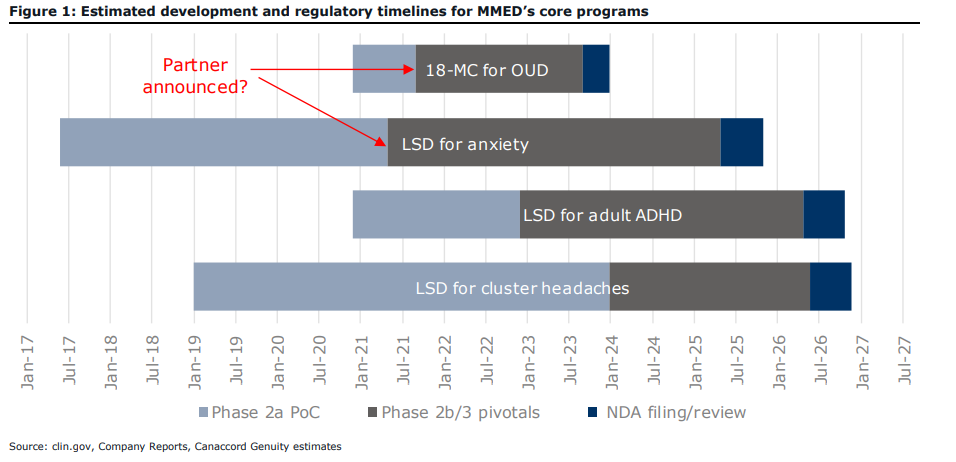

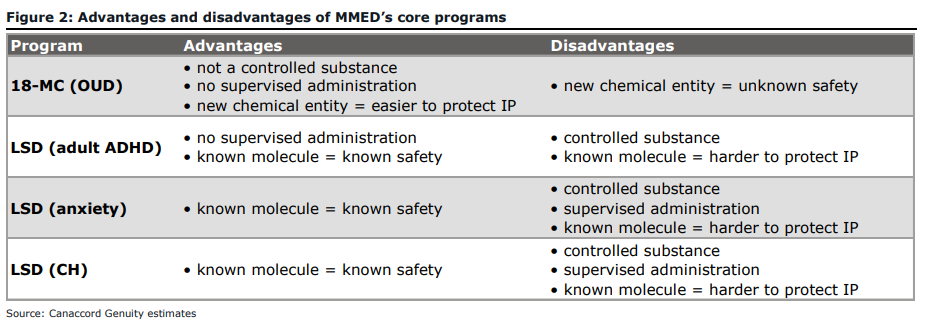

Yesterday, Canaccord initiated coverage on Mind Medicine (NEO: MMED) with a Speculative Buy rating and a C$1.75 price target. Canaccord’s analyst Tania Gonsalves commented on the initiation, stating, “open your mind to a new kind of medicine” and that Mind Medicine “differentiated itself as one of the few legitimate companies in the space. Lead drug 18-MC is a non-substitute treatment for opioid use disorder (OUD).”

Gonsalves expects 18-MC’s path to market to be fast-tracked as opioids have been declared a public health emergency. With Mind Medicines collaboration with Liechti Lab at University Hospital Basel, it gives Mind Medicines access to one of the “richest libraries of human psychedelics data,” says Gonsalves.

Gonsalves lays out the investment thesis quite clearly. The first point is that there is an unmet need as the opioid crisis costs the US economy roughly $500 billion annually. The only medications approved today to treat opioid use disorder are opioids. Gonsalves comments that it could eventually be the first non-opioid approved for opioid use disorder, and forecasts that if it takes 25% of the market, the sales could grow, “to almost $1B per year before the 20-year patent (pending) runs out.”

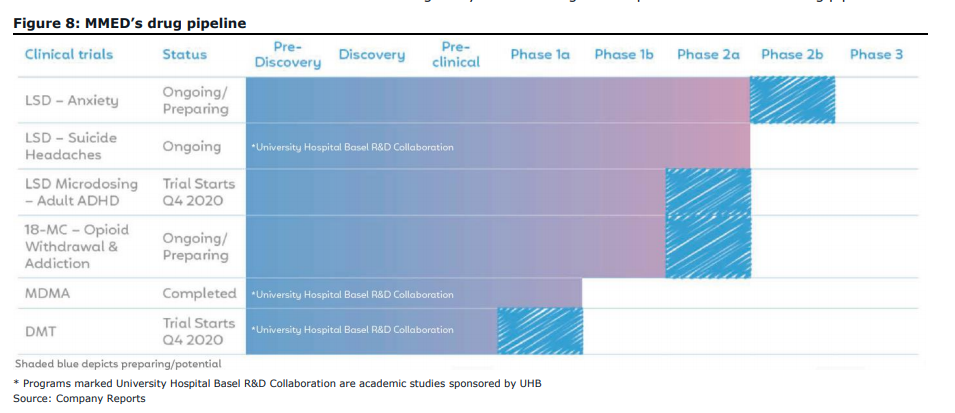

The second point is that Mind Medicine’s exclusive collaboration with Liechti Labs gives them more than ten years of psychedelics research. She says that “MMED is only at the beginning of sifting through this trove of data but has already selected five programs to advance,” and expects that Liechti Labs will, “act as MMED’s research arm, funneling new programs into its pipeline for years. “

The next highlight is Mind Medicine has many catalysts but lacks the capital to complete these catalysts with only $24 million in cash. Gonsalves believes that Mind Medicine will either have to raise equity or find a strategic partner to help fund development as the $24 million they currently have will only last through the next year. She says that there are two near term points where Mind Medicine could find a partner. They are the completion of the Phase 2a trials for anxiety and opioid withdrawal next year. Gonsalves models that they will do three equity raises for a total of $90 million, $20 million in the first quarter of 2022, the next is $30 million the following year, and the last will be $40 million in the first quarter of 2023.

She also makes note that the management and directors own 29% of the outstanding shares. The co-CEO Stephen Hurst owns 20% himself, JR Rahn, the other co-CEO, owns 4%.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.