Last week Xebec Adsorption (TSX: XBC) announced its first quarter financial results. The company reported revenues of $41.2 million, up a little over 100% year over year. Though the company only grew its gross margins by 10% to $4.6 million, for a gross margin percentage of 11%, compared to 20% during the same time last year.

The company also saw its adjusted EBITDA come in lower than last year, as they reported it as ($9) million, which is a similar case for net income which dropped from ($10.1) million last year to ($18.4) million this year, which is an earnings per share of ($0.12).

Xebec said it ended the quarter with working capital of $66.6 million while the company had $34.7 million in cash on hand. They also said that they have a backlog of $260.5 million.

Lastly, the company provided some market outlook and said, “Xebec remains optimistic about the outlook as the Company continues to execute on its three-year plan.” But notes that they faced “unprecedented” hurdles in the first quarter relating to supply chain, logistics, and material costs.

Xebec Adsorption currently has 13 analysts covering the stock with an average 12-month price target of C$2.03, which represents a 105% upside to the current stock price. Out of the 13 analysts, 2 have buy ratings, 10 have hold ratings and a single analyst has a sell rating on the stock. The street high price target sits at C$4, which is a 305% upside to the current stock price.

In Canaccord Genuity’s note on the results, they reiterate their hold rating but lower their 12-month price target from C$2.50 to C$1.50, saying that even though they believe management has done a good job at positioning the company for any increase in demand for renewable gas, they still have not shown the ability to execute and hit margin-targets.

On the results, Canaccord says that the results largely came up worse than expectations. For adjusted EBITDA they estimated that Xebec would see a ($3.5) million figure, while the company reported ($9) million, and even if you net out the EBITDA loss of $2.6 million on legacy RNG contracts, “the quarter was still significantly weaker than expected.”

Additionally, margins came in lower than Canaccord’s 25% estimate, largely due to the legacy contracts that are in the start-up and commissioning phase, while they also saw lower margins on hydrogen contracts as they were impacted by cost inflation. Canaccord writes, “We continue to observe the company’s margins proving vulnerable to external macro factors, more so than others in the space.”

Canaccord also notes that the company’s rising net debt position is something to take into consideration, as they say the company’s free cash flow in the first quarter of 2022 was ($13) million while net debt has increased by $100 million year over year.

Lastly, Canaccord says that the company’s new initiatives under the Center of Excellence Framework leaves them wanting more as they believe the margin target improvement of 2% to 4% seems underwhelming. This is because they believe that if you removed the legacy RNG contract losses in the first quarter, it would have been an EBITDA margin increase of 6.3% by itself.

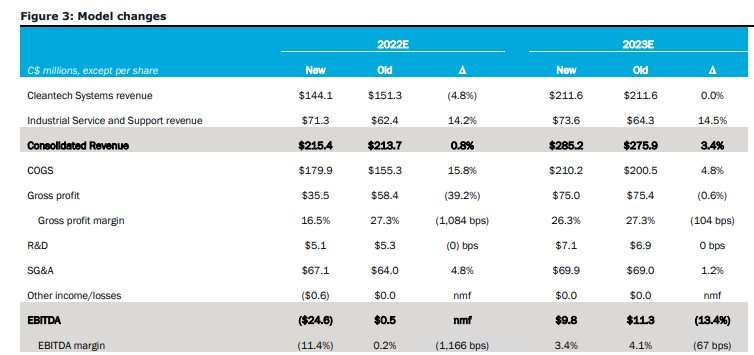

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.