One of the more controversial junior mining stocks over the last year in Canada has been Max Resource Corp. (TSXV: MXR). In October 2019, the company walked away from a seemingly fantastic transaction with Noble Minerals in Colombia due to “challenges surrounding access and due diligence.” At the time many shareholders were irate, but the company kept moving forward.

Max quickly pivoted into a project that could be described as ‘hunting for a new whale.’ They switched their focus to exploring the Andean Belt, the world’s largest producing copper belt. Most of the world’s major mining companies are entrenched in this prolific mineral belt.

Max’s wholly-owned CESAR copper-silver project in north east Colombia lies within the northern Andean belt, along a 120-kilometre sediment-hosted copper-silver belt that resembles the Kupferschiefer deposit in Poland. The CESAR region enjoys major infrastructure. Mining operations include Cerrejon, the largest coal mine in Latin America, jointly owned by global miners BHP Billiton, XStrata and Anglo American.

Background on Kupfershiefer

Kupferschiefer is known for hosting one of the world’s largest and longstanding copper and silver deposits. It is Europe’s largest copper deposit, with production in 2018 of 30 million tonnes grading 1.49% copper and 48.6 g/t silver from a mineralized zone of 0.5 to 5.5-metre thickness. The Kupferschiefer deposit is also the world’s leading silver producer, yielding 40 million ounces in 2019, almost twice the production of the world’s second largest silver mine.

Technical Study to Be Reviewed by Two Majors

Max has entered into separate non-exclusive confidentiality agreements with two global mining companies to examine the CESAR sediment-hosted copper-silver project. The technical study conducted by Fathom Geophysics is well underway, focusing on mapping stratigraphic features that may help to pinpoint stratabound copper-silver mineral horizons at CESAR. Fathom is utilizing remotely-sensed data including ASTER and Sentinel-2 infrared bands for spectral correlation mapping to compare the CESAR data set against known standards to identify occurrences of target mineral species associated with stratabound copper-silver deposits.

Two University Studies with Kupferschiefer Resonance in the Andean Belt

In the last year, Max saw the commencement of the ongoing structural analysis of the CESAR target zone conducted by Ingeniería Geológica Universidad Nacional de Colombia (IGUN) in Medellín. And on April 21st, Max announced the involvement of the University of Science and Technology in Krakow, Poland (AGH) to study the sediment-hosted copper-silver mineralization of the CESAR project. At AGH, the professors and teaching staff have a long history of working with KGHM Polska Miedz, the largest copper producer in Europe and the worlds largest silver producer. With the study, AGH will leverage their extensive knowledge of KGHM’s world renowned Kupferschiefer sediment-hosted copper-silver deposits.

Identified Mineralogy Similarities

The current feedback from the University of Science and Technology was summed up in a recent company news release as follows:

Petrographic analysis of two selected samples (#612 & #618) from the “AM South Cu-Ag Stratabound Target Area” (Figure 4) confirms the presence of native copper, chalcocite, and malachite hosted in siltstone and sandstone, and also discovered the presence of covellite, previously not known. Samples examined were rock materials collected from the CESAR stratabound copper-silver horizons and shipped to AGH for mineralogical and geochemical studies.

Company CEO Brett Match went on to say, “The petrographic study elucidated the relationships of the various copper minerals further reinforcing the similarity to Kupferschiefer mineralogy and to the stratigraphic control on mineralization.”

Some Large Samples, Including Silver

Even though CESAR was newly discovered 10-months ago, Max’s exploration team has identified an 11- km copper-silver zone to the north and traced over 5.8km of strike to the south, open in all directions.

Max has shown some very strong copper and silver grades in CESAR including:

- 34.4% copper + 305 g/t silver across 0.5-metre

- 24.8% copper + 205 g/t silver over 4-metre by 1-metre

- 16.0% copper + 146 g/t silver over 4-metre by 1-metre

- 14.2% copper + 215 g/t silver over 0.6-metre

- 13.5% copper + 95 g/t silver over 0.8-metre

- 12.1% copper + 89 g/t silver over 1-metre

Max’s in-country exploration team is conducting field activities through to year end, we will continue to monitoring their progress.

Copper has done quite well over the last few months rising as high as $3. Creating additional excitement for investors, it’s noteworthy to consider the silver bi-product the copper would produce, while also considering the current price rise in silver.

Final Thoughts

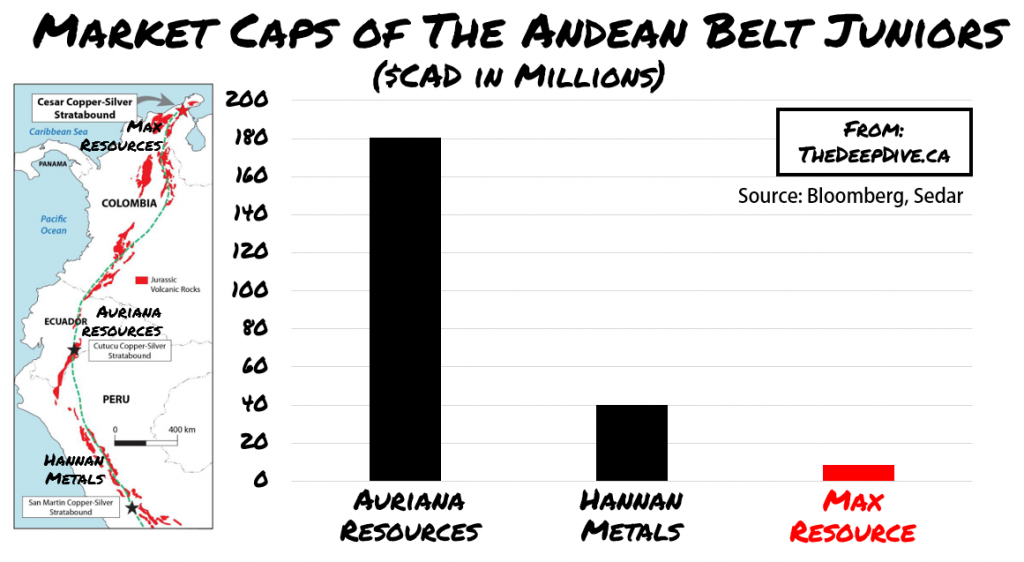

Max Resource has been consoldiating a land package designed for majors to keep an eye on. There is risk here, welcome to junior mining! When comparing the valuations of the issuers that are part of this structure it looks like Max Resource is onto something. Make no mistake, they still are haunted by their decision to walk away from the transaction with Noble.

Any investor needs to be comfortable with the reasoning behind that and understand the challenges of operating in Colombia. The company continues to show strong samples and continues to highlight the project with major partners. Overall, we feel that given the momentum in the price of copper and silver, the near-term risk/reward profile for Max looks to be attractive.

Max Resource last traded at 20.5c on the TSXV.

FULL DISCLOSURE: Max Resource Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Max Resource Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

One Response

Thank you for all your hard work, much appreciated!!👍