Newlox Gold Ventures (CSE: LUX) has closed the second and final round of its unsecured non-brokered convertible debenture financing. The company raised total proceeds of $4.0 million under the financing, with the most recent tranche seeing an additional $1.2 million raised for the junior gold producer.

The financing saw convertible debentures sold at a price of $1,500 per debenture, with each debenture carrying an interest rate of 10% per annum. Convertible at $0.15 per common share, the debentures are valid for a period of two years from the date of issuance. 10,000 common share purchase warrants were issued with each unit sold, resulting in a total of 8.1 million common share purchase warrants being sold under the offering, with each warrant containing an exercise price of $0.25 and an expiry of two years from the date of issuance.

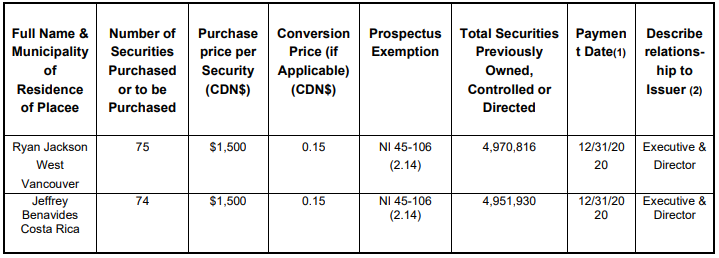

Notably, two executives from the firm as well as a family member of an executive participated in the final tranche of the financing. CEO Ryan Jackson acquired 75 units within the final round, dropping a total of $112,5000 into the financing. A relative of his also subscribed under the offering, for $112,500 as well. Also taking part in the raise was that of Jeffrey Benavides, the CFO of the company, whom acquired 74 units under the offering, thereby placing $111,000 into the company.

“The Newlox Gold team anticipates 2021 to be a milestone year for the Company, with its first processing plant slated for full-scale operation, and a second processing plant expected to become operational. We believe that Newlox Gold will be defined in the coming year as a rapidly growing gold company.”

Ryan Jackson, CEO of Newlox Gold Ventures

Newlox Gold Ventures last traded at $0.275 on the CSE.

FULL DISCLOSURE: Newlox Gold Ventures Corp is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Newlox Gold Ventures Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.