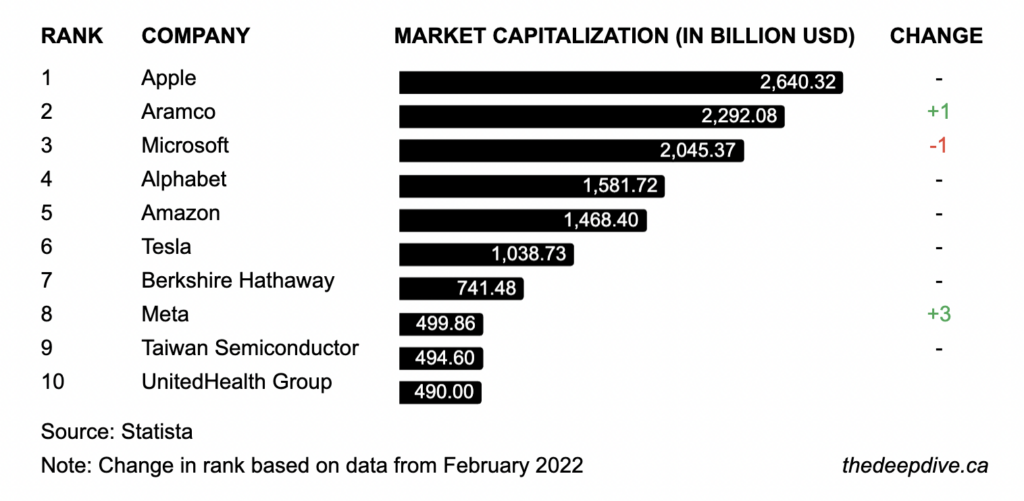

It’s a good news/bad news situation. Good news: Meta Platforms, Inc (NASDAQ: META) is back on the list of the top 10 most valuable companies in the world. Bad news: everything else Meta (except their expenses) is on a downtrend.

The company climbed up to the number 8 slot after its fall to number 11 in February.

Most companies on the list posted a decline in market capitalization from when Facebook’s parent company was booted off the top 10, with American chipmaker NVIDIA slipping down farthest. Tesla, meanwhile, stayed in its slot and grew by over US$130 billion.

Meta has dropped out of Top 10 most valuable US comps & is now #11, behind AAPL, MSFT, GOOGL, AMZN, TSLA, BRK, UNH, JNJ, V, NVDA. There used to be 5 Big Tech comps but there are now only 4 (AAPL, AMZN, GOOGL, MSFT all have >$1tn mkt caps while META <$440bn. (HT @knowledge_vital) pic.twitter.com/kKRtc3t7T9

— Holger Zschaepitz (@Schuldensuehner) July 29, 2022

Meta switched positions with the American chipmaker, which lost over US$123 of its market capitalization since February. Also climbing into the top 10 is American healthcare and insurance firm UnitedHealth with a market capitalization of US$490 billion.

Meta last traded at US$159.10 on the Nasdaq, a 54.79% decline year on year. The company’s stock saw its sharpest decline in early February 2 at 23% overnight after the then newly-named company reported a rare weak revenue forecast and an increase in expenses.

Meta’s Q2 report, released late last week, indicates a continued trend of lower revenue and growing expenses. Early in July, the company announced a 30% cut-down on its hiring plans to brace itself for “one of the worst downturns” in recent history.

The company continues to face a decrease in advertising demand as rising costs and inflation has pushed many companies across numerous markets to cut back on ad spending. The performance is also impacted by the iOS privacy update that Apple implemented late in 2021, as this limited Meta’s ability to track and target its users.

Information for this briefing was found via the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.