Michael Saylor, founder and former CEO of enterprise software giant MicroStrategy (NASDAQ: MSTR), has announced his plan to sell approximately $216 million worth of MicroStrategy stock from his personal holdings. Saylor, a well-known supporter of Bitcoin, has not signaled any intention to dispose of his substantial Bitcoin holdings, emphasizing his steadfast belief in the cryptocurrency’s resilience against asset value depreciation compared to traditional cash reserves.

MicroStrategy gained significant attention for its strategic acquisitions of Bitcoin, a move driven by Saylor’s conviction that holding the original cryptocurrency positions the company favorably in the enterprise software business.

Saylor stated, “We found by simply acquiring and holding Bitcoin, we can outperform our peers in the enterprise software business. The regulatory environment for Bitcoin is improving. As capital flows out of the crypto industry, it flows into Bitcoin.”

The company’s most recent Bitcoin purchase, announced on December 27th, solidified MicroStrategy’s position as the largest corporate holder of BTC. This acquisition played a role in MicroStrategy’s recent stock rally, propelling MSTR shares to over $685, marking a remarkable 372% increase since the beginning of 2022 and reaching its highest value since December 2021, just before the onset of the crypto winter.

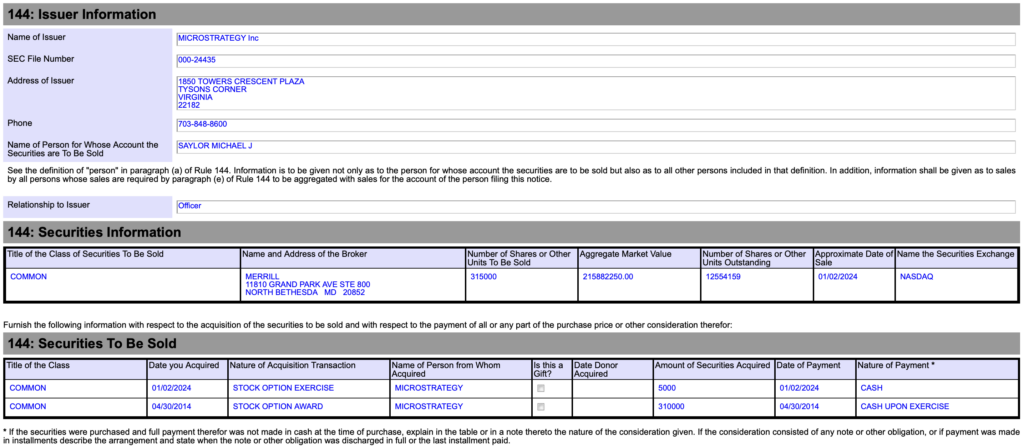

Now, Saylor is capitalizing on the surge in MicroStrategy’s stock value by selling 315,000 MSTR shares on NASDAQ, with the potential for additional sales later. An earlier announcement hinted at the possibility of selling up to 400,000 MSTR shares between January 2nd and the end of April, though the final decision may hinge on Bitcoin’s ongoing bull run.

While companies like Grayscale and Blackrock await SEC approval for their proposed Bitcoin ETFs, MicroStrategy stands out as a unique entity. With the majority of its financial reserves held in Bitcoin for several years, the company could position itself as a de facto BTC ETF that also produces software. This strategic alignment closely ties the value of MSTR shares to the performance of Bitcoin, offering institutional clients an alternative entry into the BTC circuit without navigating the complexities of non-traditional financial systems.

In explaining his intentions, Saylor mentioned plans to use the proceeds to purchase more Bitcoin personally and meet financial obligations, including stock options set to expire in April.

MicroStrategy last traded at $685.15 on the NASDAQ.

Information for this briefing was found via Crypto Potato, ihodl.com, the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.