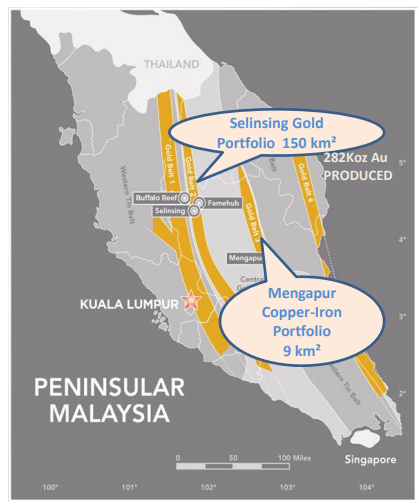

On January 10, 2021, Monument Mining Limited (TSXV: MMY; equity market cap of C$39.5 million) reached an agreement to sell its 100% interest in the Mengapur Copper and Iron Project to Singapore-based Fortress Minerals Limited for US$30 million (C$38.1 million) plus 1.25% of gross revenues of all products produced at the project. Mengapur is not expected to produce revenues for some time.

In other words, Monument should receive compensation for one of its development projects equal to 175% of its enterprise value (C$39.5 million less C$17.7 million of net cash; see below), and perhaps even more depending on the future gross revenues of the base metals project. The transaction, which is subject to several approvals, including by Fortress shareholders, is expected to close around mid-April 2021.

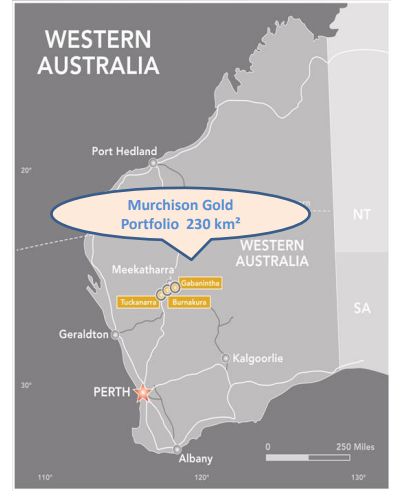

This deal comes on the heels of an October 2020 joint venture (JV) agreement with Odyssey Energy Ltd. (ASX: ODY) regarding Monument’s 100%-owned Tuckanarra Gold Project in Australia’s Meekatharra mining district. According to the JV agreement, Odyssey will pay Monument A$4 million (C$3.9 million) — plus A$1 million more if, over time, an independent third party estimates that Tuckanarra contains at least 100,000 ounces of gold resources at a minimum gold grade of 1.55 grams per tonne (g/t) of resource — for an 80% stake in Tuckanarra. Monument will retain a 20% interest.

In addition, Monument will receive a 1% Net Smelter Return (NSR) on Odyssey’s 80% stake in the project. Perhaps more importantly, Monument bears none of the development costs on Tuckanarra until a decision is made to mine the project. The Odyssey Energy transaction closed on December 24, 2020.

Taken together, these deals seem akin to the actions of a blackjack player who enjoyed a good early run at the tables, then pocketed more than his initial investment and continues to play exclusively with house money.

Monument Mining’s Ongoing Operations

With these corporate actions, Monument’s management will focus on the development of the Burnakura and Gabanintha gold projects in Australia. The company also owns the Selinsing Gold Project in Malaysia, which has produced more than 315,000 ounces of gold since mining operations commenced in 2010.

According to a NI 43-101 compliant, third-party estimate completed in 2018, Burnakura alone contains 381,000 ounces of gold (293,000 on an indicated basis and 88,000 on an inferred basis) at an average gold grade of about 2 g/t.

Similarly, Selinsing has NI 43-101-compliant resource estimate of 880,000 ounces of gold, including reserves of 267,000 ounces at a gold grade of 1.45 g/t.

Strong Actual and Very Strong Pro Forma Balance Sheet; Positive Operating Income

Even before factoring in the cash it will receive from the transactions noted above, Monument’s balance sheet is well very capitalized: nearly US$14 million of cash as of September 30, 2020, and virtually no debt. In addition, the company has recorded positive operating income over each of the last five quarters, averaging about US$1.3 million per period. On an ongoing basis, mining development expenses may trend lower, as expenses related to Mengapur and Tuckanarra will cease in April 2021 and December 2020, respectively, as the sales transactions close.

| (in thousands of U.S. dollars, except for shares outstanding and ounces of gold sold) | 1Q FY21 | 4Q FY20 | 3Q FY20 | 2Q FY20 | 1Q FY20 |

| Operating Income | $1,943 | $705 | $2,303 | $756 | $745 |

| Operating Cash Flow | 747 | 657 | 5,187 | (783) | 1,212 |

| Cash – Period End | 13,935 | 10,125 | 10,424 | 5,051 | 7,478 |

| Debt – Period End | 99 | 107 | 85 | 100 | 109 |

| Diluted Shares Outstanding (Millions) | 336.6 | 336.6 | 336.6 | 336.5 | 336.5 |

| Gold Sold (Ounces) | 3,100 | 3,282 | 7,323 | 4,473 | 4,323 |

As is always a risk, it is possible that Monument’s management team may not reinvest the C$40+ million of proceeds from the Mengapur and Tuckanarra transactions effectively. In particular, development of the Burnakura and Gabanintha gold properties may not lead to gold discoveries which can be economically mined.

To this point, investors have not fully appreciated the significant cash which Monument is set to receive from the sale of one of its development projects and the 80% divestiture of another. Before factoring in the value of potential gross revenue royalties on the Malaysian base metals property and NSR royalties on the Tuckanara Gold Project, Monument should receive cash equal to about twice its enterprise value.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.