On July 22nd, Magna International (TSX: MG) announced that they would be acquiring Veoneer for $31.25 per share for a total purchase price of $3.8 billion. The deal will create a leader in ADAS with pro-forma sales equaling to $1.2 billion, it will add engineering and software expertise to Magna.

After the news, CFRA and Wells Fargo lowered their 12-month price target down to $110 and $100, respectively. Magna currently has 18 analysts covering the stock with an average 12-month price target of $109.94 or a 36% upside. The street high comes in at $132 from Arc Research and the lowest sits at $60 from Veritas Research. Out of the 18 analysts, two have strong buy ratings, 13 have buy ratings and the last three have hold ratings.

BMO Capital Markets reiterated their $115 price target and outperform rating, saying that the company will see near term impact on the companies earnings but over time, the C-suite will be vindicated as investors see the strategic rationale. They add, “Ultimately, we believe this higher growth profile will be reflected in Magna’s valuation through a higher attributed multiple.”

BMO believes that Veoneer is a strong strategic fit for the company, specifically for its ADAS capabilities and offerings. Magna’s strength largely comes in its hardware such as cameras, radar, and LIDAR. Veoneer’s strength comes in its human capital, having 3,800 engineers, 1,700 of which are software engineers.

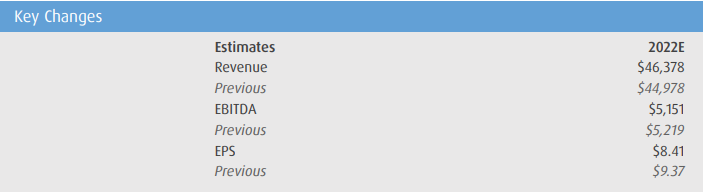

Below you can see BMO’s updated 2022 estimates for Magna.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.