On March 2nd, Kinross Gold Corporation (TSX: K) announced the suspension of its Russian operations. The company said that it will be suspending all its activities at its Udinsk development project as well as its operations at its Kupol mine.

They say that the company “is deeply concerned about the loss of life and destruction in Ukraine and wishes to express its sympathy and support for the people who are suffering because of this tragic situation.” The company also announced that it is donating $1 million to the Canadian Red Cross Ukraine Humanitarian Crisis Appeal.

As we outlined yesterday, the decision by Kinross to suspend operations at its Kupol mine will potentially impact the business in a large way. The Kupol mine has the highest gross margins and is the second-largest contributor to the company’s metal sales, which was $862.8 million in 2021.

A number of analysts have lowered their 12-month price target on Kinross Gold, bringing the 12-month average price target down to C$10.59 from C$12.74 a month ago. Kinross Gold currently has 13 analysts covering the stock, 3 have strong buy ratings, 8 have buy ratings, and 2 analysts have hold ratings. The street high sits at C$14 which represents a 109% increase to the current stock price.

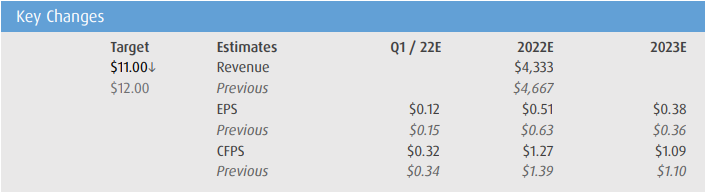

In BMO Capital Markets note, they lowered their 12-month price target on Kinross from C$12 to C$11 and reiterate their outperform rating, saying that the decision is prudent in the current environment. They also add that the company’s operations are “likely to face from potentially escalating international sanctions.”

BMO expects that as more and more countries slap Russia with sanctions, the risks of Kinross being able to get the gold mined in Russia out becomes harder and harder. Additionally, they expect that this closure will result in a seven-month impact. They are assuming, not making predictions of how long the war will last, that the mines will be shut down from March to September. For this, they are cutting their NAVs of Kupol and Udinsk by 27% and 50% respectively, to US$423 and $300 million.

They provide additional sensitivity, as if there is an additional 3 or 6-month closures, it would cause an additional NAV reduction to US$374 and US$321 million, respectively.

Below you can see BMO’s updated estimates below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.