Transportation rates paid to specialized ship owners by companies which convert natural gas to liquefied form continue to defy gravity. The demand for liquefied natural gas (LNG) and for LNG transportation services will likely remain strong in Europe and Asia for as long as Europe plans to eschew the Russian natural gas (probably a long time).

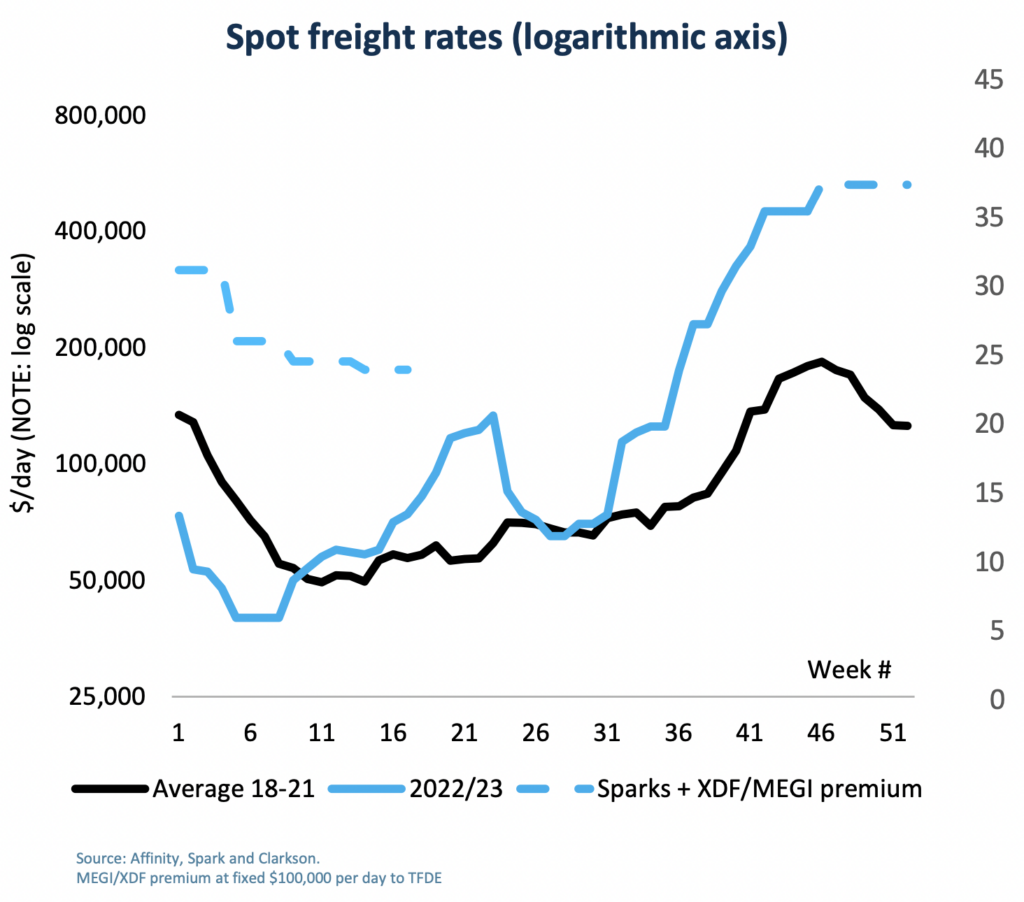

In turn, spot LNG transport rates have hit an unprecedented US$500,000 per day, five times the average over the four-year period 2018-2021.

