New Gold (TSX: NGD) has extended the life of mine of both the New Afton and Rainy River mines. The announcement was made in line with the release of its three year operational outlook last night after the close of markets.

At New Afton, the reserve mine life has been extended to 2031, with annual gold production over that life of mine expected to average 99,500 ounces, alongside average annual copper production of 79.3 million pounds. The mine life extension was driven by an increase in copper and gold reserves by 15% and 13%, respectively.

New Afton currently has reserves of 735,000 ounces of gold, 1.9 million ounces of silver, and 551 million pounds of copper. Mineral resources meanwhile sit at 1.4 million ounces of gold, 5.1 million ounces of silver and 1.1 million pounds of copper.

Rainy River meanwhile has had its life of mine extended through to 2033. Annual average gold production here over the life of mine is expected to be 218,000 ounces, with much of that front loaded. 2025 to 2027 is expected to see average annual production of 304,000 ounces from the mine.

Rainy River reserves currently sit at 2.4 million ounces of gold and 6.3 million ounces of silver, while mineral resources sit at 837,000 ounces of gold and 2.2 million ounces of silver.

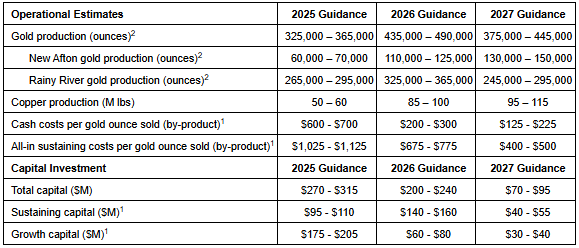

Looking to 2025, New Gold is guiding to gold production between 325,000 to 365,000 ounces, largely driven by production at Rainy River. Copper production is expected to come in at 50 to 60 million pounds. All in sustaining costs on a by-product basis are expected to come in between $1,025 to $1,125 per ounce. Capital expenditures are estimated between $270 and $315 million, while exploration is budgeted at $30 million.

Further out, gold production in 2026 is slated to be in a range of 435,000 to 490,000 ounces, while production in 2027 is to range from 375,000 to 445,000 ounces. Copper production meanwhile will grow to 95 to 115 million pounds by 2027.

New Gold last traded at $4.28 on the TSX.

Information for this story was found via the sources and the companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.