Many electric vehicle (EV) developers have succeeded in designing sleek, eye-catching vehicles with solid engineering and driving range characteristics. The “buzz” such cars receive have in many cases persuaded investors to bestow outlandish valuations on selected developers.

Perhaps the two most prominent members of this select group are Lucid Group, Inc. (NASDAQ: LCID) and Rivian Automotive, Inc. (NASDAQ: RIVN), which carry stock market valuations of US$68 billion and US$92 billion, respectively, despite having produced and sold very few vehicles, and having recorded negligible revenue.

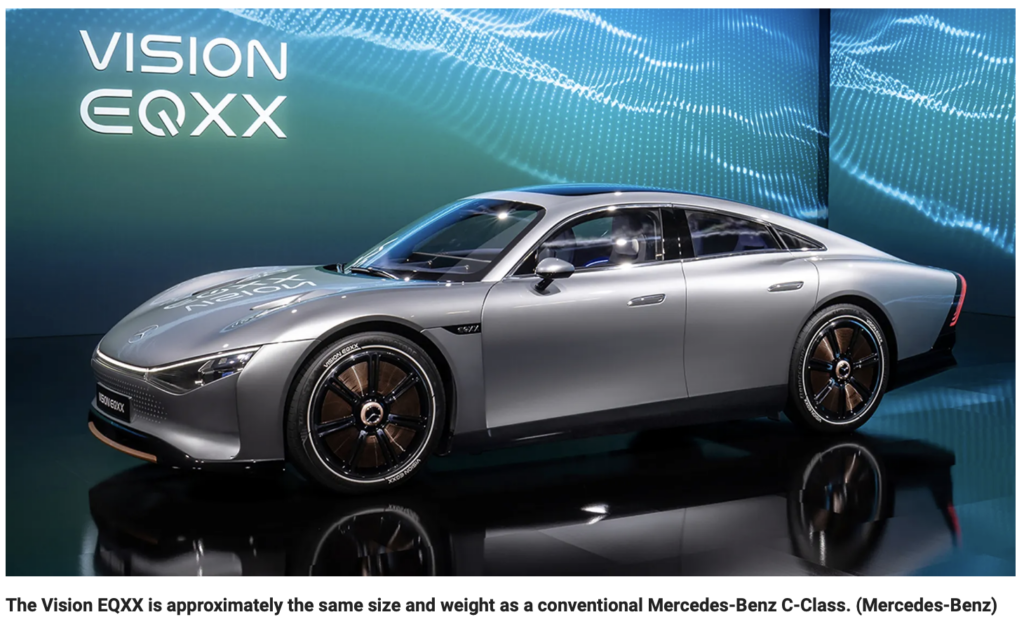

On January 3, 2022, Mercedes-Benz perpetuated this tradition of unveiling an eye-catching future EV at the 2022 Consumer Electronics Show (CES) in Las Vegas, Nevada. The Vision EQXX concept car is a beautiful, streamlined sedan that looks like it could chase down any car driven by James Bond.

Its structure consists of a mix of composites, high-strength steel, and 3D-printed aluminum. In addition, the car has a 47.5-inch-long instrument display screen with 8K resolution. Even more important, it has a reported driving range of 620 miles (by far more than any EV available today) and has equivalent fuel economy of 235 miles per gallon.

The Vision EQXX will not go into production but many of its features will be part of the compact and mid-size Mercedes EQ EVs that will launch beginning in 2024. Mercedes recently began selling its US$100,000+ 2022 EQS Sedan, its first electric vehicle.

All this is part of a mammoth, essentially bet-the-company strategic EV initiative by Mercedes announced on July 22, 2021. On that date, Mercedes announced plans to spend more than US$47 billion to fully electrify its lineup of vehicles by 2030. That dollar amount is the largest planned EV investment by any major automaker.

The impact on the stocks of EV developers from splashy car announcements like Mercedes made on January 3 seems likely to be two-pronged. First, the unveiling of a sleek, fun, high-tech EV model could cause investors to continue to allocate funds to high valuation names on the theory that the cars look so enticing to drive that the car’s producer will definitely be an economic winner. If you build a better mousetrap ….

However, the second stage could be more painful. Not all makers of eye-catching EVs will succeed. Consumers will likely prove more and more discriminating. Furthermore, manufacturing problems are sure to occur as vehicle concepts must transition to mass production. Currently, the stock market is pricing many EV developers like they will not only survive, but thrive. Not every company will be the next Tesla.

The financial consequences of introducing a vehicle which looks good on unveiling day but does not ultimately resonate with paying customers is underscored by the US$47+ billion that Mercedes alone plans to spend on EV development and production. (While high, such required investment is hardly unusual in the EV industry. General Motors Company and Stellantis N.V. have each pledged to spend about US$35 billion on EV development.) If such an investment proves less than fruitful or even disappointing, stockholders in a company which suffers that fate could lose much of their investment.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.