

On the demand side, diesel engines are being phased out in favor of gas-powered cars and trucks that meet stricter emission regulations, particularly in Europe and China. As drivers shift from diesel to gas-powered cars or hybrids, demand for palladium has buoyed the price. Despite a global downturn in auto sales in 2018 and 2019, palladium prices have held up well, on concerns that the mining industry will be unable to meet the demand for cleaner-burning vehicles.

Spot palladium is currently trading at $2,297 an ounce compared to gold’s $1,607/oz, as of this writing.

Rhodium has performed even better. Because rhodium is essential in three-way catalytic converters, and is less common than its sister PGEs, platinum and palladium, demand for it has soared, along with prices.

North American supply insecurity

The United States is heavily dependent on external sources for PGEs, importing about 90% of the platinum-group elements it consumes.

PGEs were included among a 2018 list of 37 mineral commodities the US considers critical to its economic security and national security. North America only has two producing platinum and palladium mines – Stillwater in Montana and the Lac des Iles mine northwest of Thunder Bay, Ontario.

The United States gets 31% of its palladium and 44% of its platinum from South Africa; Russia supplies 28% of US palladium needs. If North American mining companies and their customers want to get serious about controlling the flow of these critical metals, and stop their dependence on foreign suppliers, they need to start developing US and Canadian mineral deposits.

Why PGEs are critical

The platinum group elements consist of six metallic elements: iridium (Ir), osmium (Os), palladium (Pd), platinum (Pt), rhodium (Rh) and ruthenium (Ru).

PGEs share similar physical and chemical properties, and they usually occur together in the same orebodies. The similarities include a resistance to corrosion, high melting points, and catalytic qualities, meaning they speed up chemical reactions without themselves being chemically altered.

They are among the rarest elements in the earth’s crust. The crust has just 0.0005 parts per million (ppm) platinum, compared to 60 million ppm copper, 0.075 Mppm silver and 0.004 Mppm gold. Rhodium is even rarer, at around 0.0002 Mppm. In 2018 the world’s mines dug up 860 million ounces of silver and 109 Moz of gold, compared to just 6 Moz of platinum.

The leading use of PGEs is in catalytic converters. These essential automobile components scrub tailpipe emissions in gas or diesel fueled vehicles. Palladium is the main ingredient in catalytic converters for gasoline-powered cars, vans and trucks, while platinum is in the catalytic converters of diesel vehicles. Rhodium is used in three-way (platinum, palladium and rhodium) autocatalysts.

Platinum’s non-corrosive quality makes it ideal for medical implants such as pacemakers, and surgical tools. About 40% of the world’s platinum goes into autocatalysts, and an emerging market is in the manufacture of hydrogen fuel cells. Here, platinum is used to spur the chemical reaction of hydrogen with oxygen.

The chemical industry needs platinum or platinum-rhodium alloys to make specialty silicones and nitric oxide – the raw material in fertilizers, explosives and nitric acid. PGEs are needed to produce fiberglass, liquid-crystal and flat-panel screen displays.

Palladium, platinum and rhodium are also investment metals, bought and sold as bars, coins or ETFs.

While less common than platinum jewelry, jewelers like working with palladium because it does not easily tarnish. Its low density means palladium is easily shaped into fine patterns, and it can be combined with gold to create white gold.

Rhodium’s value stems not only from its rarity, but because it is extremely durable and highly reflective. This makes rhodium ideal as a finish for mirrors and search lights. Rhodium does not easily react with oxygen, making it an excellent catalyst that is resistant to corrosion and oxidation. In jewelry, a thin layer of rhodium is often plated with white gold for tarnish resistance.

About 80% of rhodium supply comes from South Africa, followed by Russia.

