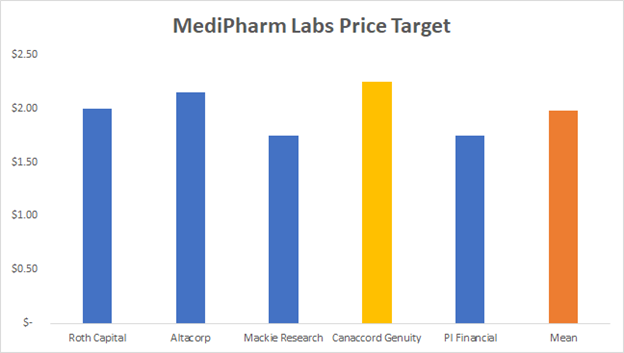

As a follow up to the earlier covered resumption of coverage by Canaccord Genuity on The Valens Company (TSX: VLNS), Canaccord has also resumed coverage on yet another cannabis focused extractor – MediPharm Labs (TSX: LABS). Canaccord Genuity resumed coverage on MediPharm Labs with a C$2.25 price target and Speculative Buy rating. Not only is Canaccord’s price target the highest price target out of the analysts covering the company, but they also have the only strong buy / speculative buy rating on the company.

Canaccord starts off their note by saying that they expect 2020 to be a transition year for MediPharm, but believes that the mix of pharmaceutical focused production and its first mover’s advantage to secure GMP certification in multiple international markets allows MediPharm to compete for the market leader in the global medical markets. Canaccord states, “we believe the company has positioned itself as a leading global supplier of medically focused cannabis inputs and finished goods products, and the lead candidate for the partnership for pharmaceutical companies looking to enter the space.”

The firm then says that the decline in wholesale extraction sales will continue to be weak for multiple reasons. LP’s will likely look to toll extraction services to convert their abundance of dried flower and trim before looking on the wholesale market.

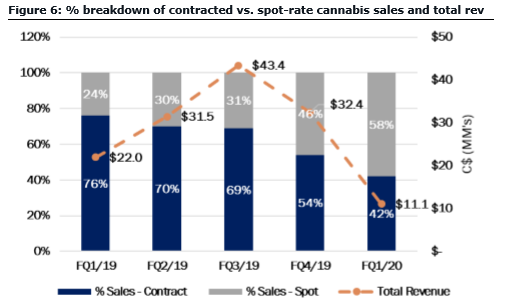

The earlier exhibited surge in revenue was due to LP’s getting ready for the demand of 2.0 by stock pilling extraction and oil-based products into their inventory. This was then countered by COVID-19 hitting retail roll outs hard which has affected the demand for these products. The last thing Canaccord mentions on this topic is that many of the company’s contracted partners have likely purchased the minimum amount that their agreement allows and are transitioning to spot price purchases. All these issued compounded on top of each other has resulted in a 75% decrease in total revenues in just two quarters.

Canaccord continues by stating that MediPharm Labs has distinguished itself with multiple white-label agreements and have received reorders from distributors. These value-added services are believed to allow MediPharm to leverage its production capabilities to include third-party products. Canaccord makes note that the Canadian exports of oil have surpassed that of dried flower on both a YoY growth and absolute basis for the first time. Meanwhile, LABS has established a global distribution network which is heavily focused on the medical segment, therefor Canaccord believes they are positioned well, “to secure an outsized proportion of contracts as more international markets begin to embrace cannabis medically.”

Current estimates by Canaccord indicate that it anticipates Medipharm’s FY2020 revenue will be C$67m, compared to the C$129m MediPharm generated in 2019, with the average price per gram dropping ~82% from C$5.01 to C$2.76. This price per gram is anticipated to post a slight rebound in FY2021 to C$3.47, while revenues climb back up to FY2019 levels at C$118m. Revenues are then estimated to nearly double in FY2022, with estimates coming in at C$220m, while the average price per gram stays flat

.Information for this briefing was found via Sedar, Canaccord Genuity and Medipharm Labs. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.