U.S. natural gas prices continue to fall; benchmark Henry Hub prices crossed through US$2.61 per thousand cubic feet (Mcf) on January 31, the lowest level since April 2021. Warm weather in gas-consuming regions, record U.S. gas production, and a supply crunch in Europe which has proved to be far less problematic than feared (due to extremely mild winter weather throughout much of Europe), are the primary culprits for the grinding decline in the price of this commodity over the last seven weeks.

Importantly, mild weather conditions on both sides of the Atlantic are generally expected to persist for the next few weeks of winter, which are historically very high consumption weeks, and U.S. natural gas production is expected to increase around 7% in 2023 from the current level of about 100 billion cubic per day (Bcf/d). In simple terms, demand may ebb from annual norms while supply increases — a prescription for further price declines.

READ: Natural Gas Prices Collapse After A Dramatic 2022

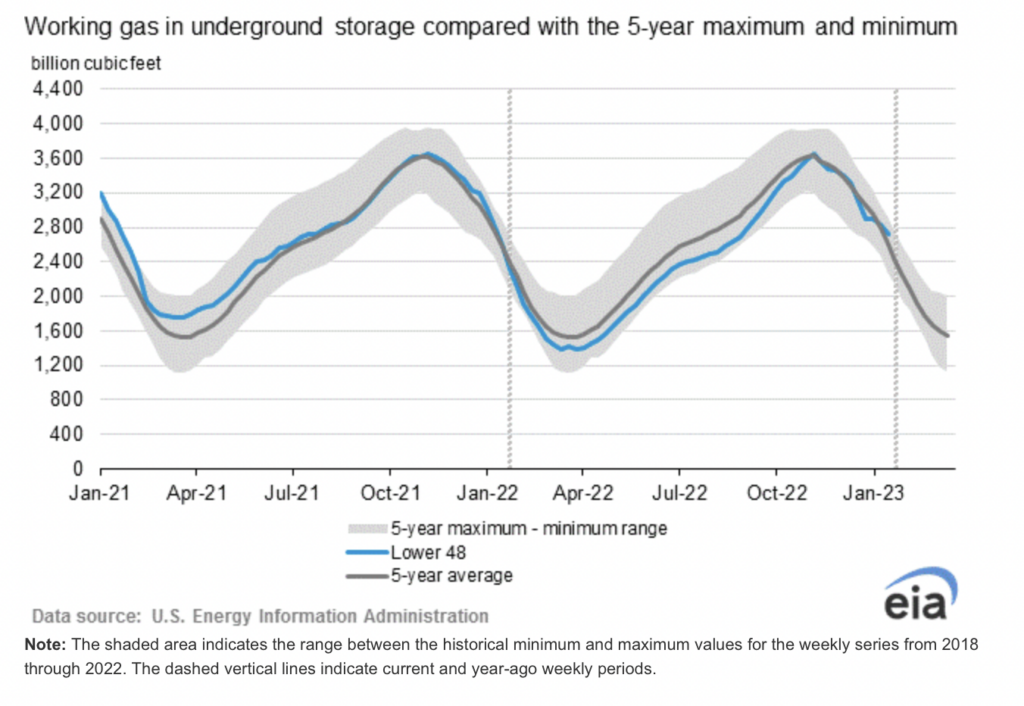

Gas storage data also seem to point to lower gas prices. According to the U.S. Energy Information Administration (EIA), total working gas in U.S. underground storage was 2,729 Bcf as of January 20, 2023. This represents 128 Bcf, or 4.9%, more than the five-year average storage level of 2,601 Bcf at the same point in the year.

Furthermore, analysts expect a draw of 138 Bcf for the week ended January 27, 2023, versus a historical average pull of 181 Bcf and 261 Bcf in an especially cold week last year. If the consensus holds, U.S. gas in storage would fall to 2,591 Bcf, but that implies the country’s surplus gas in storage versus historic averages would rise to 171 Bcf, or 7.0%. (While not necessarily predictive of the January 27 draw, 91 Bcf was withdrawn in the week ended January 20, far short of the historic norm of 185 Bcf.)

Given all this, plus the dwindling number of weeks left in winter, analysts at The Schork Report project that the quantity of gas in storage at the end of winter to be around 1,784 Bcf, far ahead of the 2022 figure of 1,382 Bcf. Such a huge storage delta would seem certain to put additional pressure on natural gas prices.

As an aside, European natural gas storage levels are well above average too — despite dramatic reductions in gas supplied from Russia. European storage was about 74% full as of January 30 versus a five-year average of 54%.

Investors may consider decreasing exposure to gas-oriented E&P companies. While the stocks may trade at marked P/E or price-to-cash flow discounts to the overall market, the pressure of continued weakness in the underlying commodity may be too difficult to overcome.

Information for this story was found via Energy News, Trading Economics, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.