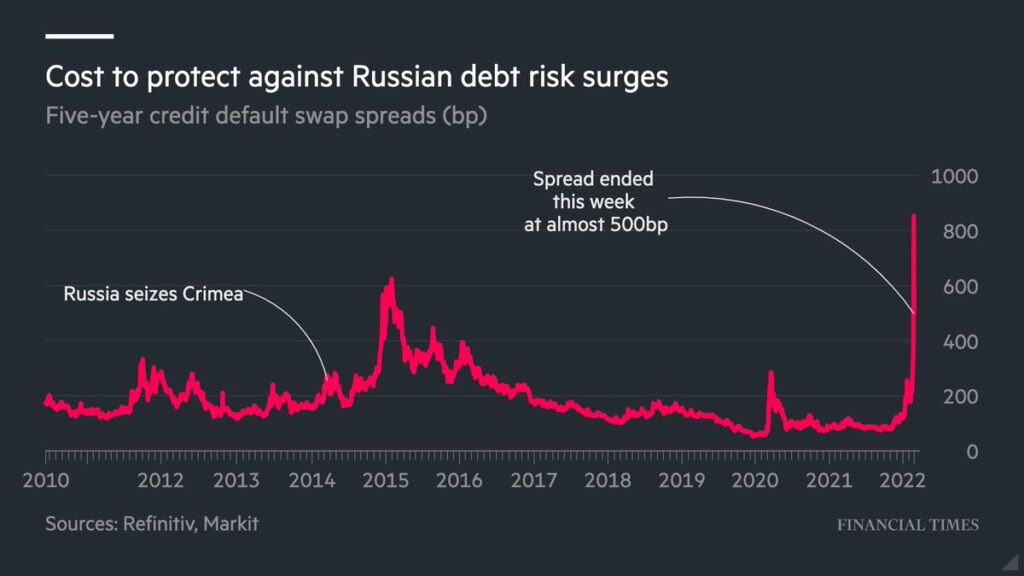

In yet another blow to Russia’s economy, Fitch and Moody’s both downgraded the country’s credit rating to junk status, after an onslaught of tough Western sanctions cast doubt on its ability to meet debt obligations.

#RussiaUkraineConflict | #Moody's & #Fitch Ratings cut Russia's rating to 'Junk', may be cut further

— CNBC-TV18 (@CNBCTV18Live) March 3, 2022

▶️Moody's Cuts Russia's Rating To 'B3' From 'Baa3'

▶️Fitch Cuts Russia's Rating To 'B' From 'BBB' pic.twitter.com/9YpEXMw4u2

Fitch Ratings on Wednesday slashed Russia’s sovereign credit rating by six levels from a rating of BBB to B, pointing to a deterioration in the country’s financial situation, stagnating economic growth, heightened geopolitical risks, and the threat of additional sanctions. “The severity of international sanctions in response to Russia’s military invasion of Ukraine has heightened macro-financial stability risks, represents a huge shock to Russia’s credit fundamentals and could undermine its willingness to service government debt,” Fitch explained in a report.

Fitch Ratings has downgraded #Russia's Long-Term Foreign Currency Issuer Default Rating (IDR) to 'B' from 'BBB'. The ratings have been placed on Rating Watch Negative (RWN).

— World Sports Weekly (@wsportsweekly) March 2, 2022

BBB – good prospects for ongoing viability.

B – weak prospects for ongoing viability.#UkraineRussiaWar

The ratings agency also warned that recently imposed sanctions by the US and EU banning all transactions with Russia’s central bank will have a “much larger impact on Russia’s credit fundamentals than any previous sanctions,” thus making the country’s international reserves futile for any foreign exchange intervention. “The sanctions could also weigh on Russia’s willingness to repay debt,” Fitch added, because “President Putin’s response to put nuclear forces on high alert appears to diminish the prospect of him changing course on Ukraine to the degree required to reverse rapidly tightening sanctions.”

Likewise, Moody’s— which just last week sent Russia’s credit rating for review for a downgrade— followed suit on Wednesday, also slashing the country’s rating by six levels from Baa3 to B3. According to Moody’s, the escalation of sanctions have progressed beyond the rating agency’s outlook, “and will have material credit implications.”

Indeed, the latest round of sanctions have made it increasingly more likely that Russia could default on its dollar-denominated and government debt, warned JP Morgan analysts. Russia, for its part, is attempting to counteract the West’s sanctions with a number of measures, including raising its lending rate to 20%, prevent international investors from selling their assets, and banning Russian brokers from liquidating securities owned by foreigners.

But, despite Russia’s attempt to cushion the negative impact of sanctions, its financial markets took a significant toll since President Vladimir Putin invaded Ukraine last week. Refinitiv data shows that the country’s stock market was only able to retain two-thirds of its value, marking the poorest-performing week on record.

Information for this briefing was found via Fitch Ratings, Moody’s, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.