Cesar Copper + Silver Project

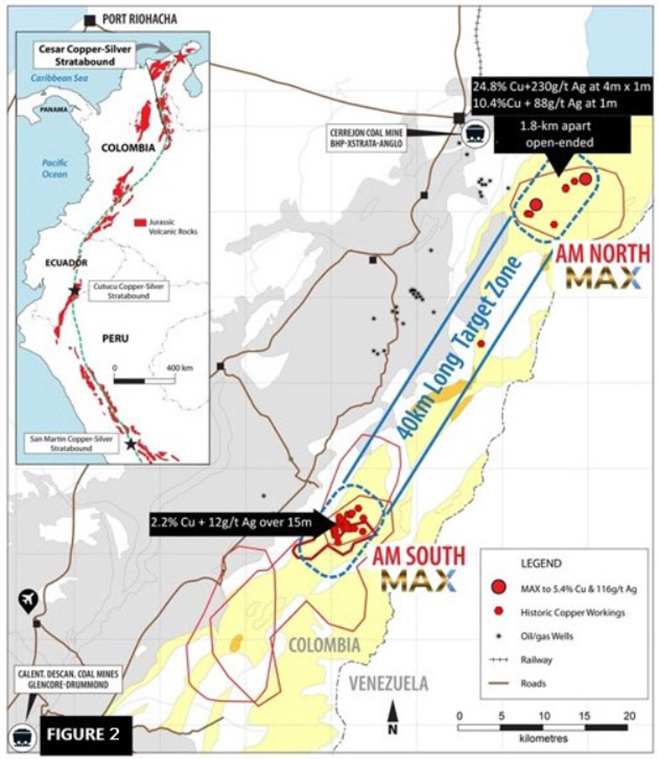

At Max Resources Cesar Copper + Silver Project, in northeastern Colombia, a number of significant newly discovered copper-silver showings have been identified.

Since November, Max’s geological teams and prospectors have been identifying copper and silver targets in the 100 km x 20 km target area at Cesar, using rock chip sampling to identify structures, continuity of thickness, and strike length, to determine potential size prior to drilling.

The company is following the theory that continuous rock chip samples are pointing to a giant sediment-hosted copper + silver mineralized system.

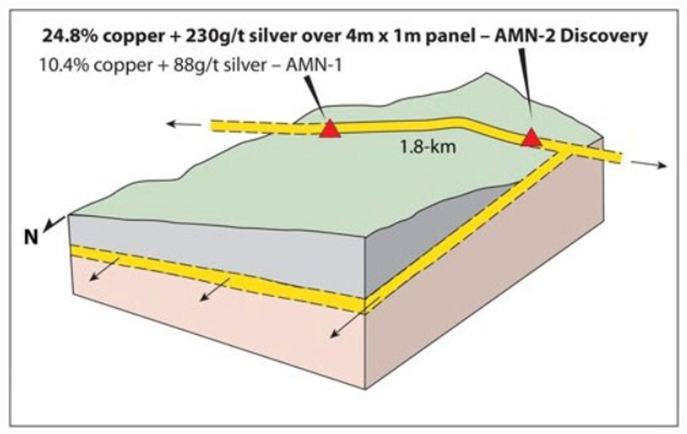

The recently discovered “AM North” zone contains two mineralized areas from which rock samples were taken – AMN-1 and AMN-2 which appear to be connected over 1.8 km open in all directions. AMN-1 returned impressive values of 10.4% copper and 88 g/t silver over a continuous one-meter interval.

AMN-2 returned 24.8% copper + 230 g/t silver over a 4m x 1m rock chip panel discovery, located 1.8 km from AMN-1.

Forty kilometers away, at the AM South discovery, rock chip sampling has zeroed in on a number of mineralized structures, for a strike length totaling over 5 km. Sampling from 0.1 to 25-meter intervals returned highlight values of 5.4% copper and 63 g/t silver.

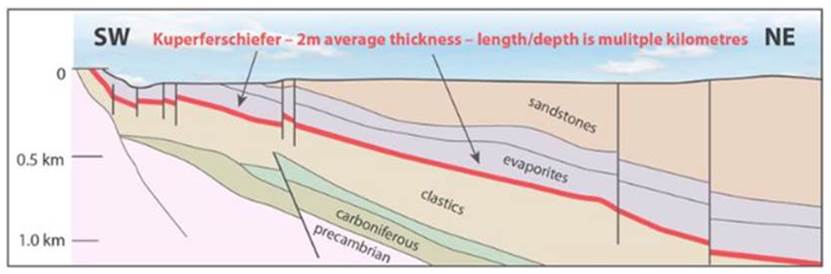

In the Feb. 27 news release, Max notes that AM North and AM South are both hosted in well-bedded sandstone-siltstone. In an earlier interview with AOTH, Max’s head geologist, Piotr Lutynski, said Colombia’s stratigraphy is similar to his homeland, Poland, and its cluster of “Kupferschiefer” sediment-hosted copper-silver deposits.

