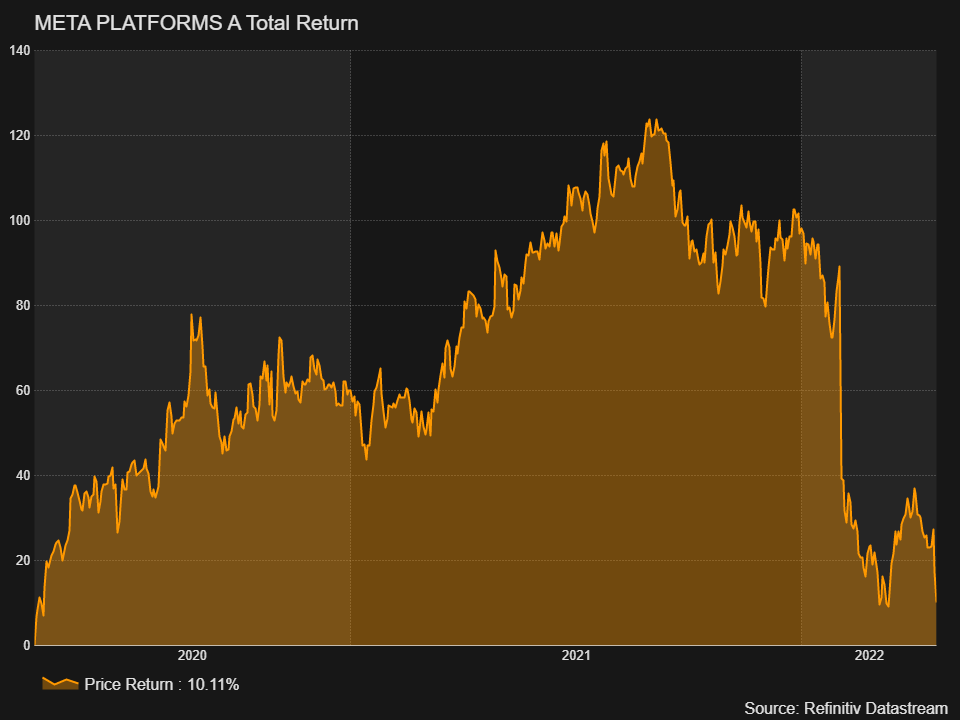

Meta Platforms (NASDAQ: FB), which is reporting its first-quarter results on April 27, is just 1% below its all-time lows of $185.58 and down more than 50% from its all-time highs of $384.33. Analysts have a consensus estimate of $28.23 billion for revenue for the quarter, which is right in the middle of Meta’s $27 to $29 billion guidance for the first quarter.

Revenue estimates have come down quite a bit in the last three months, with the consensus estimate being as high as $30.14 billion. This indicates that analysts previously generally assumed Meta would beat their own guidance.

Analysts now expect Meta to report sub 79% gross margins which have not happened before in the last 4+ years. Lastly, Analysts now anticipate Meta to report earnings per share of $2.56, down from their previous first-quarter estimate of $3.02 back in February.

Meta has 63 analysts covering the stock with an average 12-month price target of $316.43, which would represent a 70% upside to the current stock price. This average price target is down from $400 in February. Out of the 63 analysts, 17 have strong buy ratings, 28 have buys, 16 analysts have holds, 1 has a sell rating and 1 analyst has a strong sell rating on Meta. The street high sits at $466, which represents an almost 150% upside to the current stock.

In BMO’s first quarter preview, they reiterate their market performance rating and lower their 12-month price target from $290 to $225 while calling the bottom on the stock price, saying that the “Sell-Off Feels Overdone,” and comment they would not push back “overly hard” on a buy thesis at these prices.

They say that Meta trades at 5.7x their 2023 adjusted EBITDA estimates and believe that Facebook remains “a vital online advertising destination.” They tell investors however that they should look for stabilization in the stock before “forming a longer-term thesis.” They add this as they don’t doubt that Meta could put up another quarter of daily active user declines, which would pressure the stock even more.

On Meta’s privacy headwinds introduced by Apple’s new tracking policy, BMO says that Meta is having issues with ATT and does not have an IDFA (identifier for advertisers) problem. They say that since this introduction the company is seeing “tiles removed, melted together, and arriving late.”

Though BMO believes that Meta has done a good job in responding to this change by introducing new AI/machine learning tools such as Meta Advantage Ad Automation Suite. This product bundles and rebrands a number of its existing products. BMO believes that this rebrand on top of the company’s continued simplification of its advertising business will help increase the adoption of SMBs.

BMO sums up what they call the most important metrics to watch in the results. This includes daily active users, which BMO expects to come in at 1.949 billion, below the consensus of 1.951 billion. Advertising revenue meanwhile is expected to be $27.5 billion for the quarter, in line with consensus estimates.

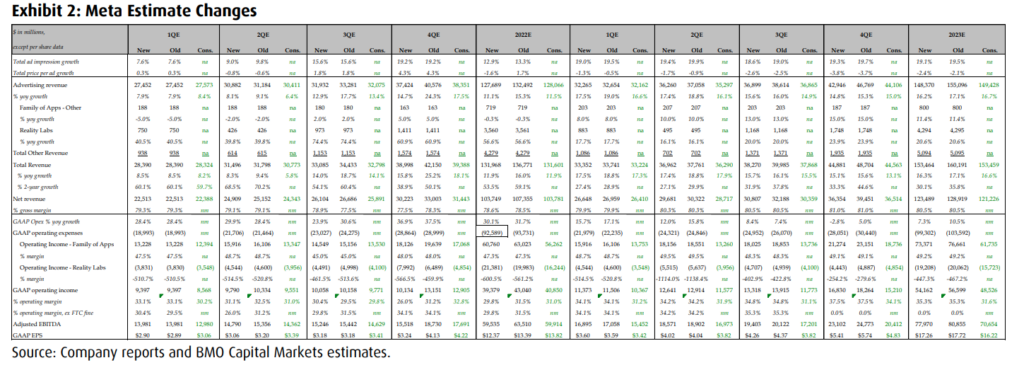

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.