On July 28, McDonald’s Corp (NYSE: MCD) reported their second quarter financial results. The company reported topline revenue of $5.88 billion, growing 56.5% year over year and slightly beating the street high estimate of $5.86 billion. Gross profit came in at $3.22 billion, an increase of 86.8% year over year. The company’s gross margin was 54.7% and operating margins were 45.7% for the quarter.

Multiple analysts raised their price targets on McDonalds, bringing the 12-month average price target to $264.38, up from $258.88 before the results. The street high sits at $295 from Longbow Research and the lowest comes in at $229 from DZ bank.

BMO Capital Markets also raised their 12-month price target on McDonalds to $280, up from $265 and reiterated their outperform rating following the results. They say that McDonald’s, “continues to drive strong momentum in the US behind a sound strategy,” which includes new menu items, digital, pricing, and macro benefits. They believe that McDonalds can continue driving its growth into the coming quarter but warns that a 6% increase in pricing is not sustainable.

The company beat or came inline in all of BMO’s estimates. Mainly, earnings per share came in $0.26 higher than estimates, which reflects better same-store sales and slightly better-operating margins. BMO writes that McDonald’s “realized double-digit positive comps across all dayparts in the US in F2Q21 vs. F2Q19, while franchisees continued to achieve record-high operating cash flow,” but warns that China sales have not reached 2019 levels due to the COVID-19 situation.

McDonald’s now has 4,000 stores in China, which could provide a nice top-line tailwind for when China sales grow back or above 2019 levels. They believe that China sales will come in above 2019 numbers due to how well McDonald’s US has done.

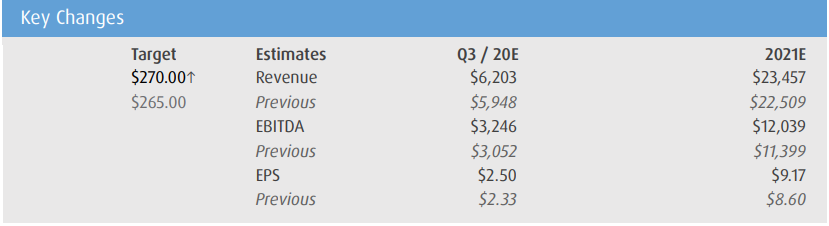

Below you can see BMO’s updated third quarter and 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.