It’s always a positive sign when a company includes a price target from its Chairman – who owns 17% of the company with over $220 million invested – within a quarterly earnings report, right?

McEwen Mining (TSX: MUX) did just that this morning with the release of their third quarter financial results. The results were toplined by revenues of $26.0 million, a decline from the $30.6 million recognized in the second quarter.

Production for the quarter amounted to 26,200 gold ounces and 852,200 silver ounces, which translated to 35,700 gold equivalent ounces, a decline from the 36,100 GEO’s produced in the second quarter and the 42,900 GEO’s produced in Q3 2021.

Cash costs per GEO totaled $1,219 for the firms wholly owned mines, while all in sustaining costs hit $1,659. The average realized price per gold ounce sold meanwhile was $1,742, resulting in gross profits for the quarter of just $1.5 million.

After operating expenses of $17.1 million, and other income of $4.5 million, the company posted an overall net loss of $10.5 million.

The decline of production was substantial enough that the company was forced to reduce its guidance for the full year, with the company now expecting to produce between 134,600 and 141,800 GEO’s this year. Guidance issued in the first quarter had called for production of 153,000 to 172,000 GEO’s. The decline is due to poor production results at both the Fox Complex as well as at Gold Bar.

The Chairman’s Price Target

The results however, did not stop Chairman Rob McEwen from posting a segment within the release titled “What might MUX be Worth?”

Within the explainer, McEwen begins his position by commenting that “Value, like beauty, is frequently in the eye of the beholder.”

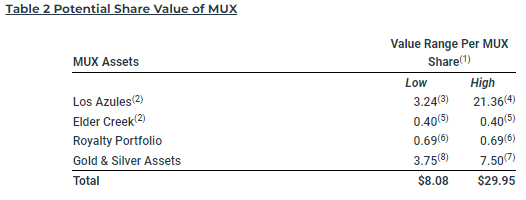

The valuation that McEwen ultimately settles on is based on a “sum of the parts” equation, where he walks through the value of each segment of the company, including its royalty portfolio, its interest in McEwen Copper, and its current operational assets.

In terms of the latter, he comments, “The operating challenges we faced in recent years have severely damaged our credibility with our shareholders and the market. As a result, few investors have taken a close look recently at our assets. If they did, I believe some would see the potential value that I see today.”

He then, in an atypical fashion, highlights exactly why the company has the current valuation it does: “Yes, our cash is tight, our costs/oz are high and our mine lives are currently short, but that has been changing for the better,” – although he does underplay this by failing to address that the company is barely operating at break even on a gross basis, before operating expenses are even considered.

This however does not stop him from providing a price target range – or a “possible potential value,” as McEwen refers to it – of between $8 to $30 a share. At current levels of dilution, this would equate to a market capitalization of between US$379.4 million and US$1.4 billion. The firms current valuation comparatively is US$174 million.

This estimate is based on a breakdown of the firms individual assets, for which both a low and high range is provided.

“Another way to look at MUX is that its current share price of $3.66 reflects the low end of potential value of the company’s ownership in McEwen Copper and you get all the other assets for free,” McEwen commented within his closing argument.

McEwen Mining last traded at $4.92 on the TSX.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.