NDP leader Jagmeet Singh is questioning the current set of anti-inflation solutions the Bank of Canada and the federal government have implemented so far.

Toronto Star reports that Singh makes the case in his letter to Prime Minister Justin Trudeau for the Bank of Canada to temper its aggressive rate hikes and emphasizes that the institution is and should be independent. He argued that the current approach has become overly severe for ordinary Canadians.

The Burnaby South MP added that employees’ earnings have not kept pace with continual price rises in essential items. Meanwhile, many of the causes of such increases, such as the war in Ukraine, supply chain snarls, and “price hikes fuelled by corporate greed,” are beyond Canadians’ control.

He further addressed Trudeau, saying “your government has a responsibility too” and argued to remove GST off home heating costs and mental health counseling, overhaul EI, and make it easier to prosecute corporations for price rigging.

Singh announced on Twitter recently that “New Democrats have secured an investigation into your food prices,” citing the Competition Bureau’s decision to probe food costs.

Breaking: New Democrats have secured an investigation into your food prices.

— Jagmeet Singh (@theJagmeetSingh) October 24, 2022

Today, the Competition Bureau announced that it is investigating the sky-high cost of food.

We're leading the fight against corporate greed.

And this is just the beginning. pic.twitter.com/7U19A3Kxvr

Appearing on CTV’s Question Period, Singh was more frank in his criticism of the Bank of Canada, claiming, “there’s absolutely no merit to their approach.”

“We absolutely need to combat inflation. But if the Bank of Canada’s approach has nothing to do with the root causes of inflation, and is only going to cause pain for Canadians, then we’ve got to question why is that the approach they’re taking?” the MP said.

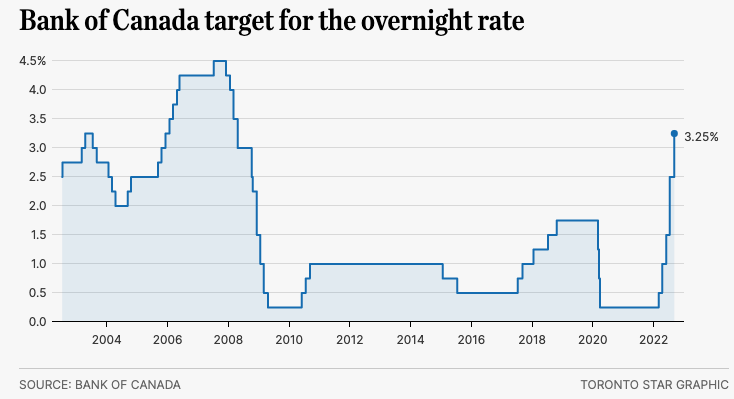

In September, the Bank of Canada raised borrowing costs by 75 basis points, bringing the overnight rate into a restrictive territory of 3.25%. Economists now expect the bank to raise interest rates by another 75 basis points after the consumer price index rose 6.9 percent year-on-year, indicating a declining but slightly higher-than-expected rate of annual inflation.

Consumers paid 11.4% more for food purchased at stores, marking the sharpest year-over-year pace since August 1981 as the category continues to rise at a faster pace than overall CPI for 10 straight months.

“Food prices continue to surge, while gasoline prices have tamed but remain elevated,” wrote Benjamin Reitzes, Macro Strategist at the Bank of Montreal. “The latest inflation figures aren’t likely to provide any leeway to soften [the Bank’s] hawkish rhetoric.”

The Organisation for Economic Co-operation and Development even predicts the Bank of Canada will raise rates up to 4.5% by 2024.

Information for this briefing was found via Toronto Star and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Choke Points: The War on Inflation is Getting Pretty Selective

Inflation is too high, so central banks are raising interest rates to try and bring...