On May 2, MEG Energy (TSX: MEG) announced its first quarter financial results for 2022. The company reported revenues of $1.53 billion, up from $914 million a year ago. The company saw its funds flow from operating activities grow from $121 million to $587 million or $1.87 per share, while its net earnings grew from ($17) a year ago to $362 million, or an earnings per share of $1.15.

The company also announced that it saw record bitumen production of 101,128 barrels per day. The company reported operating expenses net of power per barrel of $8.98 and non-energy costs per barrel of $4.74, while realized price per barrel for bitumen hit $97.28. This is up from $71.06 last quarter and $52.34 a year ago.

MEG said it spent $88 million in capital expenditures during the first quarter, compared to $106 million in the fourth quarter of 2021. Additionally, the company said it repaid almost $400 million in debt during the first quarter, bringing the total debt repayment since 2018 to approximately $2 billion.

MEG Energy currently has 14 analysts covering the stock with an average 12-month price target of C$24.68, which represents a 21% upside to the current stock price. Out of the 14 analysts, 1 has a strong buy rating, 8 have buy ratings, and the last 5 have hold ratings on the stock. The street high sits at C$34, which represents a 67% upside to the current stock price.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and raise their 12-month price target from C$22 to C$25, saying that after the better-than-expected results, “MEG has one of the best portfolios of oil sands assets and a demonstrated track record of delivering industry-leading operating performance.”

They also believe that MEG energy remains one of the better companies that will be able to take advantage of improving Canadian heavy oil prices.

On the results, MEG reported better than expected cash flow and production results. Coming into the results, BMO was estimating that MEG would report free cash flow per share of $1.82 and an average of 100,000 barrels per day. While the capital expenditures came in below their estimate of $97 million.

BMO continues to believe that the company will reach its goal of being at $1.7 billion in net debt by the second quarter of this year. While the company was recently approved to do an NCIB which will allow the company to repurchase a maximum amount of 27,242,211 shares, or 10% of the company’s public float. They expect that MEG will be able to start its buyback in the third quarter after it has met and exceeded its net debt goal.

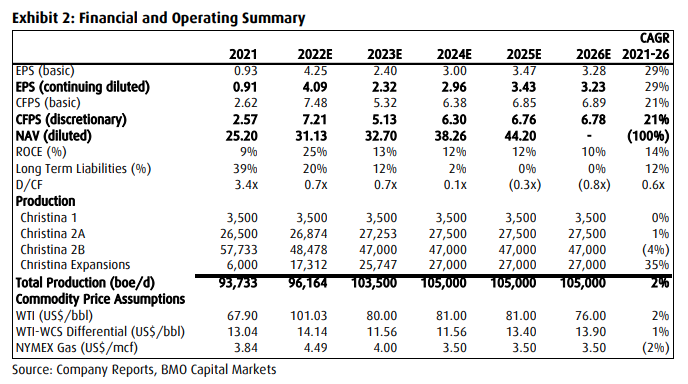

Lastly, BMO revised its estimates which you can see below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.