Microsoft (NASDAQ: MSFT) opened lower following the release of its financial results earlier this week, after its third quarter results had some investors worried about future growth and Microsofts almost $2 trillion valuations. The company announced third-quarter revenue of $41.7 billion, and a gross margin of 68.7%. Net Income for the third quarter was $15.45 billion, or a 37.1% net margin, and earnings per share of hit $2.03. Earnings were generally in line with what analysts expected for this quarter.

A number of analysts changed their price targets off the back of Microsoft’s earnings, bringing their average 12-month price target slightly down from $276.31 to $272.71 from a total of 38 analysts who cover the name.

Below are the most recent analyst changes as of the time writing:

- BOFA Global Research raises price objective to $305 from $300

- UBS raises target price to $300 from $275

- Cowen and Company raises target price to $295 from $280

- Raymond James raises target price to $290 from $275

- BMO raises target price to $290 from $280

- Mizuho raises target price to $285 from $270

- Wedbush raises target price to $310 from $300

- Credit Suisse raises target price to $300 from $265

- Barclays raises target price to $288 from $269

- Piper Sandler raises target price to $305 from $300

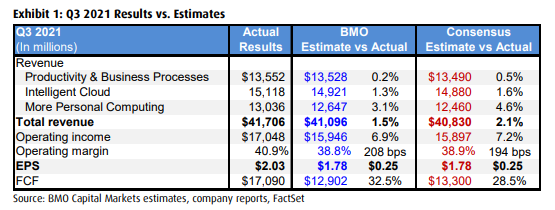

In BMO’s note, their analyst Keith Bachman also raised their 12-month price target to $290 from $280 and reiterated their outperform rating on Microsoft. Bachman calls the earnings good but not great saying that the quarter was a positive but they really expected some more. Below you can see how Microsoft did versus BMO and consensus estimates.

He says the high point was the CC revenue growth which was 1% higher than the consensus estimates of 15% year over year, while Azure CC growth was 46% year over year versus BMO’s 43% estimate. Bachman writes “we think buy-side expectations were a touch higher, particularly compared to last Qs 48% y/y CC growth.” He calls Microsoft’s cash flow impressive as the company boasts growing operating cash flow and free cash flow by 27% and 24% year over year, respectively. Bachman believes that cloud billings and a strong cash collection will be the main drivers for additional free cash flow outperformance.

Onto Microsoft’s gaming segment, the company reported 48% year over year growth, which was higher than BMO’s 42% estimate. Bachman brings into question the long-term feasibility and growth driver that online gaming is for Microsoft. He admits that Microsoft is well-positioned in the industry with their flagship console Xbox as well as ZeniMax.

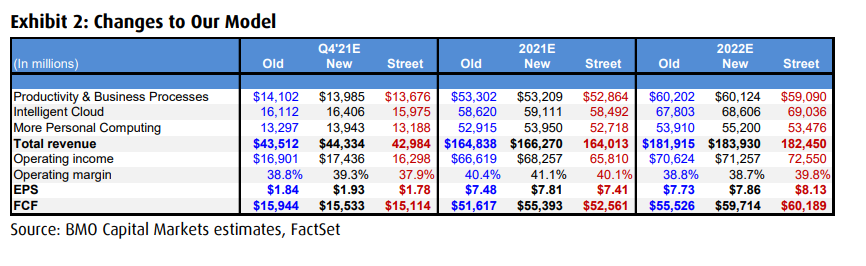

Below you can see the changes to their model for the fourth quarter, 2021, and 2022.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.