On October 20, former U.S. President Donald Trump, perhaps the most polarizing world figure in decades, announced an agreement whereby the newly formed Trump Media & Technology Group (TMTG) will merge in a SPAC transaction with a SPAC sponsor called Digital World Acquisition Corp. (NASDAQ: DWAC). TMTG intends to launch a conservative social network called TRUTH Social. Ultimately, after regulatory and shareholder approval, TMTG would become the surviving publicly traded company.

Details on the venture are scarce, but TRUTH Social plans to launch for invited users in November 2021 and hopes to be available to all users in early 2022. The company also expects to create a subscription video-on-demand service.

TMTG says the enterprise value (EV) of the company will be US$875 million. An undefined US$825 million provision was also mentioned, which could bring the initial EV to US$1.7 billion. We note these figures are presumably based on an initial US$10 share price, as is the convention with SPACs.

Since DWAC is trading at about US$45 as of yesterdays close, the current implied EV could be around four or more times these US$875 million/US$1.7 billion figures. Reflected in these calculations is some portion of the US$293 million of cash that DWAC has in trust. This cash will initially fund the launch of TRUTH Social. It is not clear if the DWAC-TMTG venture will include private investment in public equity (PIPE) financing that is typically part of SPAC transactions.

It would be easy to scoff at this transaction. In a typical SPAC transaction, the underlying business may not yet be generating revenue, but it is at least operating (e.g., electric vehicle SPACs). TRUTH Social is not yet even operating. In addition, the Trump venture provides no forecast information. Since such forecast information is used to justify (frequently inflated) SPAC valuations, this raises the question of how the initial enterprise valuation was determined.

However, Trump supporters are very loyal and may be inclined to support his venture enthusiastically. Indeed, former President Trump raised US$170 million from donors in just a few weeks last fall to fight what he termed election fraud.

More explicitly, many Trump supporters could very well join his platform, including as paying subscribers. To put this in a numerical context, President Trump, at his peak before he was barred from appearing on various social media outlets, had 146.5 million total followers on Twitter, Facebook and Instagram combined. If even a fairly smaller fraction of these followers were to join TRUTH Social, that platform could have many tens of millions of members.

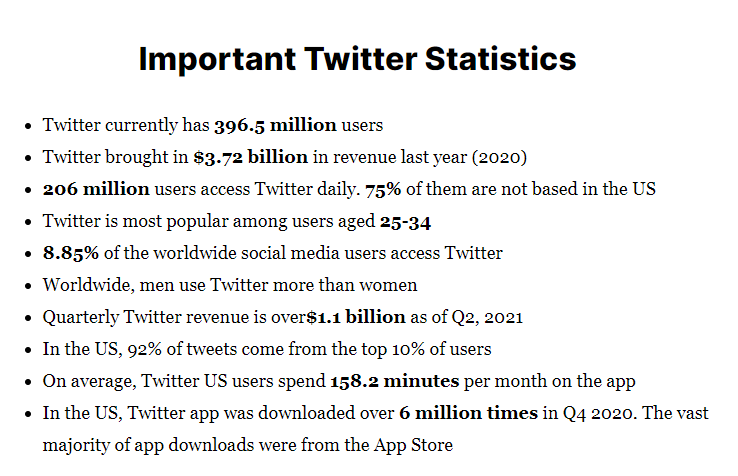

To put this in economic perspective, consider the following: Twitter (NYSE: TWTR) currently has 396.5 million users, including 206 million active users. Its stock market value is US$52 billion. While the number of active users is far from a direct link to stock market capitalization, it does not seem impossible that TRUTH Social could achieve a daily active user base (and therefore an advertising audience) of perhaps a third of Pres. Trump’s previous total followers, or around 50 million. Based on Twitter’s valuation, the market could value such a venture at significantly more than just US$4-US$7 billion.

Clearly, DWAC is a highly speculative stock, but the outsized media attention that is lavished on its very public leader could bring many members and subscribers to the upstart social media platform. That attention could drive its equity value well above current levels. After all, “There is no such thing as bad publicity.”

Digital World Acquisition Corp. last traded at US$101.50 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.