Mullen Automotive (NASDAQ: MULN) has evidently gone full conspiracy theorist, announcing this morning that it has retained outside counsel to analyze recent trading in its equity.

The firm evidently is taking this step “in light of the extraordinary trading volume and evidence of unusually high levels of failure to deliver on short sales.” Outside counsel is slated to work with Shareholder Intelligence Services, or ShareIntel, to analyze data from broker-dealers and clearing firms among other sources to “provide actionable intelligence on potential market manipulation and illegal short selling.”

The investigation follows the firms equity falling from a high of over $20 in late 2020 to that of just $0.06 as of yesterday’s close.

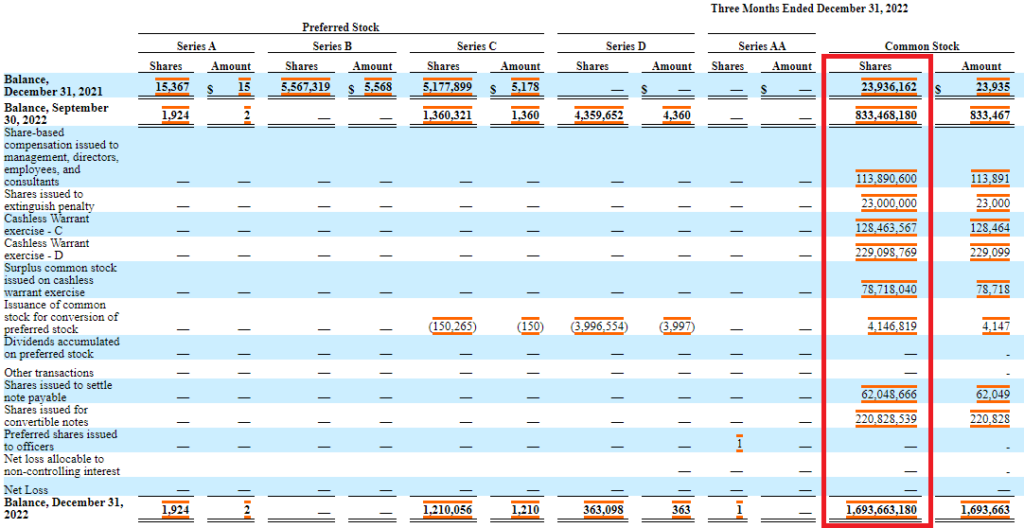

Over that time however, the company has seen its capital structure explode, expanding from just 5.1 million shares outstanding as of September 30, 2020, to an eye-popping 1.7 billion shares as of December 31, 2022.

In the first nine months of 2022, the company issued an eye-popping 809.5 million shares. In the final quarter of the year, 860.2 million shares were issued.

To top it off, at least a further 132.0 million shares were issued between the end of the quarter and the time of filing the financials on February 14, related to the partial conversion of an outstanding note.

Energy management in D.C.

Separately, Mullen this morning provided an update on ongoing testing and installation of energy management modules on 40 Chevy Bolts currently operated by the city government in the District of Columbia under a $680,000 contract.

Testing of the modules is being conducted in collaboration with Mullen Advanced Energy Operations, a 51% owned subsidiary of the company. Testing has been ongoing over the course of the last week, with the first “wave” of vehicles completed. Installation will now occur next, after which a second round of testing will occur before the vehicles are returned to service for the city government.

The energy management module is purported to “substantially increase the driving range and efficiency of any electric vehicle.” In the case of Bolts, a 60% increase in range is claimed, expanding capacity from 269 to 431 miles.

Mullen Automotive last traded at $0.068 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.