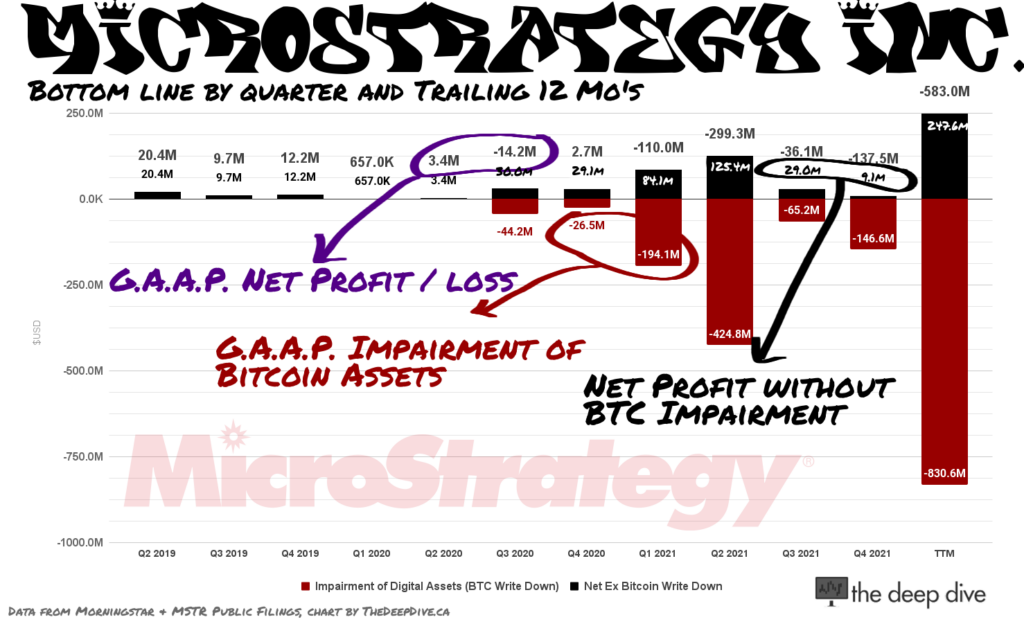

Last week, Virginia-based MicroStrategy Inc. (NASDAQ:MSTR), a maker of business analytics software for enterprises, reported its Q4, 2021 earnings. With full confidence, it told its shareholders and the world at large that its revenue grew again, its gross margin remained exceptional, and it lost $137.5 million on the bottom line; a net loss greater than the $134.5 million in revenue that the business generated in Q4.

It was the 4th quarter in a row that MicroStrategy has grown its revenue while showing a paper loss, and the fourth quarter in a row that the loss has been smaller than the impairment charge taken by the company on its single largest asset: a hoard of bitcoin that it’s buying on credit and with cash generated from equity raises.