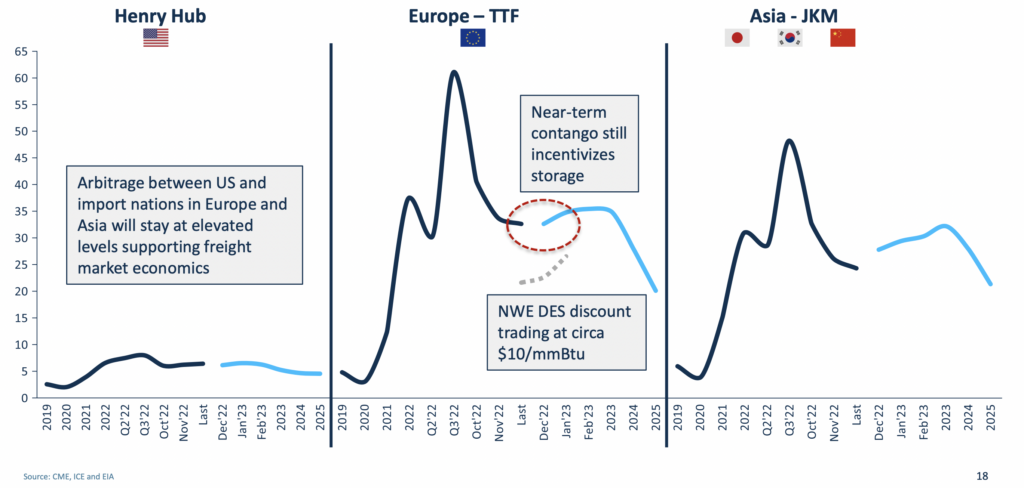

Remarkably, two conditions in the LNG market are in place that may allow these high rates to persist for some time (or possibly even rise). First, there is a natural arbitrage between natural gas prices in the U.S. (currently around US$6.30 per thousand cubic feet, or Mcf, at the Henry Hub distribution point in Louisiana) and in Europe (now about US$32 per Mcf, but it was around US$100 per mcf last summer).

Specifically, an LNG company like Cheniere Energy, Inc. (NYSE: LNG) buys the Henry Hub gas, liquefies it by cooling it to a liquid state at a temperature of negative 260 degrees Fahrenheit — thereby reducing its volume from a gas state by a factor of about 600 times — and ships it to Europe or Asia.

The profits entailed in such a transaction are enormous. In August, a shipper could reportedly realize a gain of a little more than US$200 million from selling a single shipload of LNG (containing 172,000 cubic meters, or about 6,074 Mcf, of LNG) to Europe or Asia after factoring in all costs, including shipping costs. That profit metric may be lower now, but it is still a very lucrative transaction.

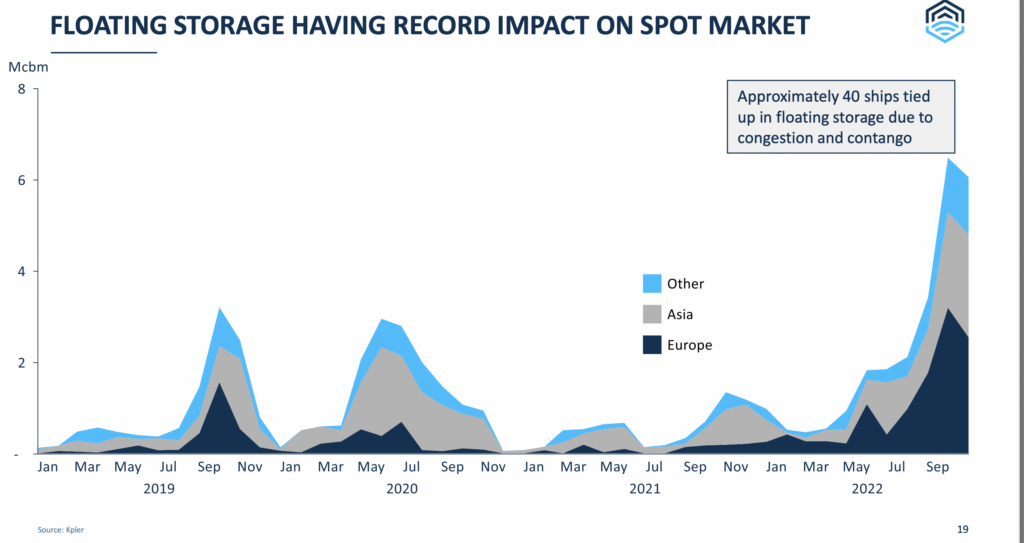

Second, and really a related point, so many LNG companies are engaged in such transactions that very few ships equipped to transport LNG are available. Many are being used for floating storage; the ships will unload their cargoes in Europe when the owners decide the price and the profit margin is right. As a consequence, the law of supply and demand has forced the price that an owner of an available ship can charge skyward.

Clearly, this is a risky business, but a speculative minded investor might consider FLEX LNG Ltd. (NYSE: FLNG) which owns 13 LNG ships that are (unfortunately given the high spot rates) highly contracted for the next few years. FLEX has US$271 million of cash and US$1.7 billion of debt as of September 30, 2022. The stock has an annualized dividend yield of about 9%.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.