In 2018 KGHM Polska Miedź (KGHM), the only copper producer in Poland, mined 30.252 million tonnes of ore at 1.49% copper (Cu) and 48.6 g/t silver (Ag), comprising 452,000t of Cu and 47.2 million ounces of silver.

Other metals recovered from copper ores at Poland’s Kupferschiefer deposits include gold, platinum, palladium and renium. It’s interesting to note that the Kupferschiefer in Poland is the biggest deposit of cobalt in Europe, but it is not currently being mined .

According to the US Geological Survey, the massive volume of metal in Poland’s Kupferschiefer deposits is due to continuous mineralization that extends down dip and laterally for kilometers.

Max cautions investors that the mineralization at Cesar is not necessarily indicative of similar mineralization in Poland.

Max’s goal is to bring in a major copper company as a partner, that can help finance a drill program at Cesar and bring it to a resource, then complete the rest of the steps (PEA, prefeasibility study, feasibility study, permits, etc.) required to build a mine.

North Choco Gold and Copper Project

Max’s North Choco Gold and Copper Project features the high-grade NW gold-copper discovery, where continuous rock chip samples returned an impressive 49.8 grams per tonne gold and 4.3% copper. Max notes the open-ended discovery has similar geology to AngloGold Ashanti’s 2005 Quebradona gold-copper discovery, and IAMGold’s 2010 Caramanta gold-copper showing, located a respective 12 km northeast and 6 km west of NW.

Quebradona has a 2014 inferred mineral resource containing 6.1 million ounces of gold, 3.95Mt copper, and four additional porphyry centers. A porphyry is a geological term for a large mass of mineralized igneous rock, that is often suitable for bulk mining. Caramata hosts five porphyry centers, where several drill intersections logged +1 g/t gold, including one intercept that cut 460.6m at 1.4 g/t gold-equivalent.

Conclusion

At AOTH, we are pleased to see Max hitting such high grades at Cesar, and that the company has identified a 40-km target zone defined, so far, by AM North and AM South. While AM North and AM South are each potentially stand-alone projects, we are very interested to see whether additional copper and silver showings, at significant grades, can be identified along that 40-km zone to call it a mineralized district. As Max continues to explore Cesar this year, it may receive a welcome lift from copper prices. In a new report, Fitch analysts revised their 2020 copper price upward by $200 per tonne, from $5,700 to $5,900, writing that they expect increased stimulus from the Chinese government to raise copper prices in the second half of the year.

We are also encouraged by Max’s spin-out of PGE Americas and its PGE Choco Project – from which historical exploration appears to hold much promise. The Ebay Palladium, Rhodium and Platinum Project in Quebec is another iron in the fire that is a perfect fit for Max’s PGE focus, in this era of high palladium, rhodium and platinum prices.

Only eight holes have been drilled into a new platinum-palladium zone – leaving much room for exploration upside.

Max offers shareholders potential exposure to many different metals:

- PGE Americas Choco and Ebay projects: palladium, rhodium and platinum while re-assaying for iridium, osmium and ruthenium and more rhodium.

- Cesar Copper + Silver Project: copper + silver and, because Colombia’s stratigraphy is similar to Poland, and its cluster of Kupferschiefer sediment-hosted copper-silver deposits potentially gold, platinum, palladium, renium and cobalt.

- North Choco Gold and Copper Project: gold and copper.

2020 has started off very well for Max Resource Corp. A lot of progress has been made at Cesar and these latest developments regarding MXR’s proposed spin-out subsidiary PGE Americas prove that Max is a company on the move and one that likes to keep the news flowing to shareholders.

Content sourced via Ahead of the Herd, written by Richard (Rick) Mills. Full disclaimer associated with this work can be found at AheadoftheHerd.com.

The Deep Dive, and it’s parent company Canacom Group, has not reviewed the above content and is hereby not responsible for statements made within. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The Deep Dive and it’s parent company Canacom Group holds no licenses.

FULL DISCLOSURE: Max Resource Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Max Resource Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.