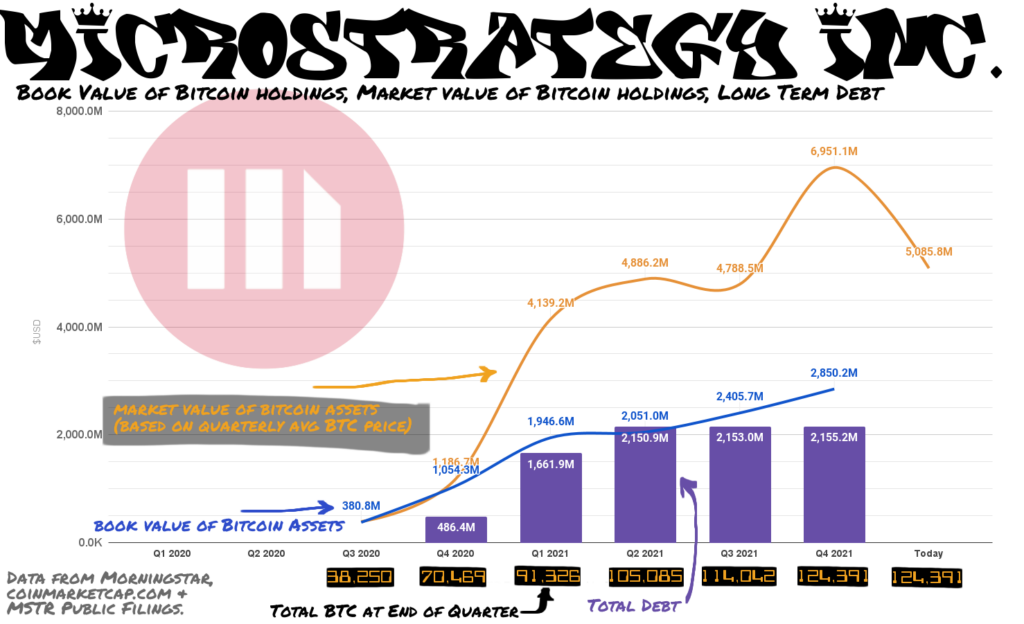

At the end of Q4 2021, the company held 124,391 BTC that it had acquired at a cash cost of $3.8 billion dollars. The position has a market value of more than $5.5 billion. But accounting rules aren’t made to accommodate modern digital wealth hoarding, so MicroStrategy’s financial statements treat the bitcoin like a digital asset – as though the company bought software, or a part of the metaverse – and forces an impairment to its book value.

So, quarter after quarter, the company takes a write down that puts it deep in the red, then borrows some more money to buy some more bitcoin and add it to the stash. Presently, the company is carrying $2.15 billion dollars worth of long term debt, including $1.7 billion worth of convertible notes, and $500 million worth of secured debt at 6.125%. The debt has been growing for the length of this experiment, and the bulk of it is due in 2028. At the end of 2021, the impairment charges sandbagging MicroStrategy’s bottom line had created a significant gap between the book value of the company’s largest asset, and its actual value. But CEO Micheal Saylor doesn’t seem too bothered.

Saylor told The Deep Dive in March of 2021 that it was the banking response to the 2020 pandemic that changed the landscape, and inspired the weaponization of MicroStrategy’s balance sheet.

“We had $500 million in cash and credit,” he said. “At a 20% monetary inflation rate, its value would be cut in half in three years.”

Saylor’s defense-against-fiat-dollar-erosion bit is one that the “sound money” gold bug crowd has been repeating for so long that it’s lost all meaning. But his high-conviction bet, having been made with such expert timing and in such a new and emerging financial medium, makes Saylor’s version of the old song a lot more compelling than Peter Schiff’s.

“A year ago, we had a $500 million business, growing about 0% per year, and a $500 million balance sheet paying 0% interest [has now become] a $5 billion balance sheet growing much faster.” (Saylor makes Bitcoin’s average growth to be 130% per year on average for a decade.)

