When the coronavirus pandemic froze over the US economy, more than 45 million Americans found themselves out of a job and subsequently became reliant on unemployment benefits. As a result of the sudden income shortcomings, many people had no choice but to miss their loan payments so they could instead afford necessities such as food.

When the severity of the pandemic became evident back in March, governments, alongside lending institutions gave borrowers the option to defer or pause their debt obligations on credit cards, student loans, auto loans, and mortgages as a means of easing sudden financial hardships. Back in April, Experian, a credit reporting agency, found that almost 77% of borrowers have either applied for, or plan to apply for, loan repayment relief as a result of the pandemic-induced economic downturn.

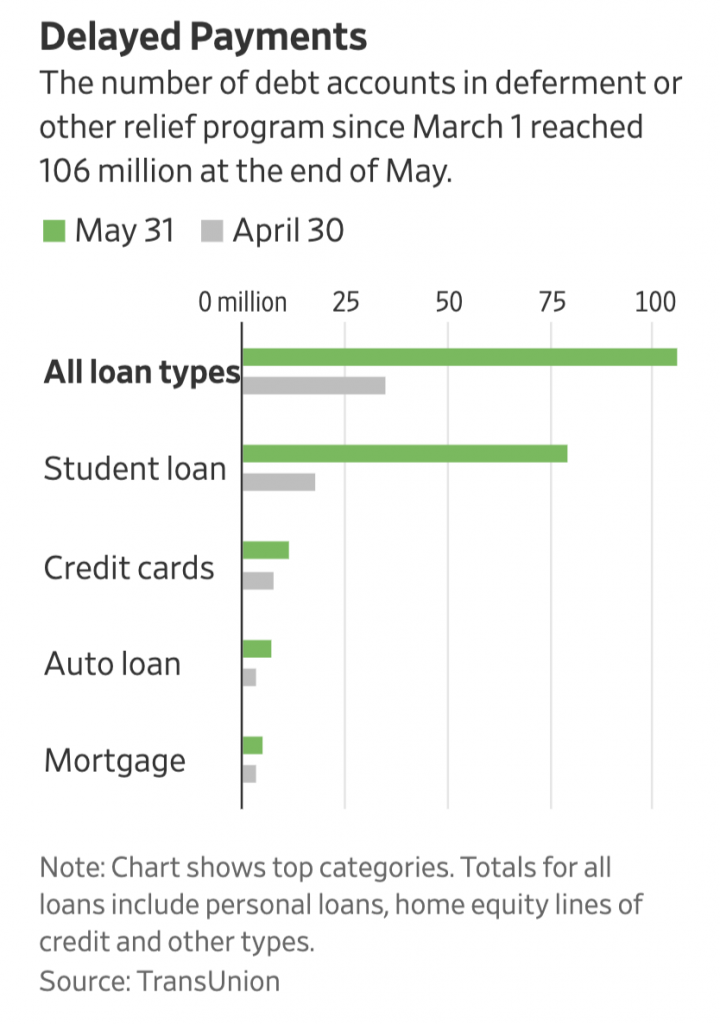

However, a recent report by The Wall Street Journal suggests the true extent of American’s debt obligations is far more startling than previously anticipated. Analyzing TransUnion data, the WSJ found that more than 106 million loans have been the subject of missed payments since March 1. The report found that by the end of May, the number was three times greater than what was reported at the end of April, suggesting that there continues to be significant economic hardships present despite the availability of unemployment benefits and stimulus checks.

Student loans accounted for the largest increase in deferment, with a total of 79 million accounts unable to meet timely debt obligations. The figure shows an increase from only 18 million reported in April. Many federal student loans were granted a pause on payments until September 30. Moreover, auto loan accounts have also been heavily impacted by the financial hardships faced by many Americans. A total of 7.3 million auto loan accounts and have sought some form of payment relief.

Furthermore, with government-funded relief aid soon coming to an end, the number of Americans applying for deferred payments is most likely going to continue increasing, given the slow economic recovery despite many states lifting restrictions. The Trump administration will no longer be providing the additional $600 weekly unemployment benefits as of July 31, with no planned extension thereafter.

Information for this briefing was found via The Wall Street Journal and Forbes. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.