Perhaps you have heard of the efficient market hypothesis?

Per Investopedia, it can be summarized as follows:

”The efficient market hypothesis (EMH) is an investment theory that states it is impossible to “beat the market” because stock market efficiency causes existing share prices to always incorporate and reflect all relevant information.”

Does this sound like something that must always be true? Nope, didn’t think so. We know investors just like you and I are irrational at times (some more than others) and as such, other factors come into play.

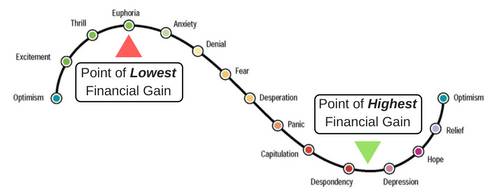

In today’s edition of Mental Hurdles, we will be going over a high-level roller coaster ride of your investing emotions. We will break down the 14 different stages of emotions you are likely to encounter at the various stages. While this is concept is not new by any means, I would like to freshen it up with a pinch of humour.

- Optimism – This stock looks pretty interesting. It has all the stars aligning just right, I think I’ll buy some.

- Excitement – Oh boy, that was a great pick and this one still looks strong. I think I’ll add some more here.

- Thrill – I’m a certified genius. 100% pure awesomeness here. Everyone take note of how awesome I am at my picks and bow before me.

- Euphoria – This thing has no cap on it. What downside? This is going straight to the moon.

- Anxiety – WTF is this? Must be a blip in the matrix. This isn’t straight up – something must be off here.

- Denial – Weird that little blip is more than just a blip, it’s not rebounding just yet. I’m sure it just needs another moment and then the thrusters will be fully engaged again.

- Fear – It’s so cold in here. Someone hold my hand. I am afraid; nothing ever goes my way.

- Desperation – OK I am sure I am a failure at picking stocks now… what do I need to do to get out of this alive and break even?

- Panic – Ahhhhhhh – I have no clue what I am doing or what to do.

- Capitulation – Well that sucked, I don’t want to hold this stock or another one like it ever again. Going once, twice, sold to the highest bidder.

- Despondency – Well that pain is all over now. I repeat – I am never buying that or a stock like that ever again.

- Depression – How did this happen to me? What did I do wrong here? I’m such a clown.

- Hope – hmm maybe this was just a cycle after all? It looks poised to make another run. I’ll keep a lookout for another opportunity.

- Relief – This is continuing to show signs of being a successful investment – what a relief. I better add some here.

Knowing that the markets tend to have patterns and cycles to them is key in making investment decisions. As a trader, you could find an ideal entrance and exit strategy from this concept. As a long term investor, you should keep this in mind while the longer term work remains in progress and not let your emotions get the best of you.

If you are looking to add or exit a position, timing this near the euphoria and despondency stages will help yield you the best results. The trouble is, is finding those key points and avoiding the mental hurdles that goes with it.