It appears that not all operators are able to successfully perform under the changing market conditions within the cannabis landscape. Medipharm Labs (TSX: LABS) this morning reported its third quarter financial figures, with revenue cratering to $4.9 million – a 64.5% decline quarter over quarter, and a 88.6% decline year over year. The company meanwhile reported a net loss of $15.3 million in the three month period.

The evaporation of revenues is said to be a result of lower bulk extract sales during the quarter, while the company attempts to re-align itself by refocusing on white label contracting rather than business to business wholesale concentrates. Finished product shipments consisted of 57% of revenue in the third quarter, or roughly $2.8 million, compared to 16% in the second quarter, or $2.2 million.

However, things certainly did not get better following the cratering revenues, with the cost of sales being nearly three times revenues at $15.5 million, resulting in a gross loss of $10.6 million. The loss is partially attributable to a $6.3 million writedown on inventory.

Operating expenses weren’t much better either. General and administrative expenses were nearly equal to revenues at $4.4 million, while marketing and selling expenses were $1.3 million. Share based compensation was a further $0.8 million, with the company recognizing a total operating loss of $16.7 million.

The company did however recognize a $3.6 million gain on derivative liabilities, essentially a function of its share price falling, while financial expenses were an additional $2.4 million. in total, the company recognized a net loss of $15.3 million, compared to a profit of $2.2 million in the prior quarter.

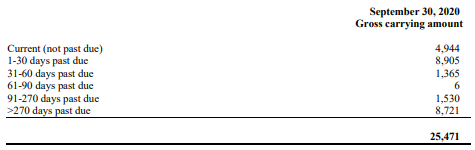

Looking to the balance sheet, the company saw its cash and cash equivalents grow to $36.5 million from that of $27.9 million, due to a $18.9 million convertible note that was issued in August with a face value of $20.5 million. Trade and other receivables meanwhile fell from $32.7 million to $25.2 million, a concerning figure given the amount of sales in the most recent quarter. 43% of receivables remain past due, while 86% is owed by two customers. Legal proceedings are said to be in place relating to $8.5 million in outstanding receivables from one client.

Restricted cash meanwhile is now nil, compared to $18.9 million in the prior period. Inventories also tumbled, falling from $40.3 million to $31.7 million, a figure that remains significantly higher than current sales levels. Total current assets overall fell to $101.0 million, down from $127.7 million in the second quarter.

The bright side here is that liabilities also fell. Trade and other payables declined to $6.0 million from that of $13.1 million, while other current liabilities now come in at nil compared to $18.9 million previously. The current tax liability also was zeroed out, down from $4.7 million previously. Total currently liabilities overall fell from $40.0 million to $14.7 million.

Moving forward into the fourth quarter, the company has indicated it has taken a number of measures given the poor financial results. Employee reductions amounting to annualized savings of $3.0 million has been conducted, while an independent operational review has been undertaken to look for improvement opportunities. The company is also focusing on continuing its transition to white label manufacturing while enhancing marketing and sales.

The company expects that its revenues both domestically and internationally will “grow beginning early in 2021,” alluding to a fourth quarter that likely does not look much better.

Medipharm Labs last traded at $0.75 on the TSX.

.Information for this briefing was found via Sedar and Medipharm Labs. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.