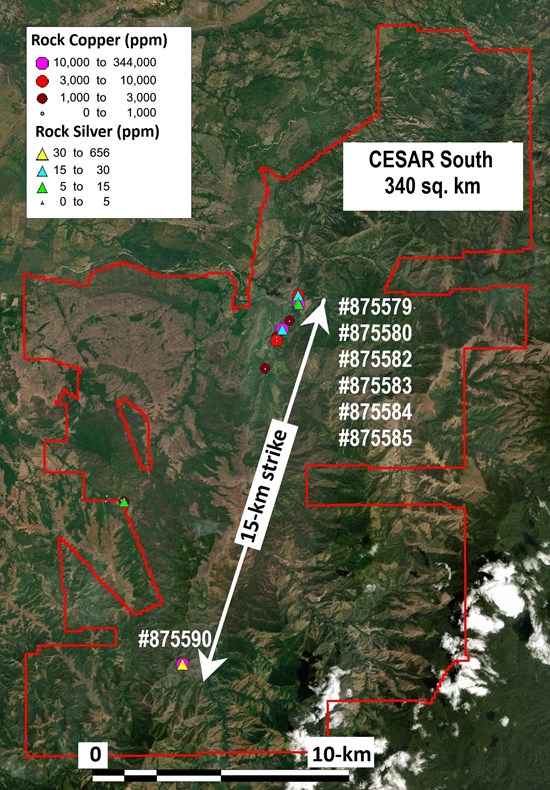

Additional property south of the current Cesar property has been acquired by Max Resource Corp (TSXV: MXR). The company announced the acquisition of the property, referred to as Cesar South, this morning, with the property covering an area of 340 square kilometres.

The new property is located 200 kilometres along trend from the wholly owned Cesar copper-silver project in Colombia. Located in the same basin, the property currently has 15 kilometres of strike with mineralization very similar to the AM North and AM South zones at the Cesar property.

Recent grab sampling conducted along strike by Max have returned highlight values of 11.4% copper and 656 g/t silver. Overall, the results ranged from 0.3% copper to 11.4%. What’s more significant however, is that the same mineralization types have been found both at the north and south ends of the Cesar copper-silver basin, suggesting that mineralization may just be continuous throughout the entire basin – which covers an area hundreds of kilometres wide.

The company currently intends to conduct followup field activities on the new property by the in-country team. Activities scheduled include systematic chip channel sampling. Furthermore, the company currently intends to undertake surface geochemical sampling, structural mapping, and data analysis at the Cesar property as well.

“The CESAR South acquisition is a key step in our CESAR district land expansion strategy. While visible copper over 15-km of reconnaissance exploration is significant on its own merits, the discovery of similar copper-silver mineralization 200-km apart in the same sedimentary basin is the most important takeaway, as it suggests these copper-silver horizons may underlie the entire basin. For a perspective, the Kupferschiefer KGHM deposits are spread over approximately 20-km by 15-km.”

Brett Matich, CEO

The property itself was acquired for a cash payment of US$250,000. The purchase price covers a total of 13 mineral applications that cover roughly 340 square kilometres. A net smelter royalty of 3% also exists on the property, which can be acquired via a payment of US$4.0 million any time prior to production.

Max Resources last traded at $0.38 on the TSX Venture.

FULL DISCLOSURE: Max Resource Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Max Resource Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.