Microsoft (NASDAQ: MSFT) will be reporting its fiscal fourth quarter financials today after markets close. Analysts have a consensus $344 12-month price target on the company, via a total of 52 analysts, with 19 analysts having strong buy ratings. 30 analysts meanwhile have buy ratings and three analysts have hold ratings. The street high sits at a $426 price target, and the lowest target sits at $252.

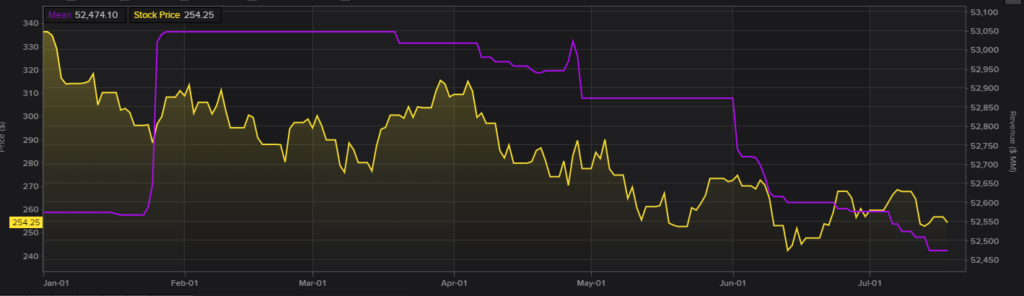

24 analysts have revenue estimates for the fourth quarter. The mean revenue estimate between all 24 analysts is $52.39 billion; this number is flat year to date now. The highest revenue estimate is $52.9 billion, while the lowest is $51.74 billion.

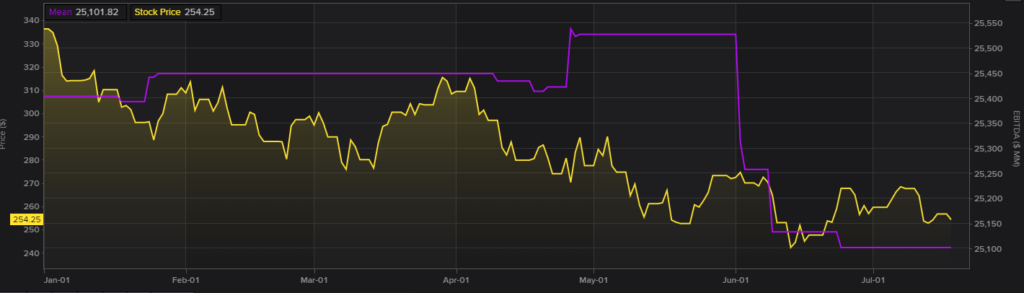

Onto EBITDA estimates, there are currently only six analysts who have fourth-quarter EBITDA estimates. The mean is currently $25.1 billion, with this number having been revised downwards from $25.4 billion at the start of the year. Street high is a $25.34 billion EBITDA estimate and the lowest is $24.88 billion.

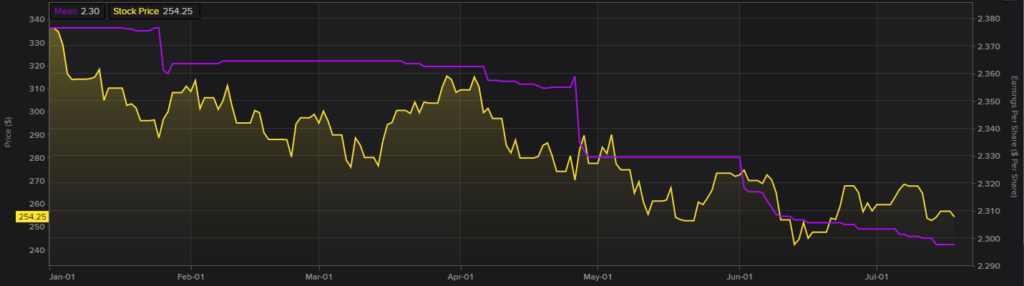

Analysts estimate that quarterly earnings per share will come in at $2.29, with this number being revised steadily down since the start of the year. Street high is $2.35, and the lowest estimate is $2.24 per share for the quarter.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.