MediPharm Labs (TSX: LABS) announced on Thursday an all-equity deal to acquire VIVO Cannabis (TSX: VIVO). The merger is expected to create a cannabis firm with over $50M in annualized revenue, based on Q3 2022 financials.

Within 12 months of the transaction’s closure, the pro-forma combined company is estimated to generate positive EBITDA of $7M to $9M on an annual basis.

“As many cannabis companies solely focused on the Canadian recreational space, both VIVO and MediPharm saw the future in cannabis wellness products and in pharmaceutical drugs containing cannabis. We were mutually focused on the global opportunities for GMP facilities as international regulations evolved with ever higher quality and regulatory standards,” said MediPharm CEO David Pidduck.

Holders of Vivo common shares will receive between 0.2110 and 0.4267 MediPharm common shares for each Vivo Share held, with the exact exchange ratio to be determined by the amount of interim working capital of Vivo, taking into account any funds advanced by MediPharm to Vivo up to a maximum of a $3.75-million promissory note.

Existing MediPharm shareholders are expected to own between 65% and 79% of the combined company arising from the transaction, while Vivo shareholders are expected to own between 35% and 21%.

The merging firm is expected to have a total combined cash position of about $30 million, including following sale of MediPharm Labs Australia, less than $2.5 million in debt at closure, and ownership of all significant assets free and clear.

“We were attracted to MediPharm as a partner given their cash position of over $19.5M, at the end of Q3, and virtually no debt. As a combined company we can service the small outstanding amount of VIVO debt, continue international operations and invest in the future to grow the Combined Company and achieve profitability sooner than by going at it alone,” added Vivo CEO Ray Laflamme.

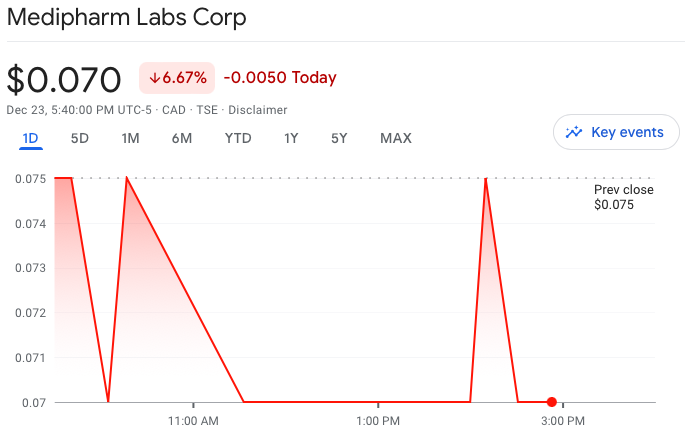

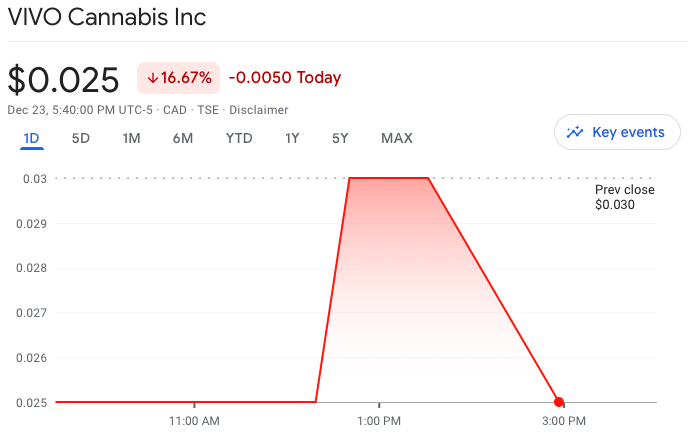

Following the news, both shares of MediPharm and Vivo declined. MediPharm was down 6.7% while Vivo fell 16.7%.

The proposed acquisition would need the approval of both Vivo shareholders (two-thirds voting in favor) and MediPharm shareholders (majority). Both firms have entered into voting and support agreements with each of its directors and officers, as well as with each person who owns at least 5% equity of their respective companies, to vote in favor of the arrangement and not to sell their currently held shares.

The transaction is subject to court and regulatory clearances, including Toronto Stock Exchange approval, which are currently expected within the first half of 2023.

MediPharm last traded at $0.07 while Vivo last traded at $0.025 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.