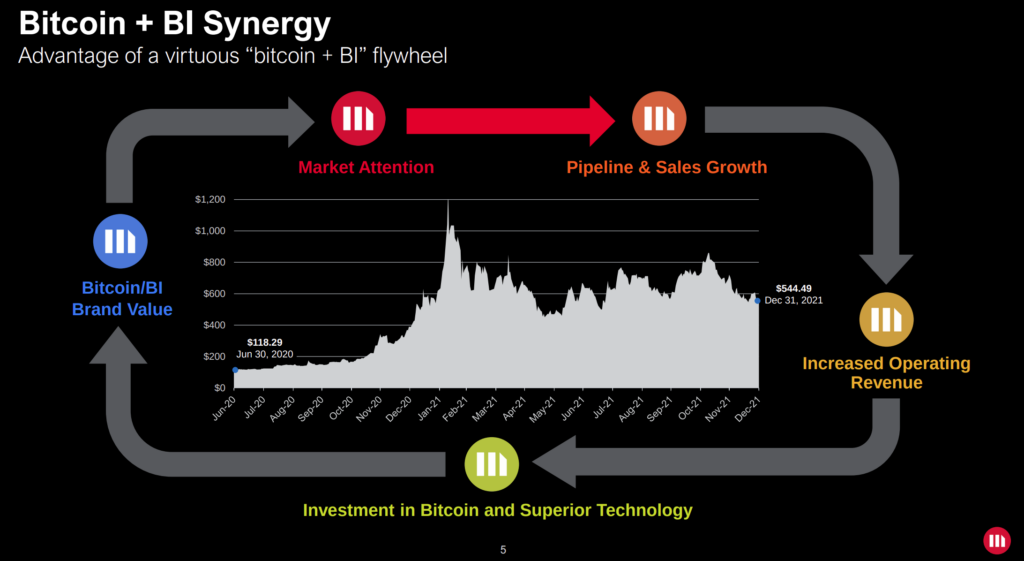

“The $500 million software business is now growing at about 10% a year. We were able to get a boost on the software business by entering bitcoin. It boosted our brand by a factor of 100.”

MicroStrategy is an objectively excellent software business, with a growing customer base and excellent user retention, that produces gross margins consistently above 80%. It makes something that is useful to its customers, and its utility is still being discovered. Business analytics is hardly a new concept, and MicroStrategy has been making business analytics products for more than 20 years, but the ability to apply it across enterprises seamlessly using advanced software is a recent development. The company wasn’t exactly toiling in obscurity, but the attention brought on by its bitcoin bet has given it an entirely different motor.

The Medium is the Message?

The motto imprinted on every page of the company’s investor literature says “Intelligence Everywhere.” Implicitly, everywhere includes all of the parts of a business that its managers are constantly fussing over and screwing with, and all of the parts hidden in the neglected seams and corners. The pitch is that MicroStrategy will help a business find and apply that intelligence to its benefit. Coming form a company in the middle of the most radically successful capital markets experiments in history, it’s bound to carry some weight.

Public companies aren’t meant to be used in this way, and the financial establishment doesn’t like this one bit. Saylor’s act of fiscal graffiti caused MicroStrategy to be removed from the S&P 600 smallcap index this past September. When the financial media isn’t ignoring MSTR, it treats the company like an obscurity running a stunt. Business news gold standard Bloomberg most recently took interest in MSTR January 21st, when the SEC told it under no uncertain terms that publishing an non-GAAP metric to show investors how the business performed without the impairment charge wasn’t going to fly. The lede of the article proclaims that, “MicroStrategy Inc. can’t strip out Bitcoin’s wild swings from the unofficial accounting measures it touts to investors,” as though it was market volatility, and not accounting impairments, obscuring the operational picture in its mandated reporting.

The emerging subculture of DeFi faithful are inclined to see MicroStrategy’s growing bitcoin bet as a form of subversion. Saylor took a perfectly profitable, cash generating software company and turned it into a leveraged bet on the most volatile emerging concept in the world of finance. It’s a gunslinger move that’s surely popping monocles beyond just the S&P and SEC. But if the 56 year old CEO is inclined to see it that way, he certainly doesn’t let on. To him, this is prudent capital allocation; the company protecting itself from the value erosion being brought on by central bank policy. The longer it goes on working, the more infuriating it’s bound to be to the conventional core of finance.

Saylor can’t be marginalized like a garden variety newsletter writer with a hedge fund. MicroStrategy is an operating, growing, cash generating business. Besides: there isn’t the same kind of controls on cryptocurrencies as there is on gold, and they might not even be possible. If (say) Tim Cook read a newsletter and decided that he wanted to protect Apple from inflation by converting its cash reserves to gold, the government’s gold reserves and its considerable ability to influence gold mining companies would enable it to mitigate any damage that a move like that might do to the Fed’s balance sheet, and possibly even come out ahead. Cryptocurrency, by contrast, is not something governments or central banks can approach on their own terms. From an establishment perspective, the notion of Bitcoin as an inflation hedge moving into the mainstream is beyond dangerous.