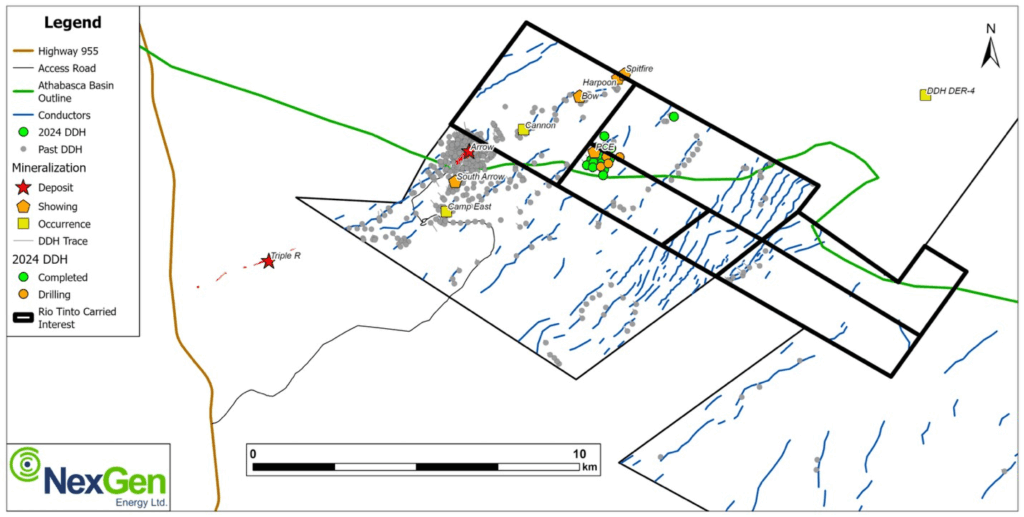

NexGen Energy (TSX: NXE) has acquired a 10% production carried interest that was previously held by Rio Tinto. The interest was held on over 39 mineral claims held by NexGen within the southwest Athabasca Basin.

The carried interest was acquired by NexGen following the exercise of a right of first refusal that they held on the carried interest, with the interest acquired by Rio Tinto prior to NexGen’s acquisition of the claims in 2012.

Under the now-void carried interest arrangement, NexGen was entitled to recover 10% of all prior costs incurred from the effective date of the original agreement from 75% of Rio Tinto’s 10% share of production. Following recovery of these costs, Rio would have received their full 10% share of production from the claims involved in the arrangement.

The carried interest notably included the PCE discovery, prior to NexGen acquiring the interest. NexGen now wholly owns 100% of their portfolio.

“Given the world class extent, high grade and superior technical setting of mineralization discovered to date at our two projects, consolidating our portfolio at PCE and surrounding area to match our 100% ownership in our world-class Arrow deposit, is entirely in line with our strategic objective of becoming the future leader in uranium production worldwide,” commented NexGen CEO Leigh Curyer on the transaction.

READ: NexGen Energy Receives Approval For Site Expansion At Rook I Project

Under the terms of the acquisition, NexGen agreed to match a cash payment offered to Rio Tinto for the interest. Terms of the transaction are said to be contractually confidential.

NexGen Energy last traded at $9.70 on the TSX.

Information for this story was found via the sources and companies mentioned. The author has no securities related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.