It appears that not everyone on the institutional side of capital markets is in love with Michael Saylor’s recent strategy surrounding the company in which he helms, MicroStrategy Incorporated (NASDAQ: MSTR). In particular, the firm has caught the ire of the S&P Small Cap 600 index.

On Friday, it was quietly announced by S&P Dow Jones Indices after market hours that the firm, which has been made popular as of late for its commitment to bitcoin and cryptocurrencies in general, will be removed from the Small Cap 600 index. Commenting on the change, the related news release simply said “MicroStrategy is no longer appropriate for the S&P SmallCap 600,” without going into more detail.

The change is notable, with several ETF’s and funds currently in place that track the S&P Small Cap 600. One of the largest, the iShares Core S&P Small-Cap ETF (NYSE: IJR), currently holds 520,337 shares, valued roughly at $362 million. Another, the Vanguard S&P Small-Cap 600, currently has $16.7 million in holdings of MicroStrategy alone, or roughly 26,725 shares. And yet another, the SPDR Portfolio S&P 600 Small Cap ETF (NYSE: SPSM) holds 31,370 shares.

ETF Database counts at least six ETF’s currently that follow the index, before mutual funds are taken into consideration. All of which will be required to sell their positions in the firm if they wish to stay true to their mandate.

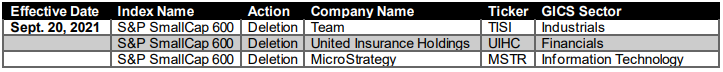

The change will be effective as of September 20, 2021.

Michael Saylor, whom has helmed the company since 1989, has notably as of late become an outspoken permabull on the prospects of bitcoin, going as far as to use MicroStrategy, a tech firm, as a means of going “all-in” on the digital coin. Numerous raises have been conducted now by the company with the sole purpose of acquiring more bitcoin, with the firm in June announcing it had over $3 billion in bitcoin holdings following further large purchases, with total ownership exceeding 105,000 bitcoins, which were acquired at an average cost of $26,080.

The firms holdings have since climbed to just under 109,000 bitcoins, at an average cost basis of $26,769. The latest round of 2,907 bitcoins were purchased at an average price of $45,294 per coin.

MicroStrategy last traded at $712.26 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.