Companies which have emerged from SPAC merger transactions have at best a spotty record of generating returns for shareholders. One stock which is looking to buck that trend is Rice Acquisition Corp. II (NYSE: RONI), the SPAC parent of NET Power.

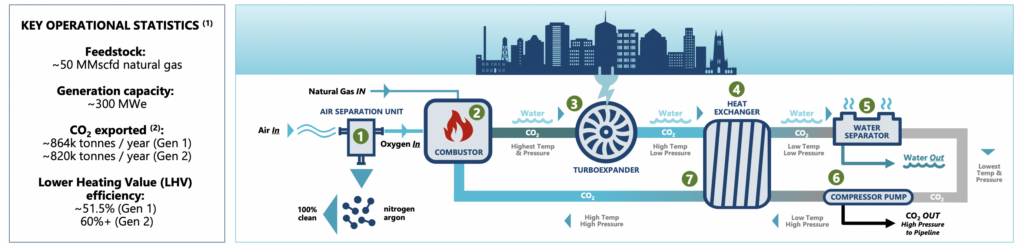

NET Power has developed a revolutionary, patented oxygen combustion power generation technology that produces low-cost electricity, sequesters valuable carbon dioxide (CO2), and emits no CO2, SOx or NOx into the atmosphere. The company is now in the final stages of commercializing this engineering feat.

CO2 represents about 5% of the effluent stream from a gas-fired power plant; removing the CO2 from that flue gas stream is very expensive. The U.S. Environmental Protection Agency recently ordered power plants to capture all CO2 by 2035, although various parties are sure to challenge that mandate in the courts.

NET Power has built a test facility near Houston, Texas and operated it during three different intervals from 2018 through 2021 to prove the technology works. Importantly, the clean power is available on a 24/7 basis, unlike other clean sources like solar and hydro which have only intermittent reliability.

One catch to the story is NET Power should probably be considered a “slow money” play. Its first full-scale, 300-megawatt (MW) plant will likely not be operational until late 2026 and will therefore generate no revenue until then. The construction cost of the plant is expected to be fully funded when NET Power emerges from the SPAC transaction in a few weeks. Occidental Petroleum Corporation (NYSE: OXY), the largest injector of CO2 for enhanced oil recovery (EOR) in the world and NET Power’s biggest investor, will buy 50% of the power produced by the plant and 100% of the CO2 it sequesters.

NET Power intends to adopt a low-capital intensity strategy by licensing its technology. The company plans to charge royalty payments with a present value (PV) of about US$65 million to adoptees.

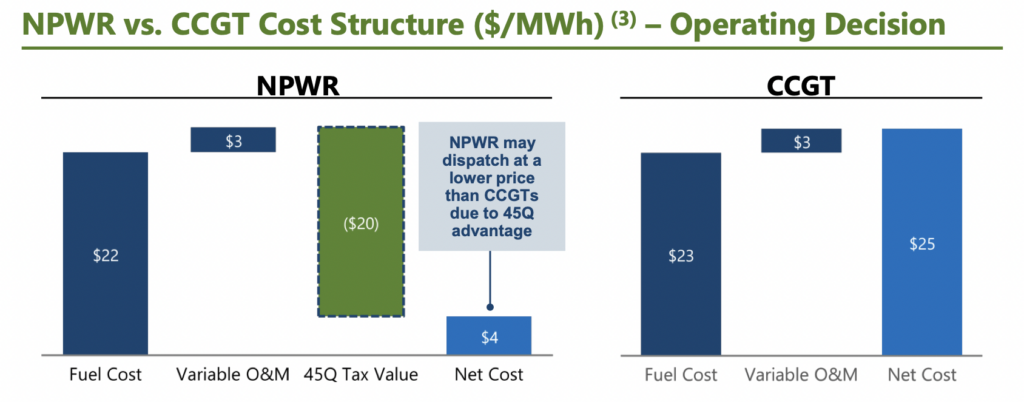

A key to NET Power’s fortunes is the 45-Q tax credits which each U.S. plant will receive based on the company’s technology. A 300-MW NET Power facility is expected to capture about 800,000 tons of CO2 per year. According to the landmark Inflation Reduction Act passed last year, the plant’s owner will receive US$85 for each sequestered ton for twelve years if at least 5% of the cost of the plant is incurred by December 31, 2032. So, a plant owner will receive US$70 million in federal tax credits annually for twelve years, equivalent to a PV of $500 million.

This offset brings the projected effective cost of energy of a NET Power plant to US$4 per megawatt-hour (MWh) produced, much lower than the US$25 per MWh production cost of a combined cycle gas turbine (CCGT) plant. The power produced by the plant will be valuable, but the pure CO2 produced and sequestered by the facility could prove to even more highly prized. Oil producers employing EOR technology pay around US$30 per ton for CO2 today.

Phrased differently, a 300-MW NET Power plant will ultimately cost about US$500 million to build, higher than the $350 million construction cost of a comparably size CCGT. However, if one factors in the PV of the tax incentives, the “effective“ construction cost is close to zero.

An (optimistic) way to describe NET Power’s technology is that it owns the intellectual property of a major energy technology — an extremely valuable intangible asset. This situation is akin to a theoretical company’s owning the widely-used CCGT technology.

NET Power believes there could be opportunity to build as many as 1,000 NET Power facilities in the U.S. alone. The best locations would of course where the competing cost of power is highest. NET Power’s biggest investor, Occidental Petroleum, may eventually have the need for as many as thirty of these facilities to support its direct air capture business. Notably, other strategic investors include some of the biggest energy companies in the world — Constellation Energy Corporation (NASDAQ: CEG) and Baker Hughes Company (NASDAQ: BKR).

A meeting is set for June 6, when shareholders are expected to vote to approve the SPAC merger. Assuming this occurs, Net Power would soon thereafter begin trading on the NYSE under the symbol NPWR.

Rice Acquisition Corp. II last traded at US$10.31 on the NYSE.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.