Over the last few months, investors have increasingly focused on supply shocks caused by COVID-19 and the effects of worldwide easy money policies causing inflationary pressures to seep into traditional industries. A more basic problem could be looming which could crimp industrial output and profitability on a worldwide basis for some time to come: a global shortage of natural gas.

This problem could become even more acute if this upcoming winter in North America and Europe proves to be colder than normal.

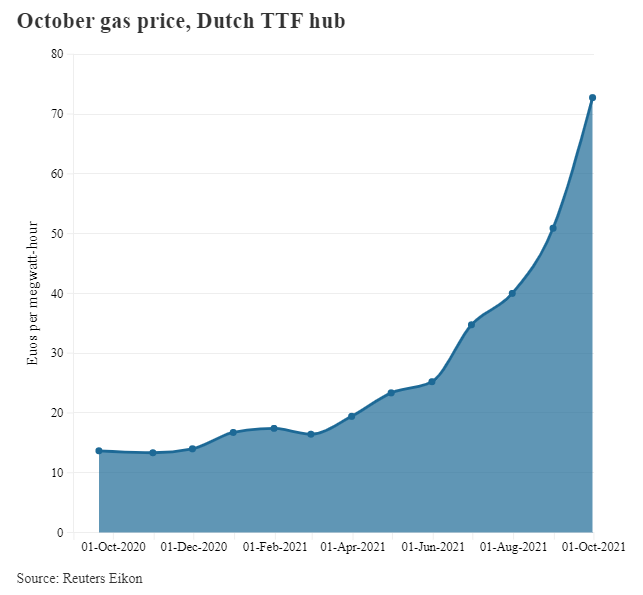

European natural gas prices have soared since early April. First, a cold winter left storage levels well below the pre-pandemic five-year average. Then, economies and natural gas demand rebounded as most European countries eased COVID-19 restrictions. On top of this, liquefied natural gas (LNG) demand from Asia and South America is increasing, and, for some still-unclear reason, Russia began to pipe smaller amounts of natural gas to Europe starting around early August. All this has caused European and U.S. natural gas prices naturally to increase around 250% and 125%, respectively, since January.

As natural gas prices rise, heavy users of natural gas like glass, cement and fertilizer manufacturers may decide to raise prices of their products further.

China plays a role in this too. It has decided to limit electricity to electricity-intensive industries like steel manufacturing to achieve green goals (one of which could be blue skies at the Winter Olympics Beijing will host in February 2022). The country is also facing a coal shortage. If gas were to be diverted to be a power source for residential consumption, global gas demand and prices could get a further boost

One way to play the strong worldwide demand for natural gas could be Cheniere Energy, Inc. (NYSE: LNG), a full-service LNG provider headquartered in Houston, TX. Cheniere provides LNG liquefaction, transportation and delivery services for clients located throughout Europe and Asia.

Cheniere‘s liquefaction facilities are about 90% contracted over the next 15+ years. It has about US$6 billion of revenue fixed via annual fixed-fee or take-or-pay style agreements. Cheniere has delivered LNG cargoes to clients in 35 countries.

| (in millions of U.S. dollars, except for shares outstanding) | 2Q 2021 | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 |

| Operating Income | $146 | $1,064 | $276 | $72 | $937 |

| Adjusted EBITDA | $1,023 | $1,452 | $1,052 | $477 | $1,393 |

| Cash – Period End | $1,806 | $1,667 | $1,628 | $2,091 | $2,039 |

| Debt – Period End | $32,030 | $31,806 | $31,658 | $31,978 | $31,628 |

| Shares Outstanding (Millions) | 275.0 | 274.9 | 273.1 | 252.2 | 252.2 |

While Cheniere seems to be a natural choice for investors who want exposure to rising international natural gas prices, one issuance is its reasonably full valuation. It trades at an enterprise value-to-estimated 2021 EBITDA ratio of nearly 12x. We do note, however, that the company raised its own EBITDA projection a number of times throughout 2021.

Natural gas prices seem destined to remain “higher for longer” on a worldwide basis. These higher prices could reduce profit margins in a number of industries. One way an investor could participate in a potential strong and enduring natural gas price trend is through Cheniere.

Cheniere Energy, Inc. last traded at US$96.01 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.