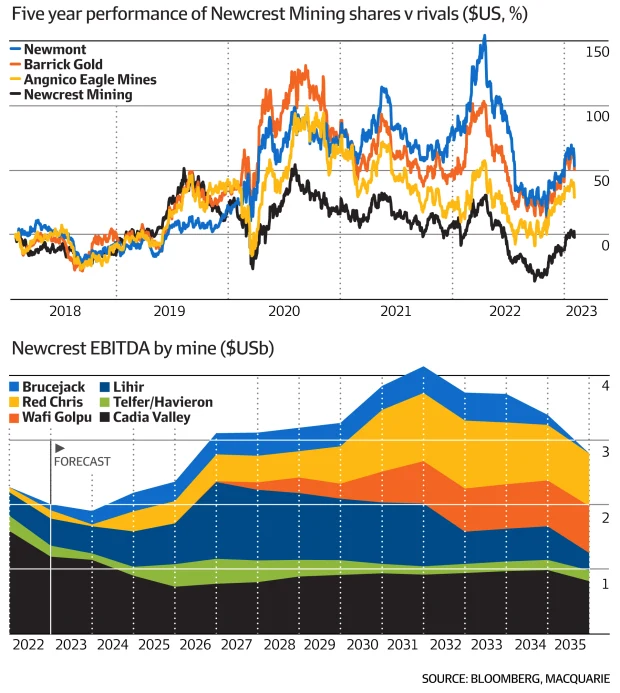

Colorado-based gold producer Newmont Corp (NYSE: NEM) announced a $16.9 billion bid for Australian miner Newcrest Mining (TSX: NCM) in an attempt to construct a worldwide gold powerhouse.

According to the Indicative Proposal, Newcrest shareholders would get 0.380 Newmont shares for every Newcrest share held. Based on the last closing price of Newmont shares and the AUD:USD FX rate as of 3 February 2023, the proposal reflects a current offer price of $27.16 per Newcrest share–a 21% premium to Newcrest’s closing price of $22.45 per share.

Since the announcement, Newmont’s shares have fallen by over 5.9% in pre-market trading. Meanwhile, Newcrest has surged by 9.3%.

The proposal is the second offer the Colorado miner gave after Newmont initially made a proposal to acquire Newcrest at an exchange ratio of 0.363 Newmont shares for each Newcrest share. However, the Newcrest board deemed the proposal “would not deliver sufficiently compelling value to Newcrest shareholders” and rejected the first offer.

The Newmont proposal is made through an agreed plan of arrangement, which must be approved by the Newcrest board and is subject to due diligence, multiple regulatory approvals, and a shareholder vote that could take months. The deal would also need to be approved by Newmont shareholders.

According to Refinitiv data, if the all-share purchase goes through, it will be the largest mining takeover and the third largest corporate buyout in Australian history. This would also make Newcrest shareholders owners of 30% stake in the resulting miner.

The majority of Newcrest’s revenue comes from gold, with the remainder coming from silver and copper mines in Australia, Canada, and Papua New Guinea.

This means many things and among those – a big endorsement of PNG. Newcrest's biggest producer is PNG (Lihir), best growth asset is PNG (Wafi) + large chunk of NAV is PNG. $NEM likes Au+Cu and this new PNG exposure therefore makes sense. $knt.to $kntnf $nem $ncm #papuanewguinea https://t.co/ghK9pPFoDo

— SluzCap (@SluzCap) February 6, 2023

The potential agreement comes as gold prices have been steadily rising since 2020, with a 15% increase since early November. It would also enhance Newmont’s footprint in copper, which is becoming increasingly valuable as economies decarbonize due to its use in renewable energy and electric vehicles.

The US miner is effectively offering to buy back its old spin-off, as Newcrest was founded in the 1960s as its Australian affiliate. In 1990, Newmont Australia Limited purchased Australmin Holdings Ltd, which was later combined with BHP Gold Limited and became Newcrest Mining Limited.

The offer also comes at a time when Newcrest is expected to look for its new CEO on the heels of previous chief executive Sandeep Biswas stepping down last December. Sherry Duhe, Newcrest’s former chief financial officer who joined the company in February of last year, is serving as interim CEO while a global internal and external search for a replacement is underway.

Information for this briefing was found via Reuters, Bloomberg, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.