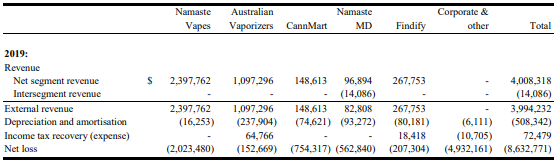

Namaste Technologies (TSXV: N) released its financials after hours yesterday, posting revenues of $3.99 million for the quarter, down from both the first quarter of 2019, as well as on a year over year basis.

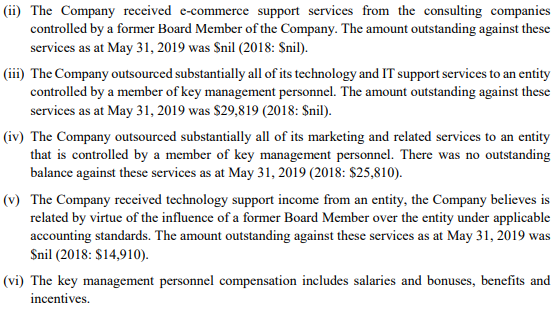

While revenues were down, this wasn’t the only bad news for investors. It seems that Namaste, who launched an internal investigation following Citron Research’s short report in late 2018, is up to its usual antics despite removing Chief Executive Officer Sean Dollinger from the company. Related party transactions have continued to represent a significant percent of overall expenses, with the latest quarter consisting of $2.18 million in such expenses.

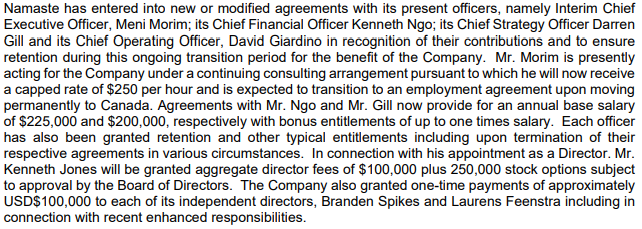

Executive compensation classified as “Key management personnel compensation” is up significantly year over year, from $541,639, to that of $1,333,521 for the quarter. For the entirety of fiscal year 2018, this key management personnel compensation totaled $1,699,629, demonstrating that despite declining revenues the management team feels their time is worth more to the company. This is likely a result of interim CEO Meni Morim collecting $250 an hour for consulting services he provides to the company.

Related party marketing services are following a similar trend, with the six month period ending May 31, 2019 totaling $2.1 million, whereas all of fiscal 2018 came in at $2.5 million for the same services.

The only “savings” seen thus far this year as a result of the removal of Sean Dollinger, is a decrease in payment processing fees and consulting fees. A decrease has also been noted under technology and IT support services, which is believed to be partially related to the departure of Dollinger.

In total, 22.27% of all expenses for the quarter consisted of related party expenses. As a percentage of revenue, related party transactions were the equivalent of 54.60%.

Outside of the incessant related party transactions displayed by Namaste Technologies, other issues within the latest financial statements are glaring. For instance, CannMart, which many have previously referred to as “The Amazon of Cannabis,” is a major loss leader for Namaste. The business unit saw meager revenues of $148,613 for the period, while the loss from operating it came in at $754,317. NamasteMD, the famed tele-doctor program that Namaste uses to funnel business to CannMart didn’t fair much better, posting revenues of $96,894 and a net loss of $562,840.

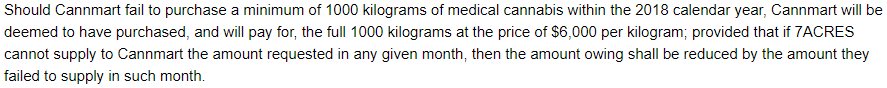

Further to that, it appears that CannMart has attempted to stiff Supreme Cannabis’ 7ACRES in relation to a supply agreement signed last year. The agreement originally called for a minimum purchase amount by CannMart of 1,000 KG per year at a price of $6 per gram. The company is reportedly disputing the obligations under the agreement, likely because expected sales have not materialized. The problem, however, is that the initial news release reveals that Namaste’s subsidiary is still on the hook for the full amount.

In a news release issued this morning, Namaste identified that its CannMart subsidiary had switched to a consignment platform, likely as a result of the money owed to Supreme under one of its first supply agreements. Given that sales have not materialized for the platform like they were claimed to, this measure will theoretically prevent future disputes with suppliers.

Namaste Technologies is currently trading at $0.52 on the TSX Venture Exchange, down $0.02 or 3.70% on the day.

Information for this analysis was found via Sedar and Namaste Technologies. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.