On November 9th, Medmen Enterprises (CSE: MMEN) reported their fiscal first-quarter financial results. The company announced revenues of $39.8 million, up 13.4% year, while gross profits came in at $17.5 million, up slightly year over year.

Selling, General and Administrative costs totaled $37.2 million for the quarter, making Medmen produce a net loss of $55.3 million or an earnings per share of negative $0.05 for the quarter. The company reported adjusted EBITDA of negative $14.6 million. Medmen ended the fiscal first quarter, which ended on September 25th, 2021 with $78.2 million in cash and equivalents on their balance sheet.

The company only has 2 analysts left who have a price target on Medmen, with both analysts having hold ratings and the mean 12-month price target being C$0.36, or an 18% upside.

In Canaccord’s first quarter review, they reiterate their hold rating but lower their 12-month price target to C$0.35 from C$0.40, writing, “Slower macro-environment leads to a flat print.”

On the results, Medmen came in just below Canaccord’s $40.3 million revenue estimate, which they believe is due to general softness in Medmen’s markets, specifically California, which saw a sequential decline of 2.4%.

Medmen reported lower than expected gross margins and adjusted EBTIDA margins which stem from the higher promotional activity and a $0.9 million inventory write-down which affected both margins, says Canaccord.

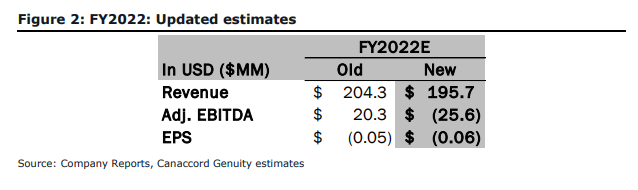

Below you can see Canaccord’s updated fiscal full-year 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.