Mullen Automotive (NASDAQ: MULN) is about to have a lot less shares outstanding. The firm this afternoon issued a mid-session press release indicating that they will be conducting a reverse stock split.

The reverse stock split is to be conducted at a 1-for-25 ratio, meaning shareholders will receive 1 post-consolidation share for every 25 pre-consolidation shares held in the company. The reverse split is set to go into effect as of May 4, 2023.

The consolidation is being implemented as a means of the company meeting Nasdaq requirements for equities to trade above a price of $1.00 per share in order to maintain a listing. The consolidation was previously approved by shareholders at the firms Special Meeting of Stockholders on January 19.

The announcement follows the news this morning that the company has a total of $263 million in outstanding purchase orders from Randy Marion Automotive Group, after the company yesterday secured a $63 million order for the purchase of 1,000 Class 3 low cab forward EV trucks.

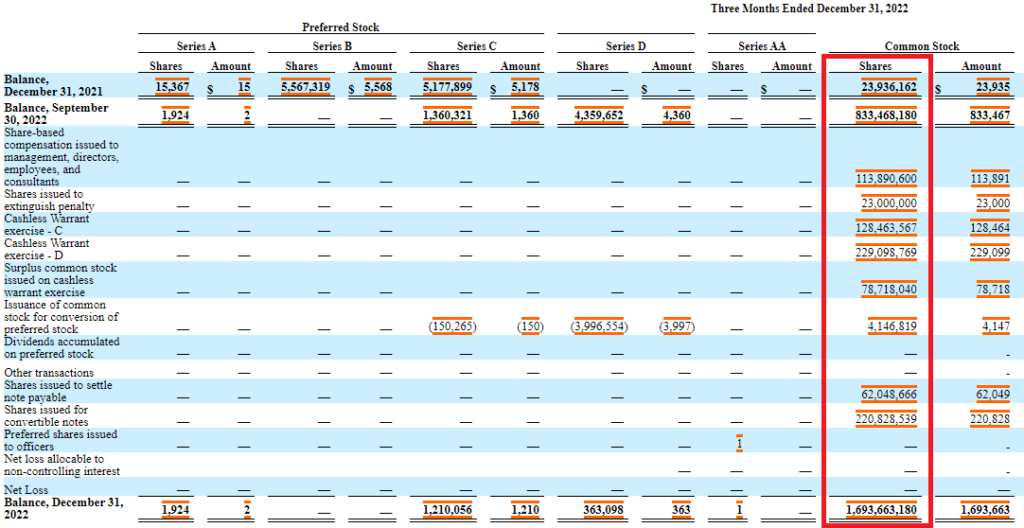

The consolidation follows the company issuing a remarkable 1.67 billion shares over the course of 2022, of which 860.2 million were issued in the fourth quarter alone.

Mullen Automotive last traded at $0.063 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.